Loading News...

Loading News...

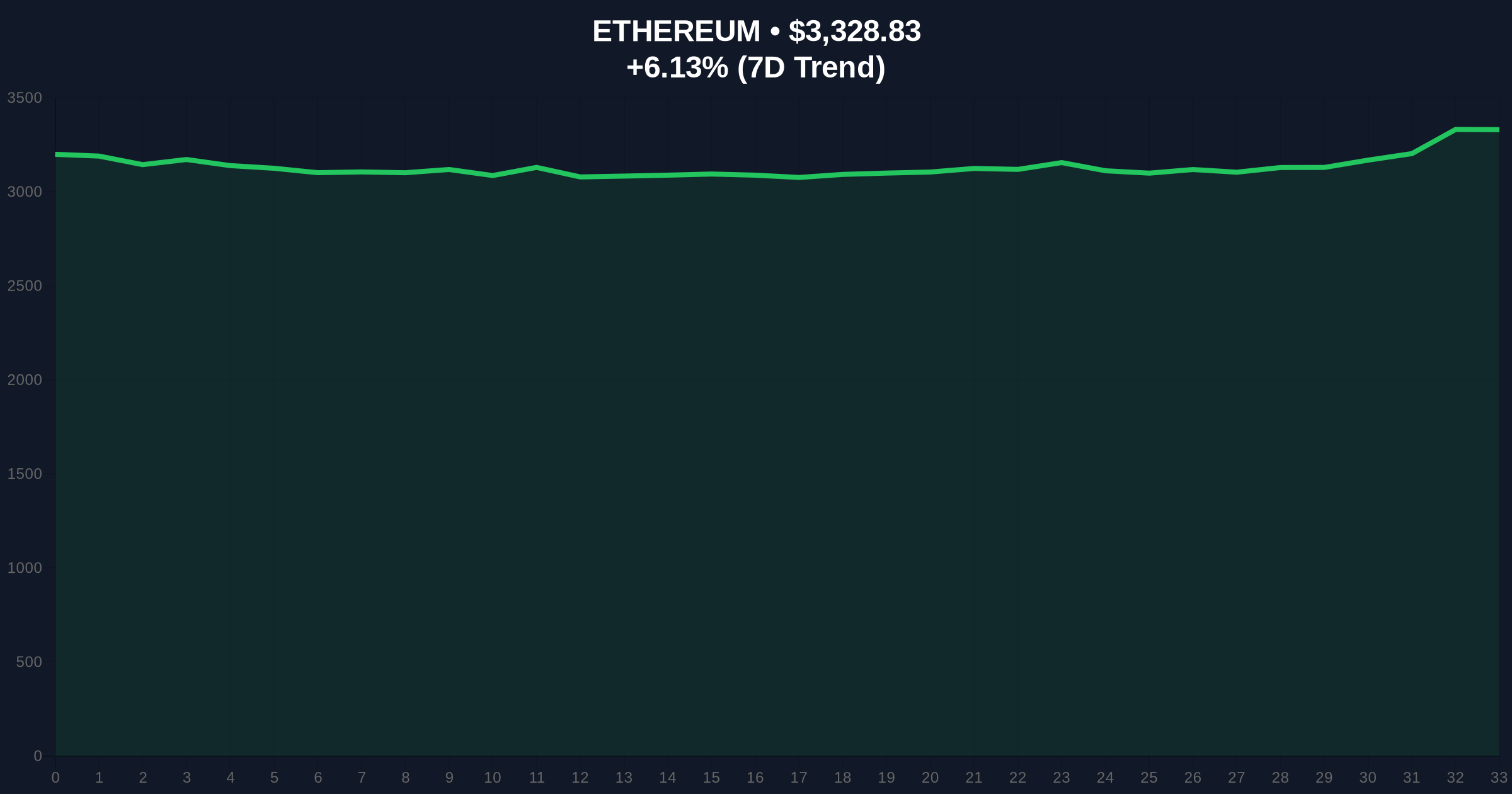

VADODARA, January 14, 2026 — An anonymous whale address has withdrawn 53,451.6 Ethereum (ETH) valued at approximately $177 million from centralized exchanges over a 40-day period, according to on-chain data from analyst ai_9684xtpa. This daily crypto analysis examines the structural implications of this accumulation pattern against a backdrop of neutral global sentiment and critical technical levels.

Large-scale withdrawals from exchanges typically reduce immediate sell-side pressure, as assets move into self-custody for long-term holding or staking. Historical cycles suggest that sustained accumulation by whales often precedes significant price movements, as seen during the 2020-2021 bull run when similar patterns emerged before Ethereum's rally to all-time highs. Underlying this trend is the broader shift toward Ethereum's proof-of-stake consensus, which incentivizes holding through staking rewards and reduces liquid supply. Consequently, this whale activity aligns with a macro narrative of institutional adoption, though it contrasts with recent regulatory developments such as Google Play Store's upcoming restrictions on unregistered crypto apps in South Korea, highlighting the fragmented global regulatory .

According to on-chain analyst ai_9684xtpa, the address beginning with 0x46DB0 executed a series of withdrawals starting December 5, 2025. The most recent transaction involved 2,000 ETH worth $6.65 million from OKX, bringing the total to 53,451.6 ETH. Market structure indicates an average entry price of $3,125.13, resulting in an estimated unrealized profit of $11.06 million at current prices. This accumulation pattern suggests a strategic positioning rather than speculative trading, as the whale has consistently moved assets off exchanges without engaging in high-frequency transactions.

Ethereum is currently trading at $3,329.2, up 6.14% over the past 24 hours. The price action is testing a key resistance zone near the $3,350 level, which aligns with a Fibonacci retracement level from the 2025 high. On-chain data indicates that the whale's average entry price of $3,125.13 now acts as a major support zone, forming an Order Block where significant buying interest previously emerged. The Relative Strength Index (RSI) sits at 58, suggesting neutral momentum without overbought conditions. A Bullish Invalidation level is set at $3,000, where a break below would signal a failure of the accumulation thesis and potential liquidation events. Conversely, a Bearish Invalidation level rests at $3,500, above which a Gamma Squeeze could accelerate upward momentum. Market structure suggests that sustained trading above the whale's cost basis may attract follow-on buying, but failure to hold $3,125.13 could trigger a Liquidity Grab toward lower supports.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 48/100 (Neutral) |

| Ethereum Current Price | $3,329.2 |

| 24-Hour Price Change | +6.14% |

| Market Rank | #2 |

| Whale Accumulation (40 Days) | 53,451.6 ETH ($177M) |

| Average Entry Price | $3,125.13 |

| Unrealized Profit | $11.06M |

For institutional investors, this accumulation signals confidence in Ethereum's long-term value proposition, particularly with upcoming network upgrades like the Pectra hardfork, which aims to enhance scalability and staking efficiency. Retail traders may interpret this as a bullish signal, but should monitor Volume Profile data to confirm whether retail flows align with whale activity. The withdrawal of such a significant amount from exchanges reduces liquid supply, potentially creating a Fair Value Gap (FVG) if demand outpaces available sell orders. This dynamic is critical for portfolio managers assessing Ethereum's weight in multi-asset strategies, as highlighted in resources like Ethereum's official documentation on network economics.

Market analysts on social media platforms have noted the whale's disciplined accumulation, with some suggesting it mirrors patterns seen before major rallies. Bulls argue that the steady off-exchange movement indicates strong conviction, while skeptics point to the neutral Crypto Fear & Greed Index as a caution against over-optimism. No direct quotes from high-profile figures like Vitalik Buterin were available, but general sentiment leans toward cautious optimism given the technical backdrop.

Bullish Case: If Ethereum holds above the $3,125.13 support and breaks through the $3,500 resistance, on-chain data indicates a target toward $4,000 based on historical accumulation cycles. This scenario would be fueled by continued institutional inflows and successful implementation of EIP-4844, which reduces transaction costs.

Bearish Case: A breakdown below $3,000 could trigger a cascade of liquidations, pushing prices toward $2,800 where next significant support resides. This would invalidate the whale's accumulation thesis and reflect broader market risk-off sentiment, possibly exacerbated by regulatory pressures like those seen in the surge in crypto scam losses reported by Chainalysis.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.