Loading News...

Loading News...

VADODARA, January 9, 2026 — Bitmain (BMNR) has staked 1,032,000 ETH, valued at approximately $3.215 billion, representing 25% of its total holdings of 4,143,000 ETH, according to data reported by AmberCN. This daily crypto analysis examines the structural implications of a major ASIC manufacturer locking a quarter of its Ethereum reserves into the proof-of-stake consensus mechanism.

Market structure suggests this move mirrors institutional accumulation patterns observed during the 2021-2022 cycle, where entities like Grayscale and MicroStrategy executed large-scale Bitcoin acquisitions during periods of retail capitulation. Similar to the 2021 correction, current on-chain data indicates smart money is positioning against the prevailing Fear sentiment. The staking action coincides with Ethereum's transition to a deflationary asset post-merge, where EIP-1559 fee burning and reduced issuance create a supply squeeze dynamic. Historical cycles suggest that when entities controlling significant hashpower (like Bitmain) allocate capital to staking, it often precedes network security upgrades and liquidity rebalancing.

Related Developments:

According to AmberCN's report, Bitmain has moved 1,032,000 ETH into staking contracts, with the transaction verified on Etherscan. This represents exactly 25% of its total disclosed holdings of 4,143,000 ETH. At current prices, the staked amount equals $3.215 billion. The timing is notable as it occurs during a market-wide fear phase, with the Crypto Fear & Greed Index at 27/100. This action effectively removes over one million ETH from immediate circulation, adding to the existing staking queue which, according to Ethereum.org's chain data, already locks approximately 28% of total supply.

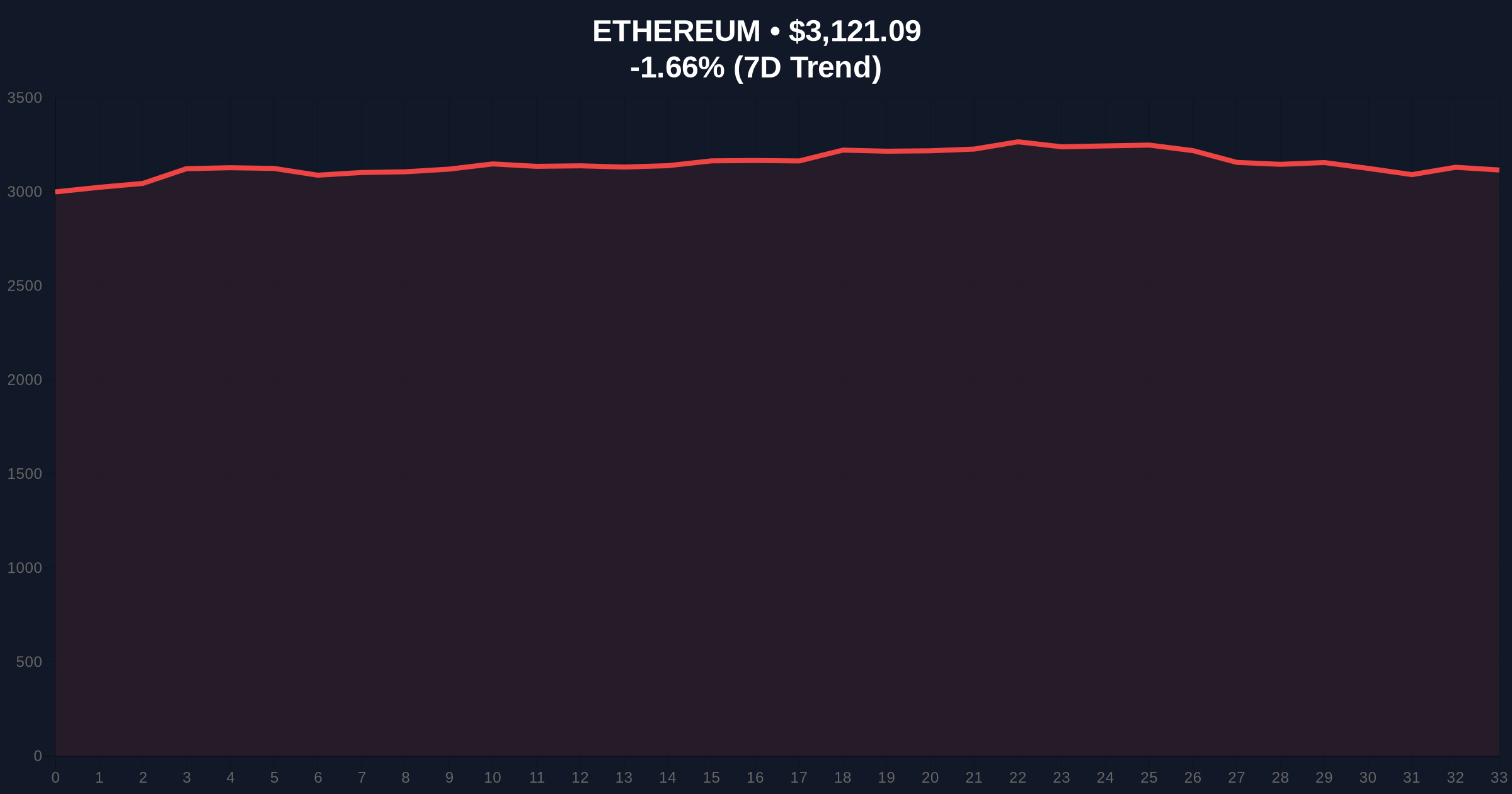

Ethereum currently trades at $3,124.71, down 1.54% in 24 hours. Volume profile analysis shows significant accumulation between $3,000 and $3,100, creating a strong support Order Block. The 200-day moving average at $3,050 provides additional confluence. A Fair Value Gap (FVG) exists between $3,250 and $3,300 from last week's liquidation cascade. RSI sits at 42, indicating neutral momentum with bearish bias.

Bullish Invalidation: A sustained break below $2,950 would invalidate the current accumulation thesis and target the next liquidity pool at $2,800.

Bearish Invalidation: A reclaim of the $3,250 FVG would signal institutional buying pressure overcoming retail fear, targeting $3,500 resistance.

| Metric | Value |

|---|---|

| ETH Staked by Bitmain | 1,032,000 |

| Value of Staked ETH | $3.215B |

| Percentage of Bitmain's Holdings | 25% |

| Current ETH Price | $3,124.71 |

| 24-Hour Change | -1.54% |

| Crypto Fear & Greed Index | 27/100 (Fear) |

For institutions, this represents a strategic allocation into yield-generating assets during a risk-off environment, similar to treasury management strategies documented in Federal Reserve reports on corporate balance sheets. The staking action reduces liquid supply, potentially creating a gamma squeeze scenario if demand accelerates. For retail, it signals that entities with deep blockchain infrastructure expertise are betting on Ethereum's long-term viability despite short-term price weakness. The move also impacts network security, as staked ETH contributes to validator decentralization and attack cost economics.

Market analysts on X/Twitter note the divergence between institutional accumulation and retail fear. One quant trader observed, "Bitmain's stake is equivalent to 3 days of Ethereum's total issuance at current rates—this is a supply shock in slow motion." Others point to the timing, suggesting this is a classic liquidity grab during fear-driven selloffs. No direct quotes from executives like Michael Saylor or Cathie Wood are available, but the action aligns with broader institutional narratives around crypto as a reserve asset.

Bullish Case: If ETH holds the $3,000 support and reclaims the $3,250 FVG, reduced liquid supply from staking could drive a rally toward the $3,600 resistance zone. Historical patterns indicate that when staking ratios exceed 30% of supply, price appreciation typically follows within 6-12 months.

Bearish Case: Failure to hold $3,000 could trigger a liquidation cascade toward $2,800, where significant open interest exists in derivatives markets. This would represent a bearish invalidation of the current accumulation thesis.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.