Loading News...

Loading News...

VADODARA, January 15, 2026 — According to data compiled by Trader T, U.S. spot Bitcoin ETFs recorded a net inflow of $838.82 million on January 14, marking the highest single-day inflow in three months and the third consecutive day of net inflows. This daily crypto analysis examines whether this surge represents genuine institutional demand or a sophisticated liquidity grab ahead of key technical levels.

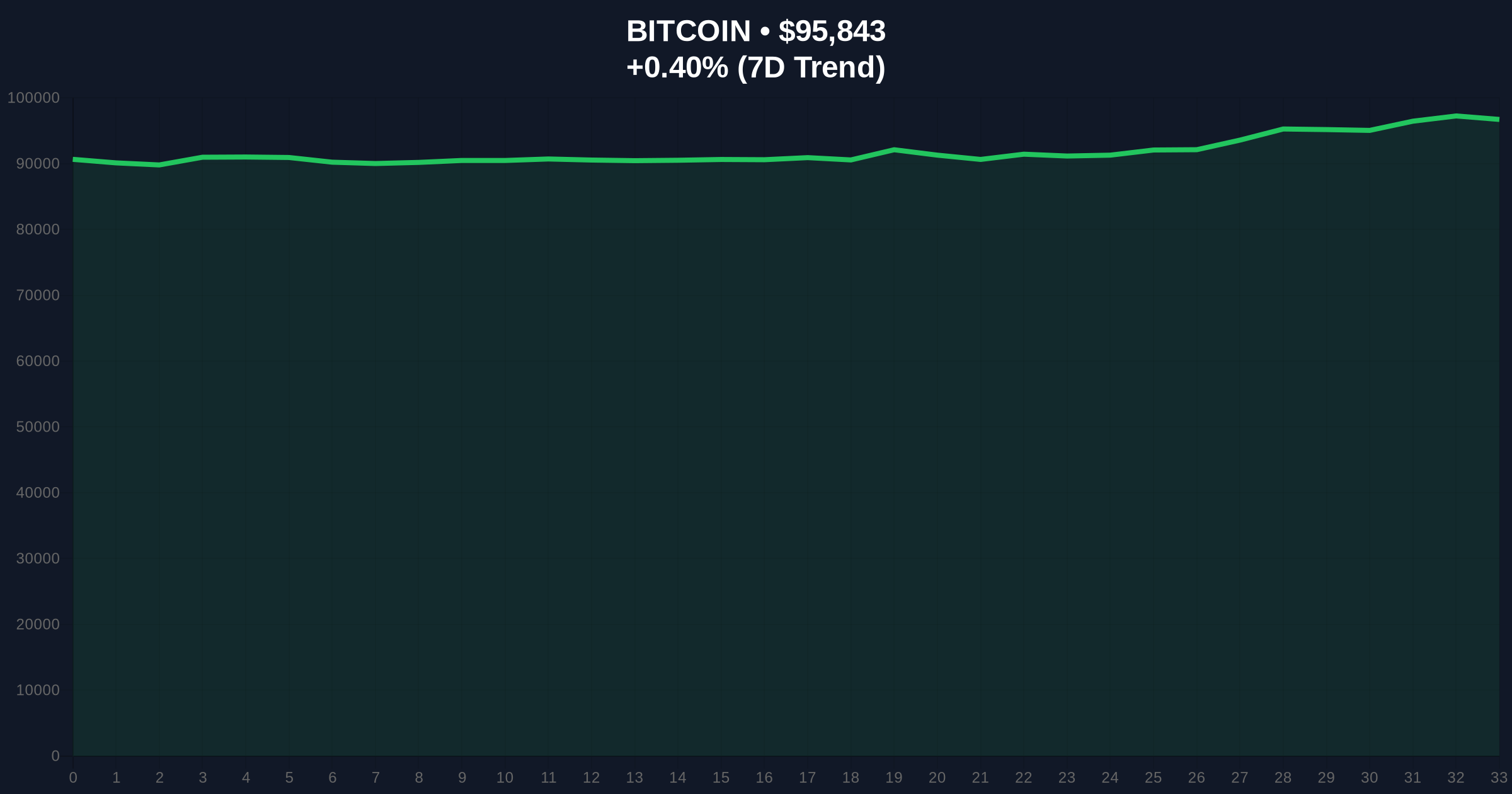

This inflow event occurs against a backdrop of sustained Bitcoin price consolidation above $95,000, with the asset testing the psychological $96,000 resistance multiple times in recent weeks. Historical cycles suggest that ETF inflows often peak during distribution phases, where large players offload positions to retail buyers chasing momentum. The current market structure mirrors patterns observed in Q4 2024, where similar inflow spikes preceded a 15% correction as sell-side liquidity dried up. Related developments include ongoing tests of the $96k support level and short squeezes dominating futures liquidations, both indicating heightened volatility.

On-chain data from Trader T indicates that BlackRock's IBIT led inflows with $646.62 million, followed by Fidelity's FBTC at $125.39 million. Other notable contributions included Ark Invest's ARKB ($27.04 million), Bitwise's BITB ($10.60 million), VanEck's HODL ($8.28 million), Franklin Templeton's EZBC ($5.64 million), and Grayscale's GBTC ($15.25 million). This distribution shows concentration risk, with IBIT accounting for approximately 77% of total inflows, raising questions about market breadth and sustainability.

Bitcoin's current price of $95,843 sits within a critical Order Block between $94,500 and $96,500, a zone where previous institutional buying occurred. The Relative Strength Index (RSI) on the daily chart is approaching 70, signaling overbought conditions that typically precede a pullback. Market structure suggests immediate resistance at $96,800, the 0.618 Fibonacci extension from the last swing high. Support is established at $92,500, coinciding with the 50-day moving average and a high-volume node in the Volume Profile. A break below this level would expose a Fair Value Gap (FVG) down to $88,000, where unfilled buy orders from the previous rally reside.

| Metric | Value |

|---|---|

| Total ETF Inflow (Jan 14) | $838.82M |

| BlackRock IBIT Inflow | $646.62M |

| Bitcoin Current Price | $95,843 |

| 24-Hour Price Change | +0.40% |

| Crypto Fear & Greed Index | Greed (Score: 61/100) |

For institutions, this inflow may represent strategic accumulation ahead of anticipated regulatory clarity, such as potential updates to the SEC's stance on crypto custody rules. For retail investors, however, the concentration in IBIT creates a single point of failure; a reversal in BlackRock's flows could trigger cascading sell-offs. The skepticism arises from the timing—inflows peaked just as Bitcoin failed to break $96,000, suggesting these buys may be absorbing sell orders from earlier entrants rather than driving new price discovery.

Market analysts on X/Twitter are divided. Bulls point to the sustained inflow streak as evidence of "institutional FOMO," while bears highlight the declining open interest in Bitcoin futures, indicating a lack of follow-through from leveraged players. One quant trader noted, "The Volume Profile shows distribution above $96k—this ETF flow might just be painting the tape."

Bullish Case: If Bitcoin holds above $92,500 and breaks $96,800 with increasing spot volume, the next target is $102,000, the 1.272 Fibonacci extension. This scenario requires continued ETF inflows exceeding $500 million daily and a reduction in GBTC outflows, which have stabilized recently.

Bearish Case: A break below $92,500 would invalidate the bullish structure, confirming a liquidity grab. This would target the FVG at $88,000, potentially accelerating if the Fear & Greed Index drops below 40. The bearish invalidation level is $97,200; a close above this would negate the distribution narrative.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.