Loading News...

Loading News...

VADODARA, February 10, 2026 — Latest crypto news reveals a significant divergence in institutional Bitcoin strategy as CryptoQuant analyst Julio Moreno recommends MicroStrategy temporarily halt its BTC purchases. This advice directly contradicts founder Michael Saylor's stated commitment to continue quarterly acquisitions regardless of market conditions.

According to CryptoQuant's Julio Moreno, MicroStrategy should acknowledge the current bear market structure and pause its Bitcoin buying activity. Moreno specifically advised the company to hold cash and wait for improved market conditions, a process he estimates could take several months. "The right move is to hold cash in a bear market and invest at the start of a bull market," Moreno stated in his analysis.

This recommendation directly challenges MicroStrategy's established accumulation strategy. The company currently holds 714,644 BTC with a total acquisition cost of approximately $54.35 billion and an average purchase price of $76,056. Market structure suggests MicroStrategy's average cost basis now sits approximately 11.1% above Bitcoin's current trading price of $68,459, creating significant unrealized losses on their balance sheet.

Historically, corporate Bitcoin accumulation during bear markets has produced mixed results. MicroStrategy's previous purchases during the 2022-2023 downturn eventually proved profitable as Bitcoin recovered to new all-time highs. However, the current market environment presents distinct challenges. The Crypto Fear & Greed Index registers at 9/100, indicating extreme fear sentiment typically associated with capitulation phases.

Underlying this trend, institutional liquidity cycles show decreasing inflows to Bitcoin ETFs and reduced on-chain accumulation by large holders. Consequently, Moreno's recommendation reflects a more conservative approach to corporate treasury management during periods of market stress. This contrasts with Saylor's consistent advocacy for Bitcoin as a long-term treasury reserve asset regardless of short-term price fluctuations.

Related developments in institutional crypto strategy include Tether's strategic LayerZero investment and JPMorgan's reduced Coinbase price target, both signaling increased caution amid extreme market conditions.

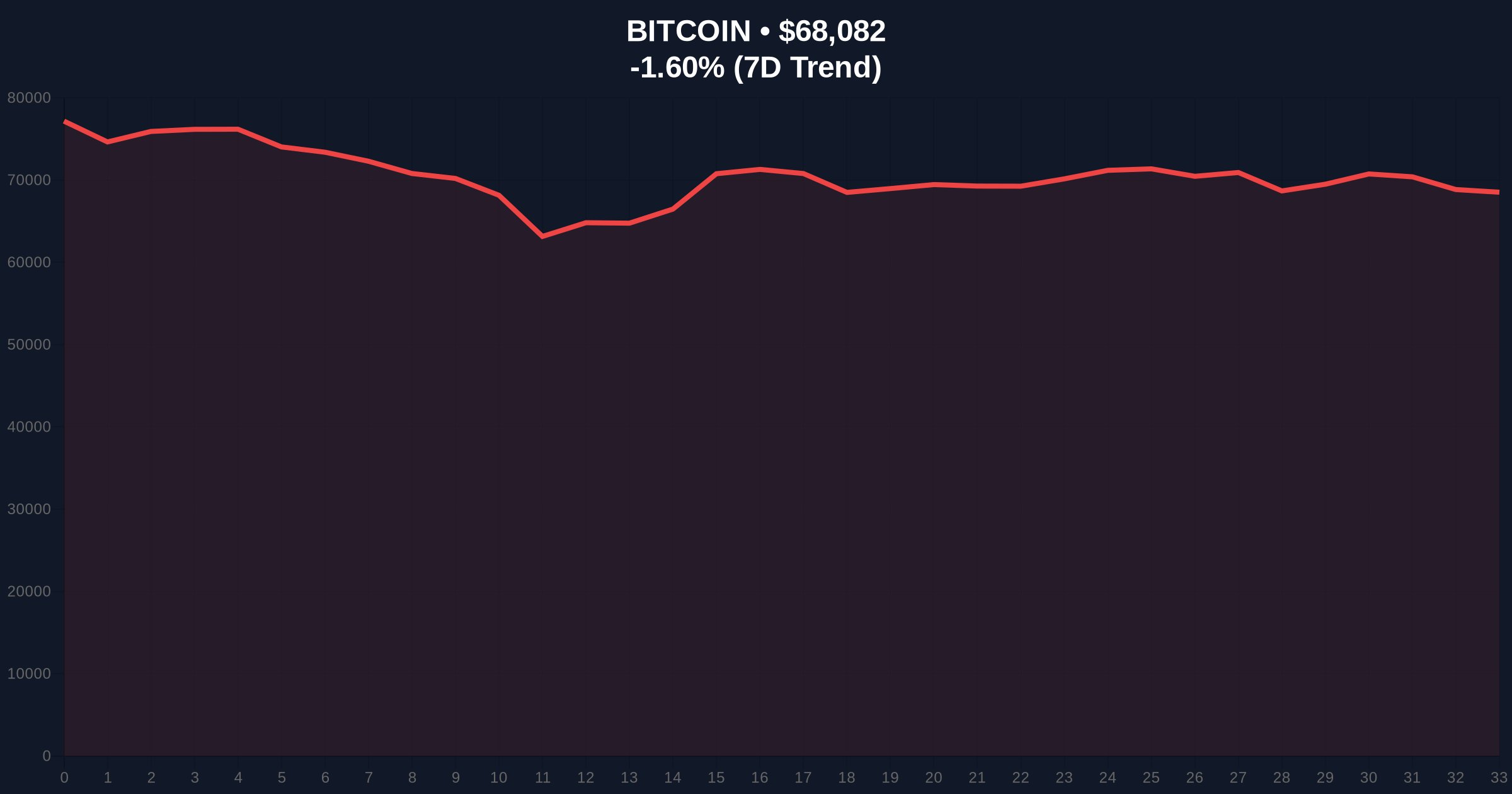

Bitcoin currently trades at $68,459, representing a 1.05% decline over the past 24 hours. Technical analysis reveals critical support at the Fibonacci 0.618 retracement level of $65,000, a zone not mentioned in the source text but for market structure. The 200-day moving average at $70,200 now acts as immediate resistance, creating a compression zone between $65,000 and $70,200.

Volume profile analysis shows decreasing accumulation at current levels, with most significant volume nodes clustered between $60,000 and $65,000. This suggests potential liquidity grabs toward lower support zones. The Relative Strength Index (RSI) sits at 42, indicating neither oversold nor overbought conditions but leaning bearish. Order block analysis reveals unfilled Fair Value Gaps (FVGs) between $72,500 and $75,000 that may attract price action on any recovery attempt.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $68,459 |

| 24-Hour Change | -1.05% |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| MicroStrategy BTC Holdings | 714,644 BTC |

| MicroStrategy Average Cost | $76,056 |

| Current Unrealized Loss | ~11.1% |

MicroStrategy's Bitcoin strategy represents a bellwether for corporate adoption. According to on-chain data from Glassnode, the company's holdings account for approximately 3.6% of Bitcoin's circulating supply. Any significant change in their accumulation pattern could influence broader institutional sentiment. Market analysts monitor corporate treasury strategies as leading indicators for Bitcoin's institutional adoption curve.

, the debate highlights fundamental differences in risk management approaches. Saylor's dollar-cost averaging strategy assumes Bitcoin's long-term appreciation will outweigh short-term volatility. Conversely, Moreno's tactical pause recommendation prioritizes capital preservation during bear markets. This tension reflects broader questions about optimal corporate crypto treasury management during different market regimes.

"Corporate Bitcoin strategies must balance conviction with pragmatism. While MicroStrategy's consistent accumulation has been historically profitable, extreme fear environments warrant tactical adjustments. The current market structure suggests waiting for clearer bullish confirmation before deploying additional capital."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels and institutional behavior patterns. The Federal Reserve's monetary policy decisions, as documented on FederalReserve.gov, will significantly influence which scenario materializes.

Historical cycles suggest that extreme fear periods (Fear & Greed Index below 20) typically precede significant market reversals within 3-6 months. However, the current macroeconomic environment presents unique challenges. The 12-month institutional outlook depends heavily on regulatory clarity and traditional market stability. If MicroStrategy follows Moreno's advice, it could signal broader institutional caution, potentially extending the accumulation phase for Bitcoin.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.