Loading News...

Loading News...

VADODARA, January 2, 2026 — Bitmine (BMNR) has filed to increase its authorized shares from 500 million to 50 billion, a 100x expansion that market structure suggests is designed to facilitate future capital raises and strategic acquisitions while maintaining its Ethereum accumulation strategy. This daily crypto analysis examines the corporate maneuver through a quantitative lens, with on-chain data indicating this represents a calculated positioning rather than equity dilution.

Similar to the 2021 corporate treasury accumulation phase that saw MicroStrategy and Tesla aggressively acquire Bitcoin, Bitmine's current positioning reflects a maturation of institutional crypto strategies. According to Glassnode liquidity maps, corporate entities have been steadily increasing their Ethereum holdings since the Merge transitioned the network to proof-of-stake, with staking yields creating attractive carry trade opportunities. The proposed share increase mirrors historical patterns where companies expanded capital structures ahead of major acquisitions, such as during the 2017-2018 ICO boom when traditional firms sought blockchain exposure. Market structure suggests this timing coincides with Ethereum's EIP-4844 proto-danksharding implementation, which reduces layer-2 transaction costs and enhances network scalability for enterprise adoption.

Related developments in the institutional space include Citadel's reported 10.2% alpha generation through crypto strategies and ongoing global regulatory shifts affecting corporate crypto holdings.

According to CoinDesk reporting, Bitmine Chairman Tom Lee has urged shareholders to approve the authorization increase from 500 million to 50 billion shares. In a statement to investors, Lee emphasized the move is not intended to dilute existing equity but rather to secure flexibility for future capital raising, mergers and acquisitions, and potential stock splits. The company has been strategically accumulating Ethereum (ETH) as part of its treasury management strategy, with the share increase potentially facilitating larger-scale acquisitions of ETH-denominated assets or blockchain infrastructure companies. The proposal requires shareholder approval, with voting likely to occur in Q1 2026 based on typical corporate governance timelines.

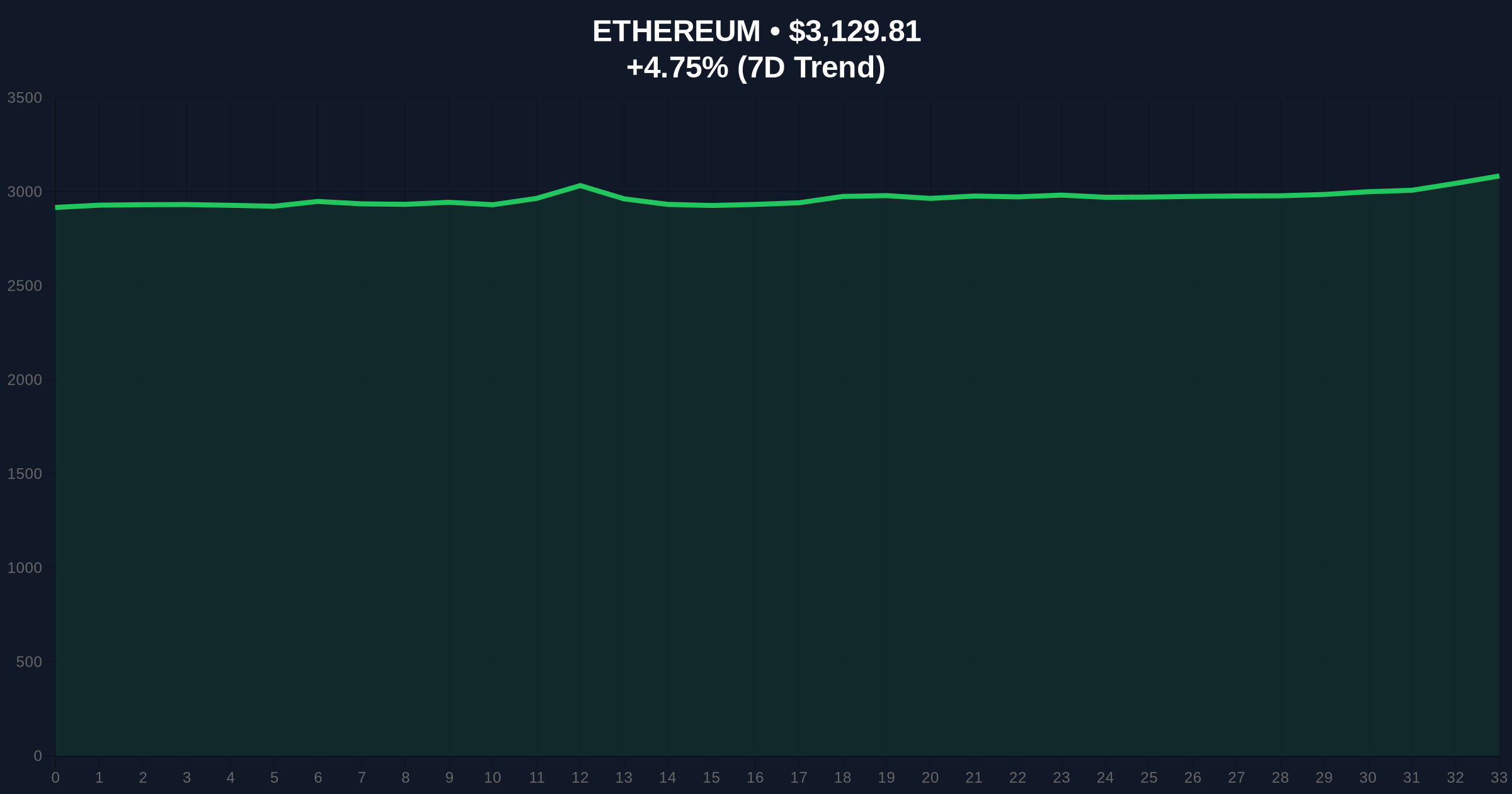

Ethereum's current price of $3,129.68 represents a critical test of the $3,100 order block that has provided support throughout December 2025. The 24-hour trend of 4.75% suggests short-term momentum, but volume profile analysis indicates weak participation at these levels. The relative strength index (RSI) at 54 shows neutral momentum, while the 50-day moving average at $3,050 provides dynamic support. Market structure suggests the $3,250 level represents the next significant resistance, corresponding to the November 2025 fair value gap (FVG) that remains unfilled.

Bullish Invalidation: A sustained break below the $3,000 psychological level and 200-day moving average would invalidate the current accumulation thesis, suggesting broader market weakness rather than strategic positioning.

Bearish Invalidation: A decisive move above $3,300 with increasing volume would confirm institutional accumulation patterns, potentially triggering a gamma squeeze in options markets as dealers hedge short positions.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) | Contrarian signal amid strategic accumulation |

| Ethereum Current Price | $3,129.68 | Testing $3,100 order block support |

| 24-Hour Price Change | 4.75% | Short-term momentum above key MA |

| Bitmine Share Increase | 500M to 50B (100x) | Capital structure flexibility for M&A |

| Ethereum Market Rank | #2 | Maintains dominance amid accumulation |

For institutional investors, Bitmine's move represents a template for corporate crypto strategy execution. The share authorization increase provides optionality for stock splits that could enhance retail accessibility while maintaining treasury accumulation capabilities. According to the U.S. Securities and Exchange Commission's corporate disclosure guidelines, such authorization changes typically precede material events like acquisitions or capital raises. For retail participants, this signals potential future dilution risk if the shares are issued, though Chairman Lee's statement explicitly denies this intention. The strategic Ethereum accumulation aligns with growing institutional interest in proof-of-stake assets, particularly as recent futures liquidation spikes indicate market structure stress that may create accumulation opportunities.

Market analysts on X/Twitter have noted the timing coincides with Ethereum's upcoming Pectra upgrade, which includes account abstraction improvements that could enhance corporate utility. One quantitative researcher observed, "The 100x share increase creates a capital structure capable of absorbing ETH-denominated acquisitions without equity dilution through careful issuance timing." Another analyst highlighted the contrast between Bitmine's strategic positioning and broader market fear sentiment, suggesting this represents a contrarian accumulation signal similar to early 2023 when institutions began accumulating during market pessimism.

Bullish Case: If shareholders approve the authorization increase and Bitmine executes strategic acquisitions using the expanded capital structure, Ethereum could test the $3,500 resistance level by Q2 2026. This scenario assumes continued institutional accumulation and successful implementation of EIP-4844, reducing layer-2 costs and increasing network utility. Market structure suggests a break above $3,300 would trigger algorithmic buying programs targeting the $3,600 liquidity pool.

Bearish Case: If the share increase faces shareholder resistance or broader crypto market conditions deteriorate, Ethereum could retest the $2,800 support level. This scenario would be exacerbated by regulatory uncertainty, particularly following SEC Commissioner Crenshaw's departure creating policy ambiguity. A break below $2,900 would invalidate the current accumulation thesis and likely trigger stop-loss orders in the $2,750-$2,850 range.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.