Loading News...

Loading News...

VADODARA, January 14, 2026 — U.S. spot Ethereum ETFs recorded $129.72 million in net inflows on January 13. This marks the second consecutive day of positive flows. According to data from TraderT, no individual fund experienced net outflows. BlackRock's ETHA led with $53.03 million. Grayscale's Mini ETH followed with $35.42 million. Bitwise's ETHW attracted $22.96 million. Fidelity's FETH and Grayscale's ETHE saw $14.38 million and $3.93 million respectively. This daily crypto analysis examines the structural implications.

Ethereum ETF flows have been volatile since launch. Initial skepticism mirrored Bitcoin ETF patterns. Historical cycles suggest accumulation phases follow initial distribution. The current two-day inflow streak represents a potential regime shift. Market structure indicates institutional players are establishing positions. This occurs amid broader regulatory uncertainty. The SEC's evolving stance on crypto assets, detailed in official SEC documentation, creates a complex backdrop. Related developments include the US crypto bill threatening privacy and significant futures liquidations testing market stability.

On-chain data from TraderT confirms the inflow figures. January 13 flows followed a positive January 12. The consistency across all funds is notable. BlackRock's dominance reflects its established distribution network. Grayscale's Mini ETH product shows retail accessibility. The absence of outflows suggests no major profit-taking. This contrasts with earlier periods of net redemption pressure. The data points to renewed institutional confidence. Market analysts attribute this to Ethereum's upcoming Pectra upgrade, which includes EIP-7702 for improved account abstraction.

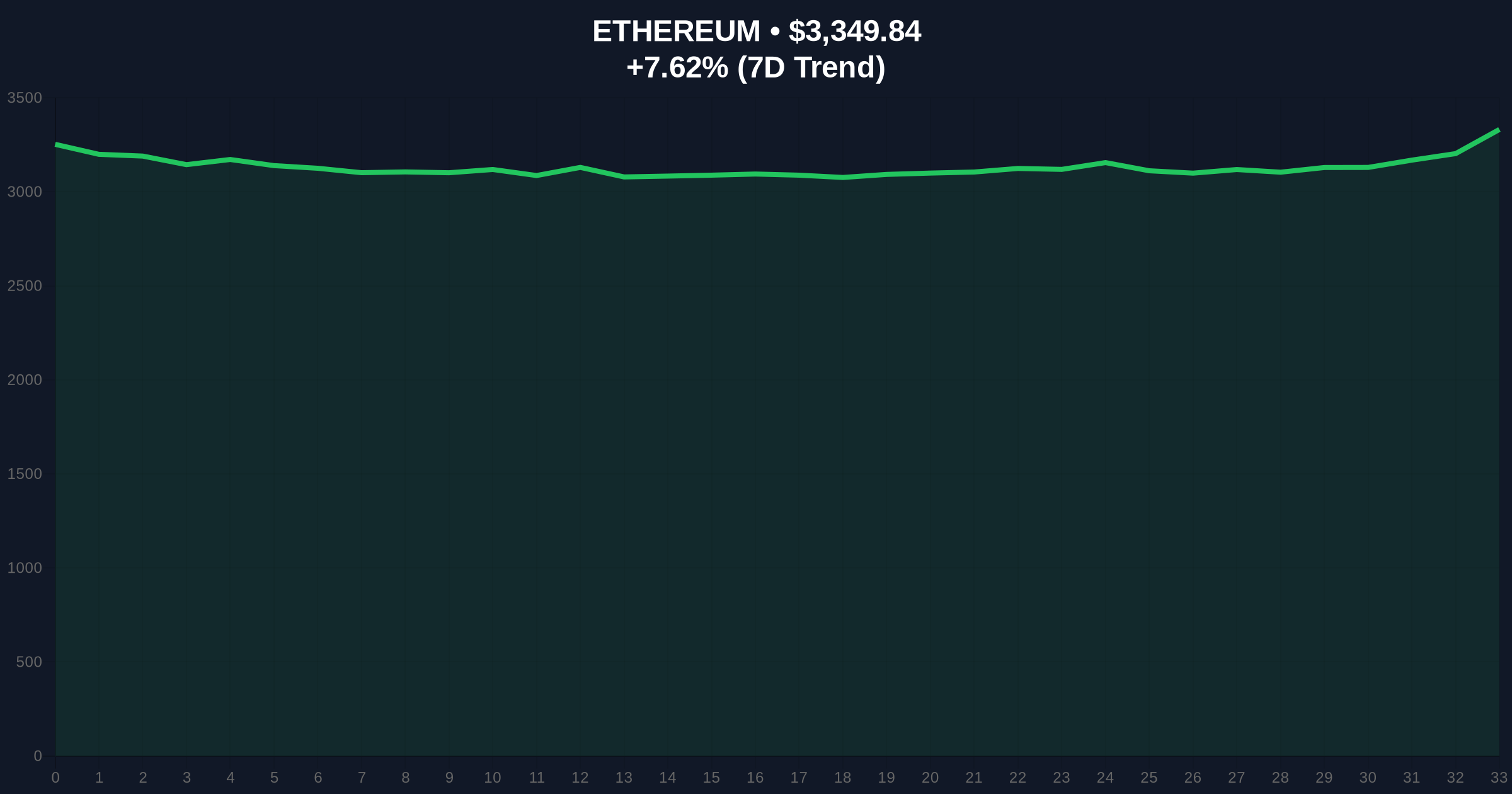

Ethereum price currently sits at $3,349.57. The 24-hour trend shows a 7.61% increase. Volume profile indicates accumulation near the $3,200 level. A Fair Value Gap (FVG) exists between $3,150 and $3,250. This gap may act as a liquidity magnet. The Relative Strength Index (RSI) approaches 65, suggesting moderate bullish momentum. The 50-day moving average provides dynamic support at $3,100. Fibonacci retracement from the recent swing high places key resistance at $3,500. Bullish invalidation level: $3,000. Bearish invalidation level: $3,600.

| Metric | Value |

|---|---|

| Total ETF Inflows (Jan 13) | $129.72M |

| BlackRock ETHA Inflows | $53.03M |

| Ethereum Current Price | $3,349.57 |

| 24-Hour Price Change | +7.61% |

| Crypto Fear & Greed Index | 48/100 (Neutral) |

Institutional impact is direct. ETF inflows represent spot market buying. This reduces available liquid supply. According to Glassnode liquidity maps, sustained inflows can create a supply shock. Retail impact is psychological. Positive flow data reinforces bullish narratives. It may trigger FOMO-driven retail participation. The structural shift matters for Ethereum's monetary policy. Post-merge issuance is already deflationary during high activity. ETF accumulation amplifies this effect. Market structure suggests a potential gamma squeeze if options markets align.

Market analysts on X highlight the flow consistency. Bulls point to BlackRock's dominance as a trust signal. Skeptics note the relatively modest total compared to Bitcoin ETF peaks. No direct quotes from executives like Michael Saylor are available in the source. General sentiment leans cautiously optimistic. The absence of outflows is viewed as a key technical positive.

Bullish Case: Continued ETF inflows above $100M daily. Break and hold above $3,500 resistance. Target: $3,800 (previous order block). Catalyst: Pectra upgrade confirmation.

Bearish Case: Inflows reverse to net outflows. Price fails at $3,500 and breaks $3,000 support. Target: $2,800 (volume node). Catalyst: Broader market correction or regulatory crackdown.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.