Loading News...

Loading News...

VADODARA, February 5, 2026 — Trend Research, a previously bullish institutional accumulator, has executed a massive $426 million Ethereum (ETH) liquidation at a significant loss, according to data from AmberCN. This latest crypto news exposes a deep underwater position and concentrated liquidation risk that contradicts the firm's public accumulation narrative since November 2025.

AmberCN's on-chain forensic report details a critical deleveraging event. Trend Research sold 188,500 ETH at an average price of $2,263. The firm simultaneously repaid 385 million USDT to reduce leverage. This sale crystallized a $173 million realized loss. Market structure suggests this was not a strategic rebalance but a forced move to avoid margin calls.

Following the sale, Trend Research's portfolio reveals severe distress. It holds 463,000 ETH worth $998 million, purchased at an average cost of $3,180. This creates an unrealized loss of $474 million. Most critically, the liquidation price for its remaining ETH-backed loans now clusters tightly around $1,640. This creates a dangerous Fair Value Gap (FVG) below current prices.

Historically, concentrated liquidation levels act as powerful magnets for price action. The $1,640 cluster represents a massive sell-side Order Block. If triggered, it could replicate the cascade effects seen in the 2022 Three Arrows Capital (3AC) and Celsius Network collapses. In contrast, the firm's aggressive accumulation since November 2025 now appears to be a high-leverage, poorly timed bet on a V-shaped recovery.

This event occurs against a backdrop of Extreme Fear across global crypto markets. Consequently, other institutional players are likely facing similar pressure, as seen in recent regulatory debates impacting stablecoin frameworks and market structure. For instance, parallel discussions around the US CLARITY Act highlight the regulatory uncertainty compounding technical stress.

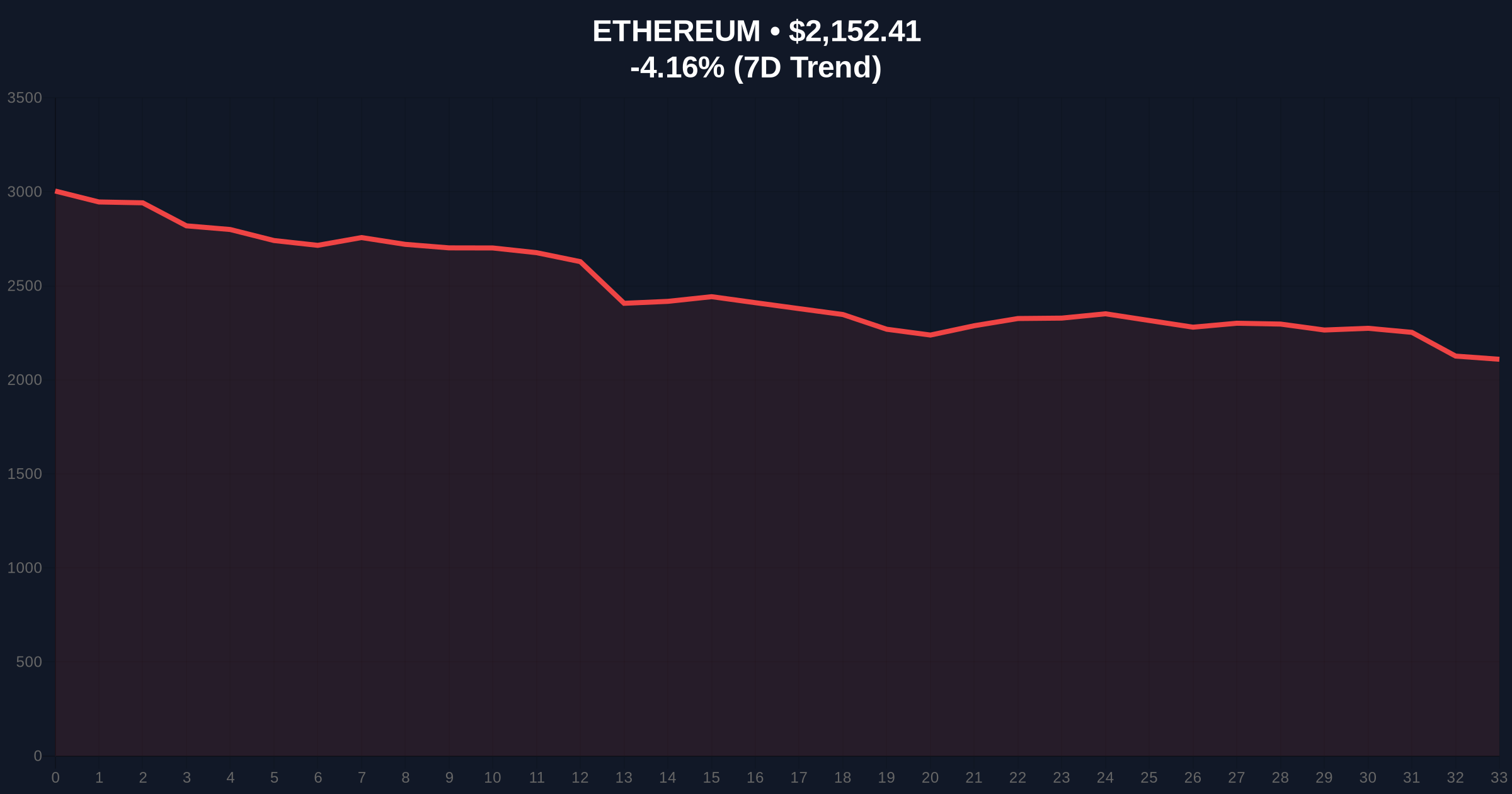

Ethereum's current price of $2,151.28 sits precariously above the critical liquidation zone. The 24-hour trend of -4.21% indicates selling pressure is intensifying. On-chain data from Glassnode indicates weak holder conviction, with short-term UTXO (Unspent Transaction Output) bands showing increased movement.

Technically, the $1,640 level now serves as the primary Bearish Invalidation level. A break below it would confirm a failure of the current support structure and likely trigger the firm's remaining liquidations. Conversely, resistance is forming near the 50-day moving average at approximately $2,450, which aligns with the 0.382 Fibonacci retracement level from the recent high. Market structure suggests any rally toward this zone will face intense selling from other over-leveraged entities.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Ethereum (ETH) Current Price | $2,151.28 |

| 24-Hour Price Change | -4.21% |

| Trend Research Realized Loss | $173 Million |

| Concentrated Liquidation Price | $1,640 |

| Trend Research Unrealized Loss | $474 Million |

This liquidation event matters because it exposes hidden systemic risk. Trend Research's actions reveal that institutional "accumulation" narratives can mask dangerous leverage. The concentrated liquidation price at $1,640 creates a clear target for market bears. A breach could trigger a negative gamma squeeze, forcing other leveraged players to sell simultaneously.

, the firm's use of USDT for loan repayment highlights the interconnectedness of stablecoin liquidity and leveraged positions. This dynamic is central to current policy debates, as outlined in resources from the Federal Reserve regarding financial stability monitoring. The event validates concerns that crypto-native leverage cycles remain a critical vulnerability.

"The data indicates a classic liquidity grab. A major player is forced to sell into weakness to meet margin requirements, creating a vacuum of bids below the market. The $1,640 liquidation cluster is now the most critical level on the ETH chart. If that breaks, the next significant support isn't until the $1,200 region, which was the previous cycle's accumulation zone," stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios based on the $1,640 liquidation level.

For the 12-month institutional outlook, this event serves as a stark reminder. It the importance of stress-testing portfolios against concentrated liquidation risks. The 5-year horizon will likely see increased regulatory scrutiny on leverage and lending practices within crypto capital markets, potentially altering market structure fundamentals.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.