Loading News...

Loading News...

VADODARA, January 30, 2026 — U.S. spot Ethereum ETFs recorded a total net outflow of $178 million on January 29, reversing a brief inflow trend and intensifying market pressure. This daily crypto analysis reveals institutional capital retreating at a critical technical juncture. According to data from TraderT, Fidelity's FETH led withdrawals with $59.19 million, followed by BlackRock's ETHA at $55.22 million. Grayscale's ETHE and Mini ETH funds contributed outflows of $26.49 million and $21.92 million, respectively.

TraderT's flow data confirms a sharp reversal from January 28's net inflows. Fidelity and BlackRock, representing over 64% of the total outflow, executed coordinated withdrawals. This liquidity grab occurred as Ethereum's price tested key support levels. Market structure suggests these outflows reflect institutional risk management amid deteriorating sentiment. The single-day reversal pattern mirrors historical ETF behavior during volatility spikes, where short-term inflows quickly evaporate under selling pressure.

Consequently, the ETF outflow aligns with broader market deleveraging. For instance, recent massive crypto futures liquidations exceeding $1.26 billion exacerbated the sell-off. This creates a feedback loop where ETF withdrawals pressure spot prices, triggering further liquidations. Underlying this trend is a shift in institutional positioning from accumulation to distribution, as evidenced by the dominance of long-position liquidations.

Historically, ETF flow reversals precede extended consolidation phases. The January 29 outflow echoes patterns from Q4 2023, when Bitcoin ETF outflows correlated with a 15% price correction. In contrast, sustained inflows in early 2025 supported Ethereum's rally to $3,800. The current extreme fear sentiment, scoring 16/100 on the Crypto Fear & Greed Index, indicates capitulation risk. This sentiment often marks local bottoms but requires confirmation from on-chain metrics like exchange net flows and miner reserves.

, macroeconomic headwinds amplify the outflow impact. Recent US jobless claims exceeding forecasts have fueled risk-off sentiment across asset classes. Ethereum's correlation with traditional risk assets has increased post-merge, making it vulnerable to broader financial conditions. Related developments include a dormant Ethereum whale selling $1.87 million while opening an $18 million leveraged long, showcasing divergent institutional strategies.

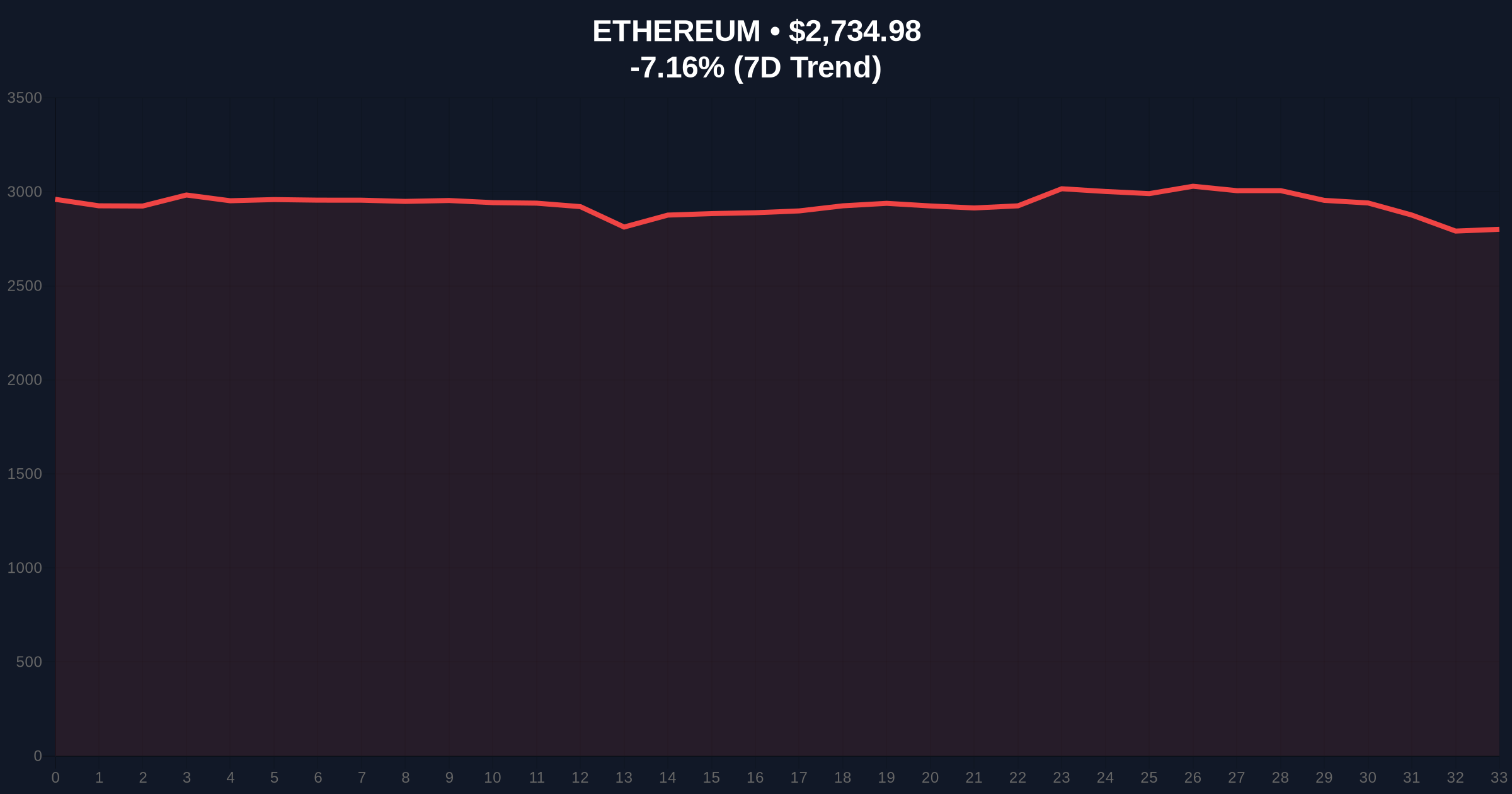

Ethereum currently trades at $2,735.48, down 7.14% in 24 hours. The price action reveals a critical test of the 200-day exponential moving average (EMA) near $2,700. A sustained break below this level would invalidate the bullish higher-timeframe structure established since the Shanghai upgrade. Volume profile analysis shows significant volume nodes between $2,650 and $2,800, indicating a battleground for control.

Market structure suggests the ETF outflow created a Fair Value Gap (FVG) between $2,750 and $2,800. This FVG acts as a magnet for price, likely to be filled before any sustained rally. The Relative Strength Index (RSI) sits at 32, approaching oversold territory but not yet signaling a reversal. Fibonacci retracement levels from the 2025 high of $3,800 to the 2024 low of $1,500 place the 0.618 support at $2,450, a potential target if current support fails.

| Metric | Value | Source |

|---|---|---|

| Total ETF Net Outflow (Jan 29) | $178 million | TraderT |

| Fidelity FETH Outflow | $59.19 million | TraderT |

| BlackRock ETHA Outflow | $55.22 million | TraderT |

| Ethereum Current Price | $2,735.48 | Live Market Data |

| 24-Hour Price Change | -7.14% | Live Market Data |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Live Market Data |

ETF flows serve as a proxy for institutional sentiment. A $178 million outflow represents a significant liquidity withdrawal from the spot market, increasing selling pressure. This matters because institutional participation, post-merge, has been a key driver of Ethereum's valuation. The outflow coincides with Ethereum's transition to a proof-of-stake consensus mechanism, where validator economics and staking yields influence long-term demand. According to Ethereum.org, the network's annual issuance rate has dropped to approximately 0.5%, making supply dynamics increasingly sensitive to demand shocks.

, the outflow impacts market structure by depleting bid-side liquidity on centralized exchanges. This creates vulnerability to flash crashes and exacerbates volatility. Retail traders often follow institutional leads, potentially amplifying the downtrend. The extreme fear sentiment suggests panic selling may be nearing exhaustion, but recovery requires a catalyst such as renewed ETF inflows or positive regulatory developments.

The $178 million outflow reflects institutional de-risking amid macroeconomic uncertainty. While concerning, such outflows often mark sentiment extremes. Historical cycles suggest that when ETF flows reverse sharply, it can signal a contrarian buying opportunity, but only after price stabilizes above key moving averages. The critical watch is whether this is a one-off event or the start of a sustained withdrawal trend.

CoinMarketBuzz Intelligence Desk notes that similar outflows in Bitcoin ETFs during 2024 preceded a 20% rally, highlighting the non-linear relationship between flows and price.

Market structure suggests two primary scenarios based on the ETF outflow and technical levels.

The 12-month institutional outlook hinges on ETF flow sustainability and Ethereum's adoption of EIP-4844 proto-danksharding, which aims to reduce layer-2 transaction costs. If outflows persist, Ethereum may underperform Bitcoin in the near term, as seen in recent Bitcoin price action below $83,000. However, long-term fundamentals remain intact, with the network's fee burn mechanism and staking yield providing structural support.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.