Loading News...

Loading News...

VADODARA, January 15, 2026 — In a significant on-chain move, two anonymous addresses linked to crypto market maker Amber Group and the Ethena (ENA) Foundation deposited a combined 3,956 ETH, valued at $13.24 million, to Coinbase and Binance approximately seven hours ago, according to on-chain analyst The Data Nerd. This daily crypto analysis reveals a liquidity divergence, as an address associated with Arrington Capital simultaneously withdrew 5,500 ETH ($18.51 million) from Coinbase, creating a net outflow of 1,544 ETH. Exchange deposits are typically interpreted as a precursor to selling, while withdrawals suggest accumulation or holding intent, setting the stage for potential price volatility.

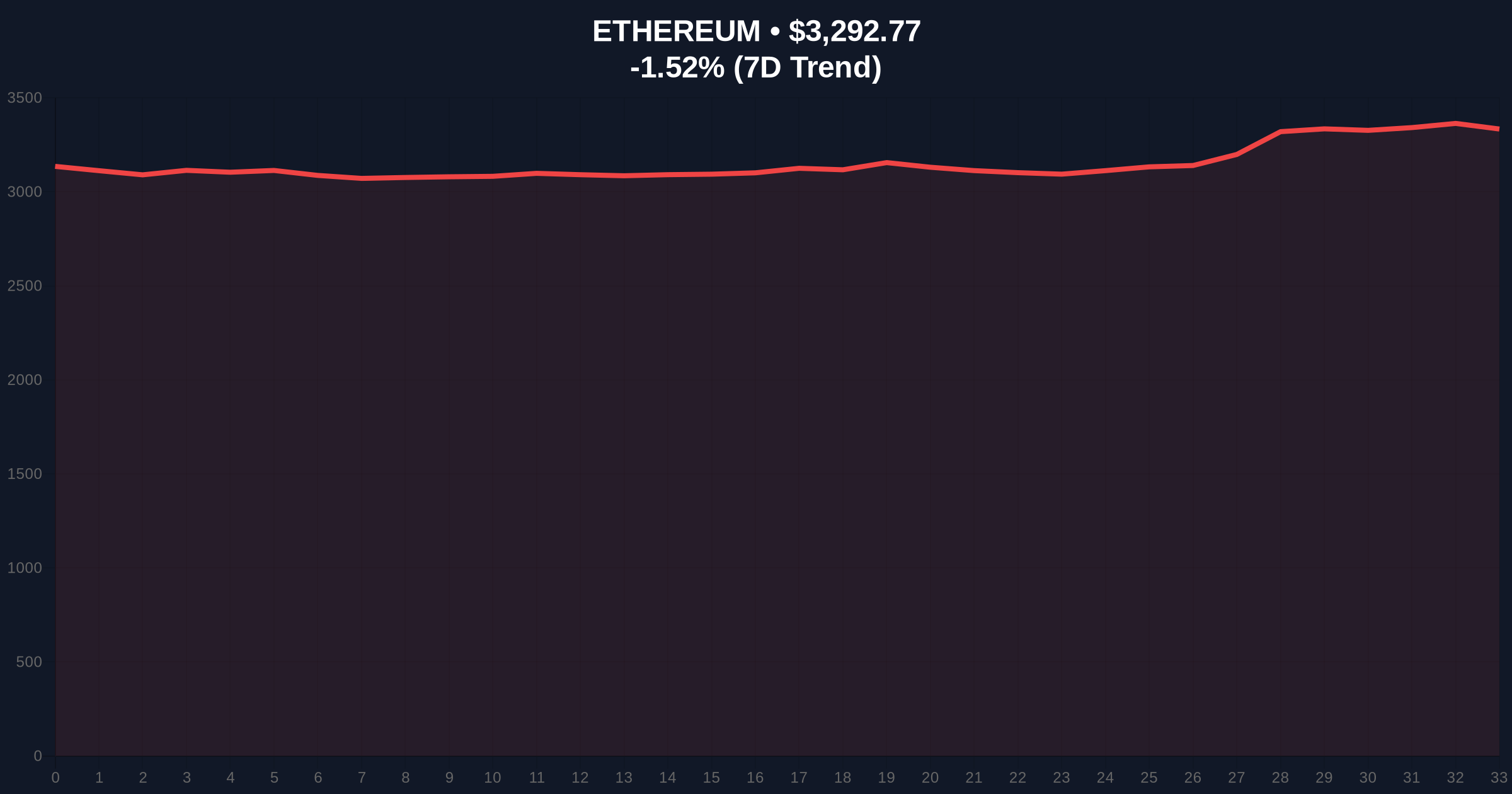

This event occurs against a backdrop of heightened institutional activity in the cryptocurrency space, where exchange flows serve as a leading indicator of market sentiment. Historically, large deposits from entities like Amber Group—a major liquidity provider—often precede short-term price corrections, as they may offload assets to capture profits or manage risk. Underlying this trend is the broader market structure, where Ethereum has been consolidating near the $3,300 level, a critical psychological barrier. The simultaneous withdrawal by Arrington Capital mirrors patterns seen in previous cycles, where savvy investors accumulate during periods of retail uncertainty. Related developments include recent inflows into US Bitcoin ETFs and BlackRock's significant Bitcoin ETF activity, highlighting institutional divergence across assets.

According to on-chain data from The Data Nerd, the deposit transaction involved 3,956 ETH split between Coinbase and Binance, with the addresses cryptographically linked to Amber Group and the Ethena Foundation based on historical wallet patterns. In contrast, Arrington Capital's address executed a withdrawal of 5,500 ETH from Coinbase, creating a net negative exchange balance of 1,544 ETH. This activity was timestamped approximately seven hours prior to analysis, indicating real-time market movements. The Data Nerd's methodology relies on clustering algorithms and transaction history to attribute addresses, though anonymity prevents absolute verification. Consequently, this flow divergence suggests a split in institutional strategy, with some players preparing for liquidation while others position for long-term holds.

Market structure suggests Ethereum is testing a key support zone around $3,200, with the Relative Strength Index (RSI) hovering near 50, indicating neutral momentum. The deposit from Amber Group and Ethena may represent a liquidity grab, targeting sell-side orders clustered above $3,300. A Fair Value Gap (FVG) exists between $3,250 and $3,280, which could be filled if selling pressure intensifies. The 50-day moving average at $3,150 provides additional support, while resistance is noted at $3,400, a previous order block. Bullish invalidation is set at $3,100, a break below which would confirm bearish dominance and target lower supports. Bearish invalidation lies at $3,450, where a sustained move above would negate the sell signal and suggest accumulation phases.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Live Market Data |

| Ethereum Current Price | $3,292.9 | Live Market Data |

| Ethereum 24h Trend | -1.51% | Live Market Data |

| Amber Group/Ethena Deposit | 3,956 ETH ($13.24M) | The Data Nerd |

| Arrington Capital Withdrawal | 5,500 ETH ($18.51M) | The Data Nerd |

This divergence in exchange flows has distinct implications for institutional and retail participants. For institutions, it highlights risk management strategies, where market makers like Amber Group may be rebalancing portfolios ahead of potential volatility, possibly linked to macroeconomic factors such as interest rate decisions from the Federal Reserve. Retail traders, however, face increased sell-side pressure if these deposits translate into market orders, potentially eroding short-term gains. The net outflow suggests some institutional confidence, but the volume profile indicates that selling intent could overwhelm buying support. According to Ethereum's official documentation on network upgrades, developments like EIP-4844 could influence long-term valuation, but short-term price action is driven by liquidity events like this.

Market analysts on X/Twitter are split on the interpretation. Bulls argue that Arrington Capital's withdrawal signals accumulation during a dip, with one commentator noting, 'Large withdrawals often precede rallies, as seen in past cycles.' Bears, however, point to the deposit volume, with a trader stating, 'Exchange inflows from known entities typically lead to a gamma squeeze downward, as options markets adjust.' Overall, sentiment leans cautious, with many awaiting confirmation from price action around the $3,200 level. This aligns with broader cryptocurrency news trends, where regulatory shifts and ETF flows add layers of complexity.

Bullish Case: If Arrington Capital's withdrawal reflects strategic accumulation and buying pressure absorbs the deposited ETH, Ethereum could rebound to test resistance at $3,400. A break above this level, supported by positive on-chain metrics like reduced exchange balances, might target $3,600 in the coming weeks. Historical cycles suggest that net outflows often precede upward moves, as seen in early 2024.

Bearish Case: If the deposits from Amber Group and Ethena trigger a sell-off, Ethereum could fill the FVG down to $3,250, with further downside to the $3,100 invalidation level. Increased selling volume could exacerbate the decline, especially if broader market sentiment shifts, as indicated in recent Bitcoin price action. A break below $3,100 would confirm a bearish trend, potentially targeting $2,800.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.