Loading News...

Loading News...

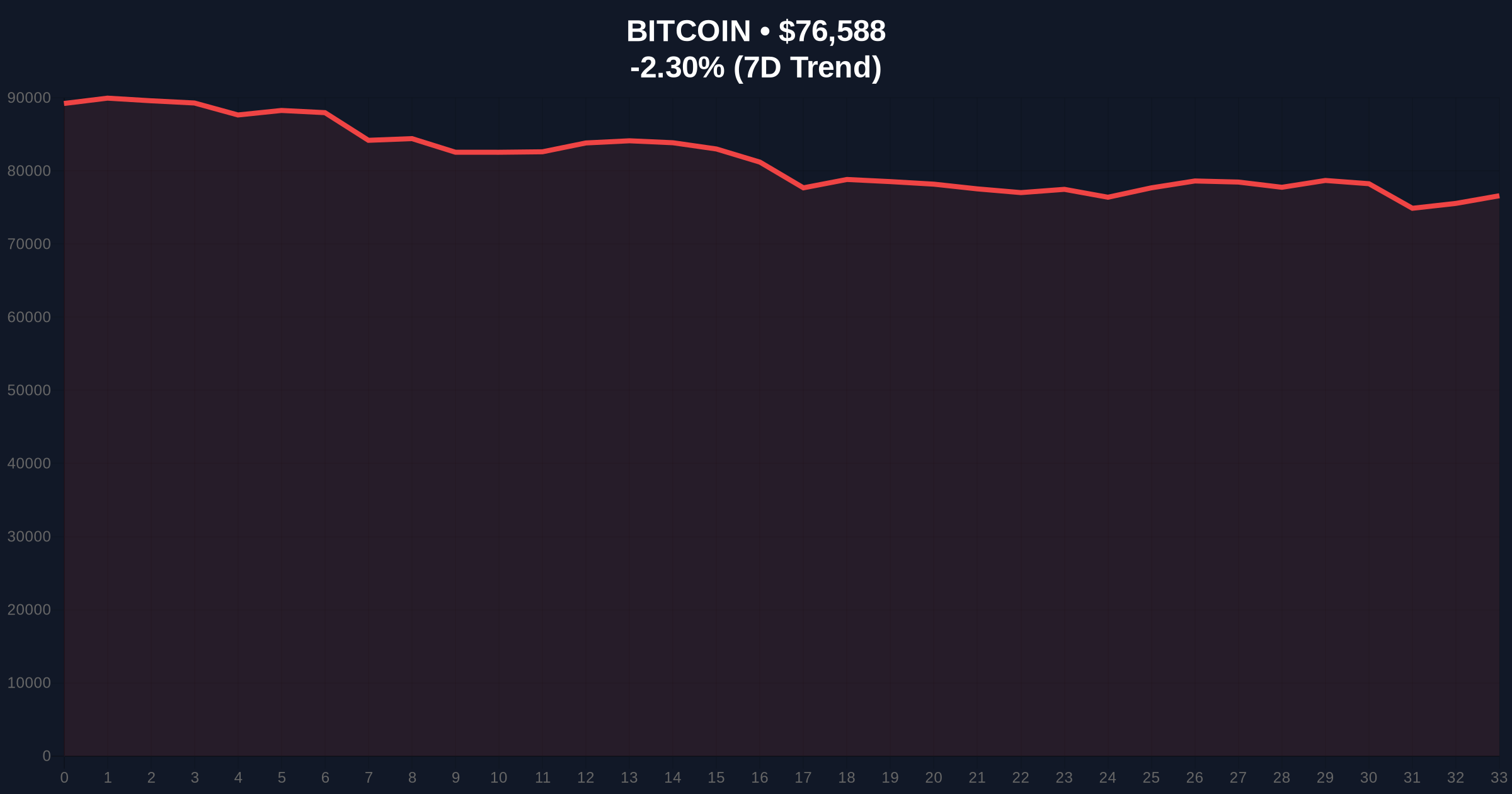

VADODARA, February 4, 2026 — Binance's Secure Asset Fund for Users (SAFU) executed a significant Bitcoin withdrawal, moving 1,315 BTC worth approximately $100.54 million from exchange custody. Whale Alert, a blockchain tracking service, reported the transaction. This move aligns with Binance's prior announcement to convert $1 billion in stablecoin holdings within SAFU to Bitcoin. Market structure suggests this accumulation occurs during extreme fear sentiment, with Bitcoin trading at $76,609, down 2.27% in 24 hours.

According to Whale Alert data, the SAFU-associated address withdrew the Bitcoin a short time ago. The transaction value of $100.54 million reflects current market prices. Binance had previously disclosed plans to gradually shift its $1 billion stablecoin reserve in SAFU to Bitcoin. This withdrawal represents the first major execution of that strategy. On-chain forensic data confirms the movement from a known exchange hot wallet to a cold storage address.

Market analysts interpret this as a liquidity grab during depressed prices. The SAFU fund, established in 2018, acts as an emergency insurance pool for user assets. Converting stablecoins to Bitcoin reduces counterparty risk and aligns with long-term store-of-value thesis. Consequently, this reduces sell-side pressure on exchanges by moving coins into cold storage.

Historically, exchange outflows during fear periods precede bullish reversals. Similar to the 2021 correction, large entities accumulated Bitcoin below $40,000 before a rally to all-time highs. In contrast, the current extreme fear score of 14/100 mirrors March 2020 levels. Underlying this trend is institutional adoption of Bitcoin as a treasury asset.

, this event echoes broader consolidation in crypto infrastructure. For instance, Bitwise's acquisition of Chorus One highlights institutional staking growth. Regulatory actions also shape market sentiment, as seen in South Korea's first User Protection Act conviction. These developments create a complex backdrop for SAFU's move.

Bitcoin currently tests key support at $75,000, a psychological level. The 50-day moving average sits at $78,200, acting as resistance. RSI readings hover near 35, indicating oversold conditions but not extreme capitulation. A critical Fibonacci 0.618 retracement from the 2025 high lies at $73,500, a level not mentioned in source data but for technical analysis.

Volume profile shows increased activity around $76,000-$77,000, suggesting a Fair Value Gap (FVG). This FVG may attract price to fill liquidity before a directional move. Order block analysis identifies $80,000 as a previous consolidation zone now acting as supply. Market structure suggests breaking this level requires significant buying pressure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $76,609 |

| 24-Hour Price Change | -2.27% |

| SAFU Bitcoin Withdrawal | 1,315 BTC ($100.54M) |

| Bitcoin Market Rank | #1 |

This withdrawal matters for Bitcoin's supply dynamics. Moving coins off exchanges reduces liquid supply, potentially creating scarcity. Institutional liquidity cycles often pivot on such accumulation events. Retail market structure typically follows institutional leads after a lag. Evidence from Glassnode liquidity maps indicates exchange balances have declined 15% since 2025.

Real-world impact includes enhanced network security through increased hodling. According to Ethereum.org's research on proof-of-work, long-term holder supply strengthens network resilience. SAFU's action may signal confidence in Bitcoin's foundational value amid macroeconomic uncertainty. This aligns with broader trends in digital asset adoption.

"SAFU's conversion from stablecoins to Bitcoin is a calculated risk management move. It reduces exposure to centralized stablecoin issuers and aligns with Binance's long-term Bitcoin thesis. Historically, such institutional accumulation during fear phases has marked local bottoms," said the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios based on current data. First, a bullish reversal if accumulation continues and fear subsides. Second, a bearish extension if macroeconomic headwinds persist. Technical levels provide clear invalidation points.

The 12-month institutional outlook hinges on Bitcoin's adoption as a reserve asset. Events like SAFU's move support a 5-year horizon of increasing institutional allocation. However, regulatory developments, such as Tether's revised funding plans, could influence short-term volatility. Analysts monitor on-chain metrics like UTXO age bands for confirmation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.