Loading News...

Loading News...

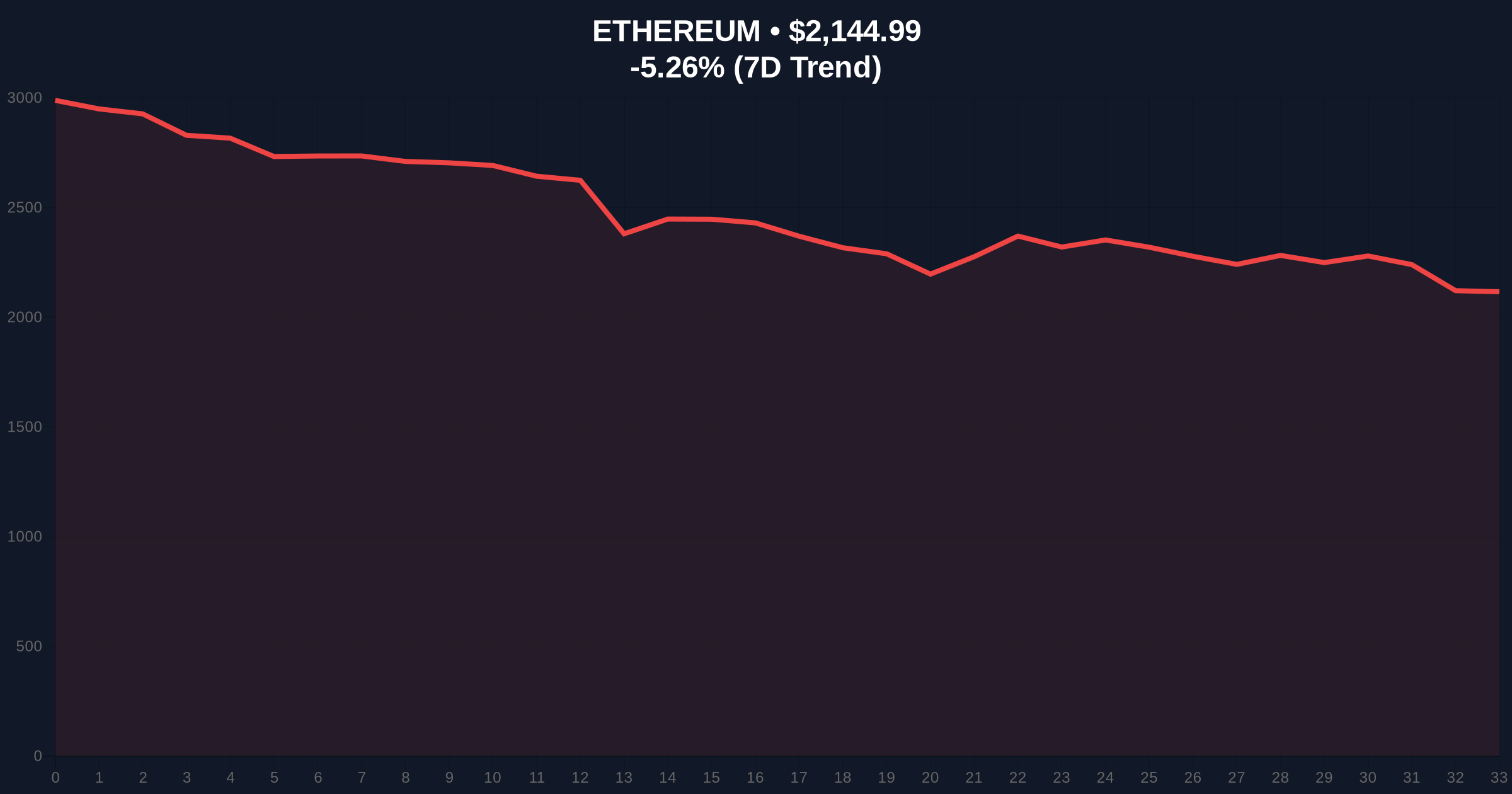

VADODARA, February 5, 2026 — An anonymous crypto whale executed a massive loss-taking event, selling 96,585 Ethereum (ETH) and 334,000 Solana (SOL) holdings for a combined estimated loss exceeding $140 million. According to on-chain data reported by EmberCN, the whale deposited these assets to an exchange approximately four hours ago, liquidating positions acquired during 2025's bull market at significantly higher prices. This latest crypto news highlights a severe liquidity drain during a period of extreme market fear, with Ethereum's price currently at $2,146.01, down 5.21% in 24 hours.

On-chain forensic analysis reveals precise transaction details. The whale purchased 96,585 ETH in July 2025 at an average price of $3,363 per token. Market structure suggests this accumulation occurred near the local top of that cycle's rally. The ETH was sold at approximately $2,222, resulting in a realized loss of roughly $110 million. Simultaneously, the address liquidated 334,000 SOL acquired in October 2025 at an average of $186 per token. EmberCN data indicates the SOL sale generated an additional $30.78 million loss. Following these transactions, the address now holds 58.34 million USDC, representing a complete exit from volatile crypto assets into stablecoins.

Historically, large-scale loss-taking events often signal local capitulation points. The 2021-2022 bear market witnessed similar whale exits near cycle bottoms, where sustained selling pressure eventually exhausted weak hands. In contrast, this event occurs amid a broader regulatory tightening phase, including South Korea's expanded Travel Rule for all crypto transactions. Underlying this trend is a global shift toward stricter AML frameworks, potentially influencing institutional exit strategies. , this whale activity follows Vitalik Buterin's recent sale of 2,779 ETH, though Buterin's transaction was significantly smaller and part of a planned treasury management strategy.

Ethereum's price action now tests critical technical levels. The sell-off created a Fair Value Gap (FVG) between $2,222 and $2,300, which market makers will likely attempt to fill in the short term. Volume Profile analysis shows high-volume nodes at $2,100, aligning with the 0.618 Fibonacci retracement level from the 2025 low. This confluence forms a major Order Block. A break below this support would invalidate the current bullish structure and target the next liquidity pool at $1,950. The Relative Strength Index (RSI) sits at 28, indicating oversold conditions but not yet extreme capitulation. Consequently, this whale dump acts as a forced liquidity event, potentially flushing out late longs and resetting the market for a healthier rally.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Ethereum Current Price | $2,146.01 |

| 24-Hour Price Change | -5.21% |

| ETH Whale Sale Volume | 96,585 ETH ($214.6M approx.) |

| Total Estimated Whale Loss | $140.78M |

This event matters because it represents a classic liquidity grab during extreme fear. Institutional-grade analysis treats such large loss sales as potential contrarian signals. When whales capitulate at significant losses, it often indicates that selling pressure is nearing exhaustion. However, the immediate impact is negative price action and increased volatility. The whale's shift to 58.34 million USDC also reflects a broader trend of capital rotation into stablecoins during uncertainty, similar to patterns observed during the recent Binance liquidity concerns. Market structure suggests this could be a precursor to a volatility squeeze, where compressed price ranges eventually break out violently.

"Large realized losses often mark inflection points. This whale's exit at a $140 million loss signals extreme pain, which historically precedes relief rallies. However, traders must watch the $2,100 support; a break below would indicate deeper structural damage and likely trigger further downside to $1,950. The shift to USDC suggests this entity is preparing for either deeper buys or fiat exit." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $2,100 support level. First, if support holds, the Fair Value Gap between $2,222 and $2,300 could attract buying pressure for a fill, leading to a relief rally toward $2,400. Second, if support breaks, the next major liquidity pool sits at $1,950, potentially triggering a cascade of stop-loss orders. The 12-month institutional outlook remains cautious but opportunistic, with entities like BlackRock monitoring such events for accumulation zones. According to historical cycles, extreme fear readings below 20/100 often precede substantial rallies within 3-6 months, but timing remains uncertain.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.