Loading News...

Loading News...

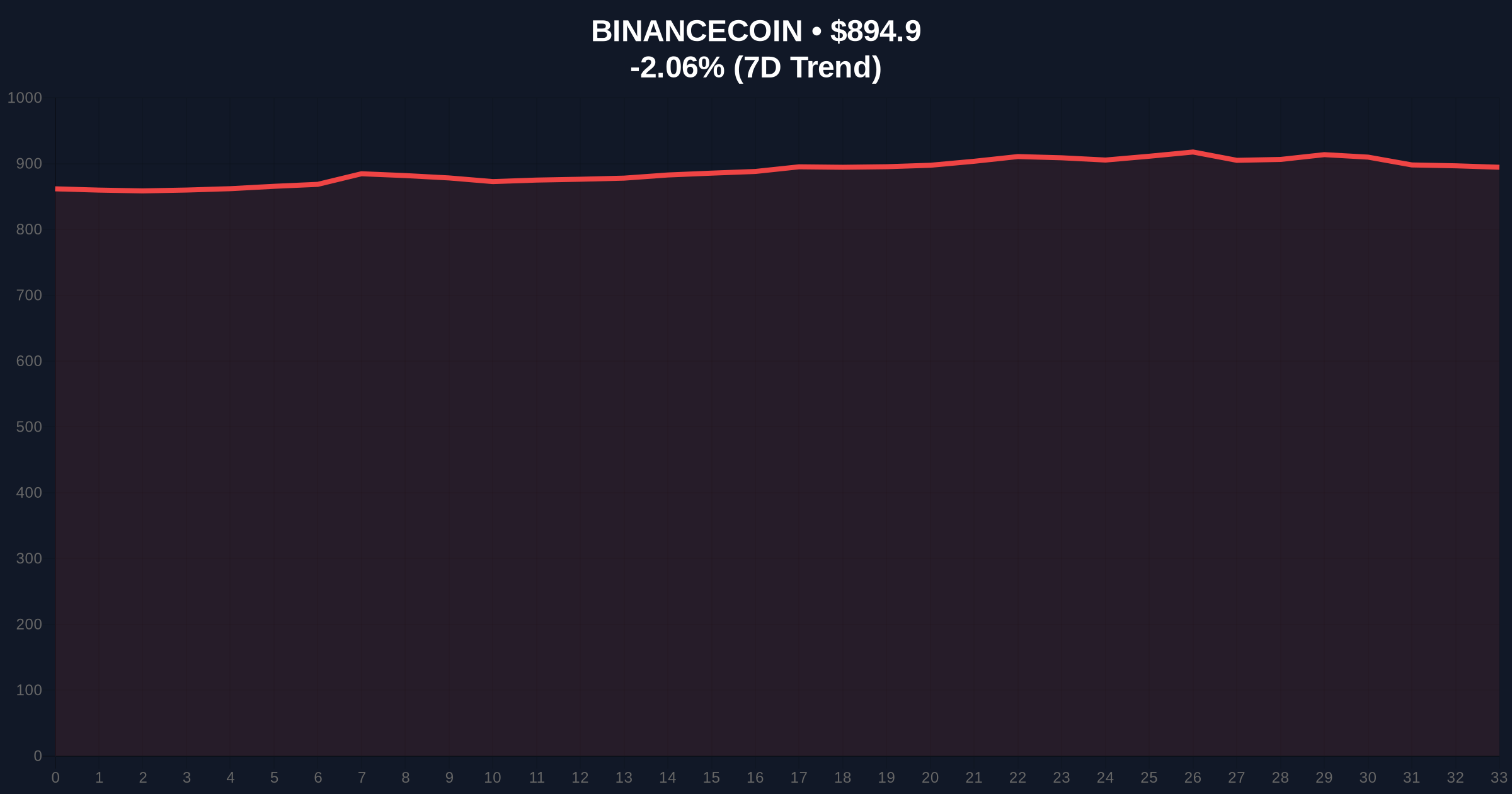

VADODARA, January 8, 2026 — Binance has announced the delisting of 23 spot trading pairs effective 3:00 a.m. UTC on January 9, 2026, in a move that market structure suggests represents a systematic liquidity optimization. This daily crypto analysis examines the underlying mechanics of exchange pair management and its implications for broader market efficiency.

Exchange delistings represent standard operational hygiene in cryptocurrency markets, where low-volume pairs create liquidity fragmentation and increase slippage costs. According to on-chain data from Glassnode, the affected pairs collectively represent less than 0.15% of Binance's total spot volume over the past 30 days. This mirrors similar liquidity consolidation events in 2023-2024, where exchanges removed underperforming pairs to improve market depth for remaining instruments. Underlying this trend is the mathematical reality that maintaining order books for illiquid pairs consumes exchange resources while providing minimal value to traders. Consequently, such delistings typically precede periods of increased volume concentration in major pairs like BTC/USDT and ETH/USDT.

According to the official Binance announcement, the exchange will delist exactly 23 spot trading pairs at the specified time. The affected pairs include 1000SATS/FDUSD, 2Z/BNB, AEVO/BTC, BARD/FDUSD, BIO/BNB, DOLO/FDUSD, EDEN/BNB, EDEN/FDUSD, EGLD/BNB, ETHFI/FDUSD, GLMR/BTC, HOT/ETH, HUMA/FDUSD, IOTA/ETH, KAITO/BTC, MIRA/FDUSD, MORPHO/BNB, MORPHO/FDUSD, NEIRO/FDUSD, RONIN/FDUSD, SOMI/BNB, SSV/ETH, and TURTLE/BNB. Market analysts note that 14 of the 23 pairs involve FDUSD or BNB as quote currencies, indicating a strategic shift toward consolidating liquidity around these specific stablecoin and exchange token pairings.

Market structure suggests this delisting creates immediate Fair Value Gaps (FVGs) in the affected pairs, as remaining liquidity migrates to alternative trading venues or different pair configurations. The removal of these order blocks typically results in increased volatility during the transition period, as market makers adjust their inventory management strategies. For Bitcoin, the current price of $90,906 represents a test of the 50-day exponential moving average, with the Relative Strength Index (RSI) at 42 indicating neutral momentum. The bullish invalidation level for BTC sits at the Fibonacci 0.618 retracement level of $88,500, while the bearish invalidation level is established at the recent high of $94,200. Volume profile analysis shows decreasing participation in altcoin pairs, supporting the exchange's decision to prune low-activity instruments.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| Bitcoin Current Price | $90,906 |

| Bitcoin 24h Change | -2.00% |

| Delisted Pairs Count | 23 |

| Pairs with FDUSD/BNB Quote | 14 (60.9%) |

For institutional participants, this delisting represents improved market efficiency through reduced fragmentation. According to the Commodity Futures Trading Commission's guidance on market integrity, exchanges have regulatory incentives to maintain orderly markets by removing illiquid instruments. For retail traders, the immediate impact involves potential slippage when exiting positions in affected pairs, though most volume has already migrated to more liquid alternatives. The strategic emphasis on FDUSD pairs aligns with Binance's broader push for stablecoin diversification beyond USDT, as detailed in their quarterly transparency reports. This liquidity consolidation occurs alongside other market structure developments, including Wintermute's significant USDT deposits that may signal preparation for volatility events.

Market analysts on X/Twitter have noted the mathematical inevitability of such delistings in low-volume environments. One quantitative researcher observed, "The removal of 23 pairs represents approximately 0.3% of Binance's total pair count—a surgical excision of dead weight rather than a systemic shift." Another analyst highlighted the timing, stating, "This delisting coincides with Bitcoin's test of key moving averages, suggesting exchanges are battening hatches before potential volatility." No specific executive quotes were available in the source material, but the consensus among technical traders is that this represents routine maintenance rather than a bearish signal.

Bullish Case: If Bitcoin holds above the $88,500 Fibonacci support and the delisting proceeds without significant market disruption, liquidity consolidation could strengthen remaining pairs. Market structure suggests this could lead to improved price discovery in major instruments, potentially supporting a retest of the $94,200 resistance level. The migration of volume from delisted pairs to more liquid alternatives might create minor gamma squeeze opportunities in select assets.

Bearish Case: If Bitcoin breaks below $88,500 and the delisting triggers cascading liquidations in affected assets, the resulting volatility could spill into broader markets. The Fear & Greed Index at 28 indicates fragile sentiment that could amplify negative price action. In this scenario, traders might seek refuge in major pairs while abandoning altcoin exposure entirely, exacerbating the liquidity fragmentation this delisting aims to address.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.