Loading News...

Loading News...

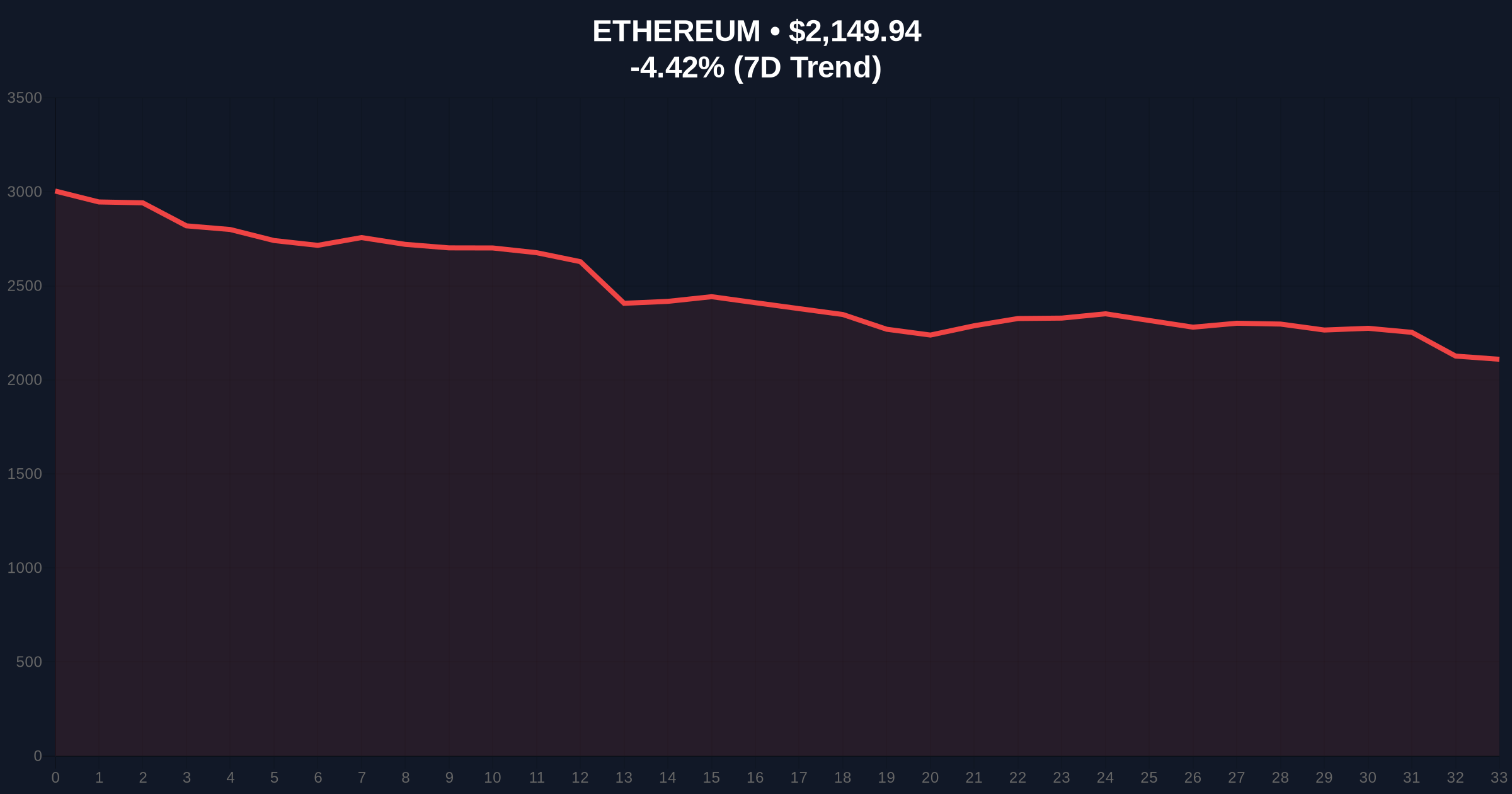

VADODARA, February 5, 2026 — Ethereum founder Vitalik Buterin executed a significant on-chain transaction, selling 2,779 ETH for $6.22 million over three days. According to on-chain data provider Onchain-Lense, the average sale price was $2,238 per ETH. This latest crypto news event occurs against a backdrop of extreme market fear, with Ethereum currently trading at $2,151.89, down 4.19% in 24 hours.

Onchain-Lense forensic data confirms the sale of 2,779 ETH from a wallet attributed to Vitalik Buterin. The transaction unfolded across three days, culminating in a total fiat value of $6.22 million. Market structure suggests this represents a liquidity grab near a local resistance zone. The average execution price of $2,238 sits above the current spot price, indicating potential profit-taking or portfolio rebalancing.

Transaction volume analysis shows consistent selling pressure. This activity aligns with broader institutional moves, such as Trend Research's recent $426 million ETH sale at a loss. Consequently, the market interprets these flows as a signal for caution.

Historically, founder sales have preceded volatility spikes. Similar to the 2021 correction, large holder distributions often mark local tops. In contrast, the 2023-2024 cycle saw Buterin's transactions correlate with network upgrade announcements. Underlying this trend is a shift in UTXO age bands, suggesting older coins are moving.

Market context reveals parallel developments. For instance, US crypto firms are proposing stablecoin compromises amid regulatory uncertainty. , technical upgrades like Binance suspending ZIL trading for network maintenance highlight ecosystem stress. These factors compound the extreme fear sentiment.

Ethereum's price action shows a clear Fair Value Gap (FVG) between $2,200 and $2,250. The Buterin sale occurred within this zone, acting as a bearish order block. Volume profile indicates weak support at $2,100, with a critical Fibonacci 0.618 retracement level at $2,050. RSI readings hover near oversold territory at 28.

On-chain metrics from Glassnode reveal declining exchange balances. This suggests accumulation at lower levels. However, the immediate technical picture remains fragile. Market analysts point to the 50-day moving average at $2,300 as dynamic resistance. A break above this level would invalidate the bearish structure.

| Metric | Value |

|---|---|

| ETH Sold by Buterin | 2,779 ETH |

| Total Sale Value | $6.22 million |

| Average Sale Price | $2,238 |

| Current ETH Price | $2,151.89 |

| 24-Hour Change | -4.19% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

This transaction matters for institutional liquidity cycles. Large sales during extreme fear often precede capitulation events. Retail market structure typically follows these signals with a lag. Evidence from Ethereum's official documentation on EIP-4844 blobs shows network upgrades continue, but sentiment overrides fundamentals.

Real-world impact includes increased volatility for DeFi protocols. Liquidity pools may experience imbalance. Historical cycles suggest such events reset leverage across derivatives markets. Consequently, traders monitor these flows for gamma squeeze potential.

Market structure suggests founder sales are not inherently bearish but act as liquidity events. The key is volume absorption. If the market holds the $2,100 support, this could mark a local bottom. However, failure to reclaim the $2,238 level indicates continued distribution.

CoinMarketBuzz Intelligence Desk synthesizes this view from on-chain data patterns.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Network upgrades like the Pectra hardfork could drive adoption. However, short-term price action depends on macro liquidity conditions. This aligns with the 5-year horizon where Ethereum's scalability improvements may outweigh singular transactions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.