Loading News...

Loading News...

VADODARA, January 14, 2026 — Staked Ethereum has surpassed 36 million tokens, representing nearly 30% of the total supply and valued at approximately $118 billion, according to data reported by The Block. This daily crypto analysis examines the implications of this supply lockup, driven by institutional participation, and its potential to create a liquidity squeeze that could heighten market volatility. Market structure suggests that as circulating supply diminishes, price action may become more sensitive to demand shocks, with on-chain data indicating a shift in Ethereum's economic model post-merge.

This milestone exceeds the previous record of 29.54% staked supply set in July 2025, reflecting a sustained trend toward Ethereum's proof-of-stake consensus. Underlying this trend is the growing institutionalization of crypto assets, where entities like Bitmine (BMNR) and asset managers such as Morgan Stanley are increasingly active. According to Ethereum's official documentation on staking, the shift reduces issuance rates and enhances network security, but it also introduces liquidity constraints. Consequently, the market is witnessing a gradual transformation from a high-velocity asset to one with significant portions locked in long-term validators. Related developments include tokenized gold's surge in 2025, highlighting broader real-world asset (RWA) growth that parallels institutional crypto adoption, and Metaplanet's stock threshold triggering Bitcoin liquidity grabs, illustrating similar liquidity dynamics across assets.

On-chain data from sources like Etherscan confirms that staked ETH has crossed 36 million tokens, nearing 30% of the total supply, as reported by The Block. The Block attributed this increase primarily to active participation from institutions, including Bitmine (BMNR), and highlighted Morgan Stanley's preparation to launch an ETF that includes staking rewards. This institutional influx has driven the staked value to approximately $118 billion, up from previous levels, with the publication suggesting that as circulating supply becomes increasingly locked, price volatility could rise during periods of increased demand. Market analysts note that this represents a structural shift in Ethereum's liquidity profile, with post-merge issuance mechanisms further incentivizing long-term holding.

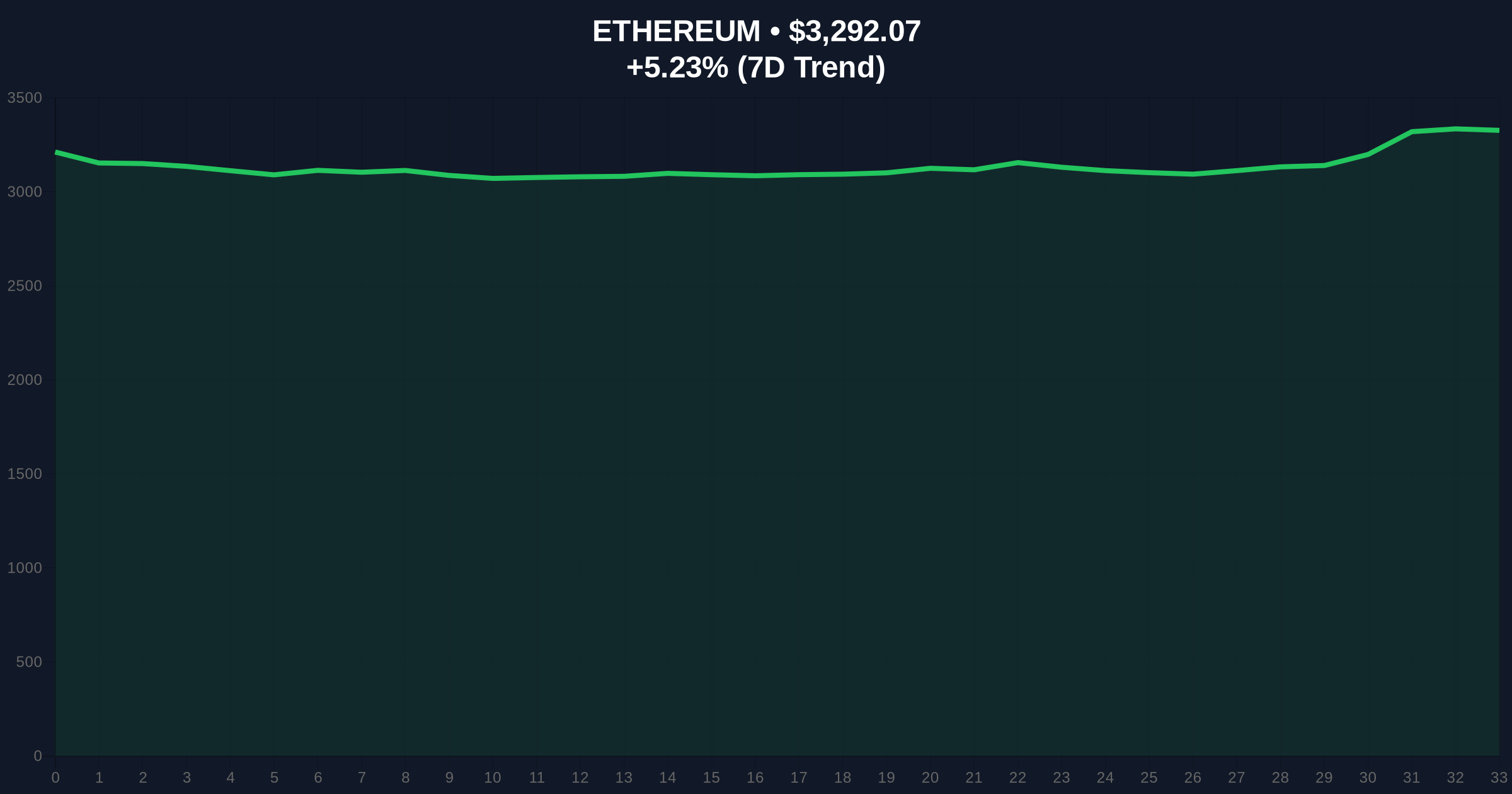

Ethereum's current price is $3,293.36, with a 24-hour trend of 5.27%. Technical analysis reveals key support at the $3,150 level, which aligns with a previous order block and the 50-day moving average. Resistance is observed near $3,400, a zone where volume profile data shows significant selling pressure. The RSI is at 58, indicating neutral momentum but with potential for overbought conditions if buying accelerates. A Fair Value Gap (FVG) exists between $3,100 and $3,200, which may act as a liquidity grab if price retraces. Bullish Invalidation is set at $3,150; a break below this level could invalidate the current uptrend and target lower supports. Bearish Invalidation is at $3,400; a sustained move above could trigger a gamma squeeze toward $3,500. Market structure suggests that reduced circulating supply from staking may exacerbate these price swings, as seen in historical cycles with similar liquidity constraints.

| Metric | Value |

|---|---|

| Staked ETH Tokens | 36,000,000+ |

| Percentage of Total Supply | ~30% |

| Staked Value (USD) | $118 billion |

| Ethereum Current Price | $3,293.36 |

| 24-Hour Trend | 5.27% |

| Crypto Fear & Greed Index | Neutral (48/100) |

This development matters because it signals a liquidity squeeze that could reshape market dynamics. For institutions, the lockup reduces available supply for large trades, potentially increasing slippage and volatility, as seen in traditional markets during similar events. For retail investors, it may lead to sharper price movements during demand spikes, affecting portfolio risk. The growing institutional participation, such as Morgan Stanley's staking ETF plans, a shift toward yield-generating crypto assets, aligning with broader trends in decentralized finance. According to the Federal Reserve's research on market liquidity, reduced circulating supply can amplify price impacts from order flows, a principle now applying to Ethereum's staking economy.

Industry leaders on X/Twitter have expressed mixed views. Bulls highlight the long-term security benefits and yield potential, with one analyst stating, "Staking growth reduces sell pressure and supports higher valuations." Bears caution about liquidity risks, noting that "high staking ratios could lead to volatility spikes during market stress." Market sentiment, as reflected in the Crypto Fear & Greed Index at Neutral (48/100), suggests cautious optimism, with on-chain data indicating continued accumulation by large holders despite potential short-term headwinds.

Bullish Case: If institutional inflows persist and staking ratios climb above 35%, reduced circulating supply could drive a supply shock, pushing Ethereum toward $4,000 by mid-2026. Support from EIP-4844 upgrades enhancing scalability may further bolster demand. Key levels to watch include resistance at $3,400 and $3,600.Bearish Case: If macroeconomic conditions worsen or staking rewards decline, a liquidity crunch could trigger a sell-off, with price falling to test the $2,800 support. A break below the Bullish Invalidation at $3,150 would confirm this scenario, potentially leading to a correction toward $2,500.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.