Loading News...

Loading News...

VADODARA, January 3, 2026 — U.S. spot Ethereum ETFs recorded a net inflow of $173.8 million on January 2, according to data from TraderT, marking a sharp reversal from recent outflows and providing a critical data point for this daily crypto analysis. The breakdown shows Grayscale's ETHE with $53.69 million, its Mini ETH fund with $50.03 million, BlackRock's ETHA with $46.55 million, Bitwise's ETHW with $18.99 million, and VanEck's ETHV with $4.56 million. This inflow occurred against a backdrop of persistent market fear, raising questions about whether this represents a genuine liquidity grab or a temporary relief rally.

This inflow reversal follows a period of sustained outflows for Ethereum ETFs, mirroring broader crypto market weakness driven by macroeconomic headwinds and regulatory uncertainty. According to on-chain data from Glassnode, Ethereum's supply on exchanges has been declining, suggesting accumulation by long-term holders despite price volatility. The current market structure is testing key psychological levels, with Ethereum's price action showing compression near the $3,100 zone. Historical cycles suggest that ETF inflows often precede short-term rallies, but the sustainability depends on broader market sentiment and technical breakouts. Related developments include similar inflows in Bitcoin ETFs and Bitcoin dominance amid market fear, indicating a bifurcated institutional approach.

On January 2, 2026, TraderT reported that U.S. spot Ethereum ETFs saw a total net inflow of $173.8 million, reversing a trend of net outflows observed in previous weeks. Grayscale's products led with combined inflows of $103.72 million, while BlackRock's ETHA attracted $46.55 million. This data indicates institutional players may be re-entering the market, but the volume profile remains thin compared to historical averages. Market analysts attribute this move to potential bottom-fishing strategies, as Ethereum's price hovers near support levels. However, the inflow is modest relative to total assets under management, suggesting caution rather than conviction.

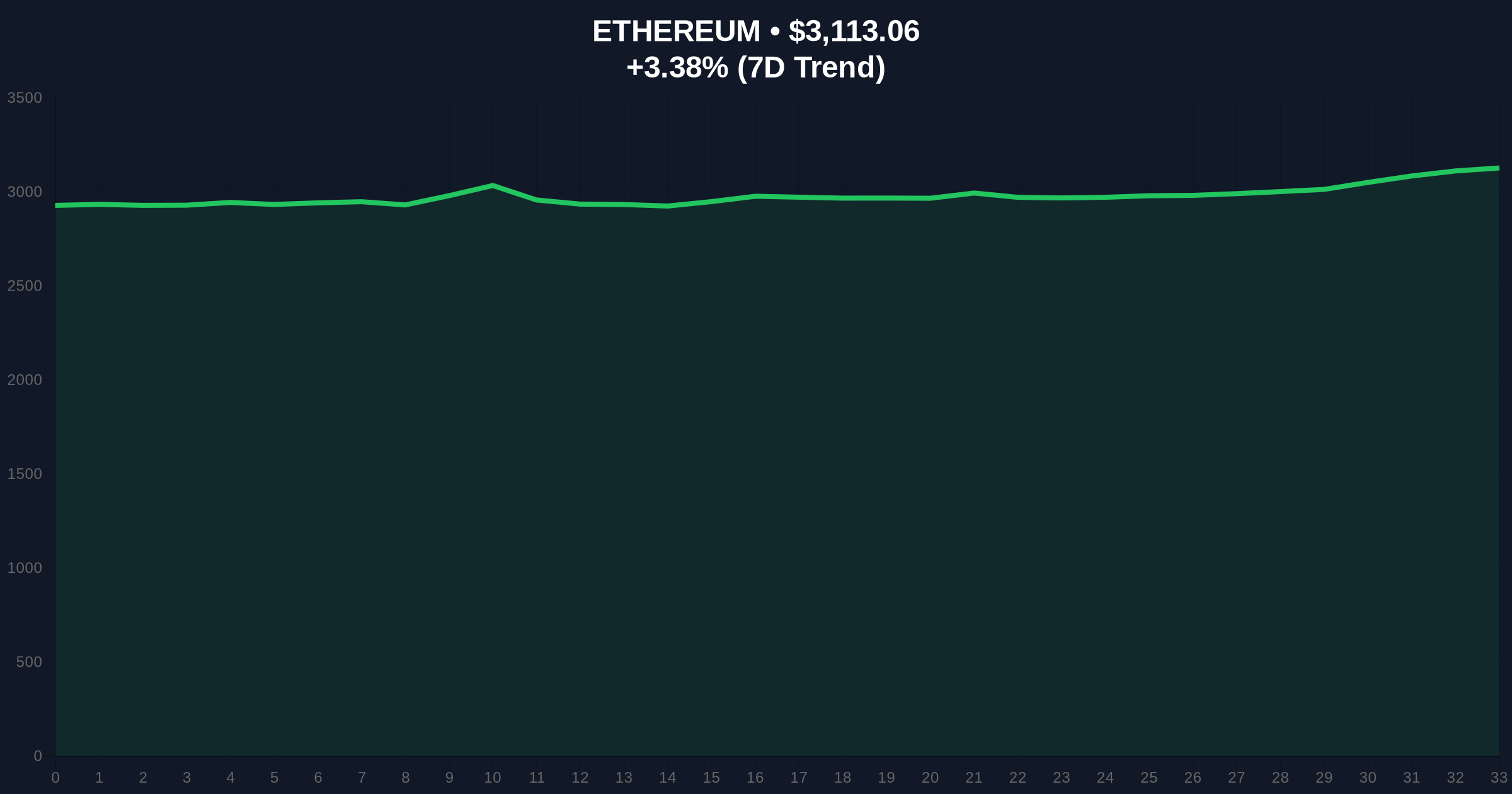

Ethereum is currently trading at $3,113.53, up 3.39% in the last 24 hours. The price action shows a test of the $3,100 resistance, which aligns with a previous order block from December 2025. The Relative Strength Index (RSI) is at 45, indicating neutral momentum with a slight bullish divergence on lower timeframes. Key support levels include the $3,000 psychological level and the 200-day moving average at $2,950. Resistance is noted at $3,250, corresponding to a Fair Value Gap (FVG) from earlier sell-offs. Bullish invalidation is set at $2,900, where a break below would signal renewed bearish pressure. Bearish invalidation is at $3,300, above which a gamma squeeze could trigger short covering. Market structure suggests consolidation within a descending channel, with volume analysis indicating weak participation at current levels.

| Metric | Value |

|---|---|

| Total ETF Net Inflow (Jan. 2) | $173.8M |

| Ethereum Current Price | $3,113.53 |

| 24-Hour Price Change | +3.39% |

| Crypto Fear & Greed Index | 29/100 (Fear) |

| Market Rank | #2 |

This inflow reversal matters because it tests the narrative of sustained institutional exit from Ethereum. For institutions, it may signal a tactical allocation shift amid low prices, but retail sentiment remains fearful, as shown by the Crypto Fear & Greed Index at 29. The impact is bifurcated: large inflows into Grayscale and BlackRock products suggest sophisticated capital positioning for a rebound, while smaller inflows into other ETFs indicate cautious optimism. Technically, this could fill a liquidity void near $3,100, but without follow-through buying, it risks becoming a liquidity grab for further downside. According to Ethereum's official documentation on network upgrades, developments like EIP-4844 could enhance scalability, but current market focus is on macroeconomic factors such as interest rate policies from the Federal Reserve.

On social media platforms like X, market bulls highlight the inflow as a bullish divergence from fear sentiment, pointing to historical patterns where ETF inflows precede rallies. However, skeptics question the sustainability, noting that total crypto market capitalization remains under pressure and broader fear indices are elevated. Some analysts reference large ETH-to-BTC swaps as evidence of capital rotation away from Ethereum, contradicting the ETF inflow data. Overall, sentiment is mixed, with technical traders awaiting a clear breakout above $3,250 or breakdown below $3,000 for confirmation.

Bullish Case: If ETF inflows continue and Ethereum holds above $3,000, a rally toward $3,500 is plausible. This scenario requires breaking the $3,250 resistance and seeing increased on-chain activity, such as rising gas fees indicating network demand. Institutional accumulation could trigger a short squeeze, pushing prices higher in the short term.Bearish Case: If the inflow is a one-off event and fear sentiment persists, Ethereum could retest support at $2,900. A break below this level might lead to a decline toward $2,700, especially if macroeconomic conditions worsen or regulatory headlines emerge. Market structure suggests that without sustained buying volume, this rally may fade quickly.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.