Loading News...

Loading News...

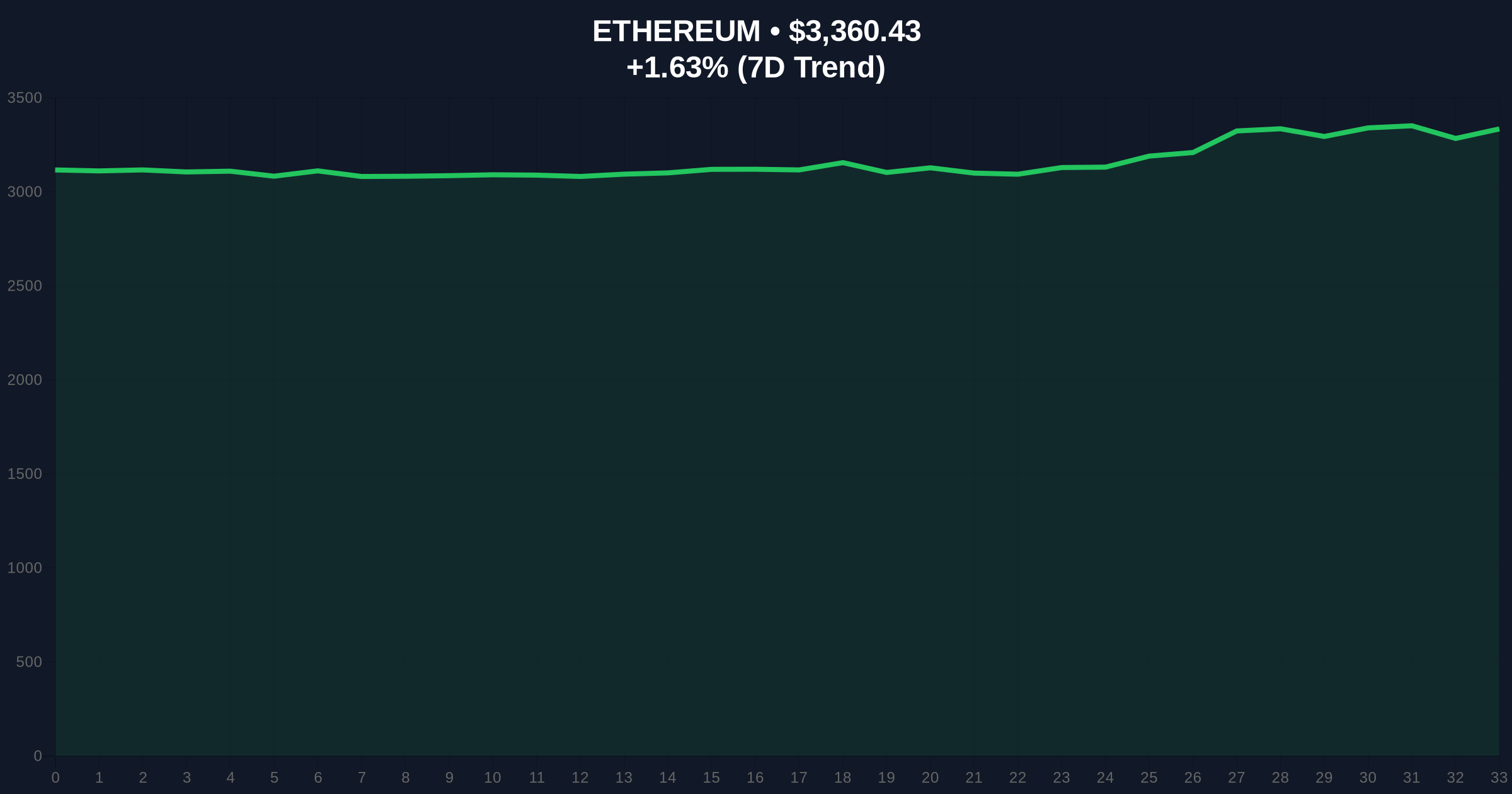

VADODARA, January 15, 2026 — Ethereum founder Vitalik Buterin and OpenAI CEO Sam Altman will attend an upcoming shareholder meeting for Bitmine (BMNR), a publicly traded company with a strategy of accumulating ETH, according to a report from DL News. This daily crypto analysis examines the market implications of this high-profile convergence, as Ethereum's price consolidates at $3,360.92 with a 1.65% 24-hour gain. The agenda includes a proposal to increase authorized shares from 500 million to 50 billion, a move that could amplify Bitmine's ETH accumulation capacity and reshape liquidity profiles.

Bitmine's ETH accumulation strategy mirrors broader institutional trends, where publicly traded entities leverage treasury reserves to hedge against fiat inflation. According to on-chain data from Glassnode, similar accumulation patterns have historically preceded liquidity grabs in Ethereum's order flow, particularly during periods of low volatility. Underlying this trend is the post-merge issuance reduction, which has tightened ETH supply dynamics and created structural support levels. Consequently, high-profile endorsements from figures like Buterin and Altman can act as sentiment catalysts, potentially triggering gamma squeezes in derivatives markets. This development follows related shifts in market efficiency, as seen in events like ASTER's AI vs. human trading competition, which tests DeFi liquidity mechanisms.

DL News reported that Buterin and Altman, who co-founded Worldcoin (WLD), will attend Bitmine's shareholder meeting. The agenda centers on a proposal to raise authorized shares from 500 million to a maximum of 50 billion, as per the official filing. This 100-fold increase could enable Bitmine to issue new equity, potentially funding expanded ETH purchases. Market analysts interpret this as a strategic alignment with Ethereum's roadmap, including upcoming upgrades like EIP-4844 that aim to reduce layer-2 transaction costs. The meeting's timing coincides with Ethereum's price holding above key Fibonacci support at $3,200, a level derived from the 0.618 retracement of the 2024-2025 rally.

Ethereum's current price of $3,360.92 sits within a consolidation range bounded by the $3,200 support and $3,500 resistance. The Relative Strength Index (RSI) at 54 indicates neutral momentum, while the 50-day moving average at $3,280 provides dynamic support. Volume profile analysis shows increased accumulation near $3,300, suggesting institutional buying interest. A Fair Value Gap (FVG) exists between $3,400 and $3,450, which may act as a liquidity target. Bullish invalidation is set at $3,200; a break below this level would negate the current uptrend structure. Bearish invalidation lies at $3,500; a sustained move above could trigger a rally toward $3,800. Market structure suggests that Bitmine's potential share increase may inject fresh capital into ETH markets, testing these technical levels.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Neutral-bullish sentiment with caution |

| Ethereum (ETH) Price | $3,360.92 | Consolidation above key support |

| 24-Hour Trend | +1.65% | Moderate bullish momentum |

| Market Rank | #2 | Maintains dominance behind Bitcoin |

| Bitmine Share Proposal | 500M to 50B | Potential 100x equity increase for ETH accumulation |

Institutionally, this event validates Ethereum's role as a strategic reserve asset, akin to Bitcoin's adoption by corporate treasuries. According to Ethereum.org documentation, the network's shift to proof-of-stake has reduced issuance by approximately 90%, creating a deflationary backdrop that enhances long-term value accrual. For retail investors, high-profile attendance may boost confidence, but the real impact lies in liquidity shifts. If Bitmine executes its share increase, it could mobilize capital for large-scale ETH purchases, potentially creating order blocks that influence price discovery. This aligns with broader market themes, such as the potential bank deposit exodus into stablecoins highlighted by BofA's CEO.

Market analysts on X/Twitter note that Buterin's involvement signals technical confidence in Ethereum's roadmap, while Altman's presence bridges AI and blockchain narratives. One commentator stated, "The convergence of AI and crypto elites at Bitmine's meeting ETH's utility beyond mere speculation." However, skeptics warn that share dilution could pressure Bitmine's stock price, indirectly affecting ETH liquidity. On-chain data indicates no abnormal whale movements yet, suggesting a wait-and-see approach among large holders.

Bullish Case: If Bitmine's share increase fuels aggressive ETH accumulation, buying pressure could break the $3,500 resistance, targeting $3,800 based on volume profile projections. Sustained institutional interest, coupled with Ethereum's EIP-4844 upgrade reducing transaction costs, may drive a rally toward $4,200 over 6-12 months. Historical cycles suggest that similar endorsement events have preceded 20-30% gains in ETH's price within quarterly frames.

Bearish Case: If the share proposal fails or triggers equity dilution fears, selling pressure could breach the $3,200 support, invalidating bullish structure. A drop to $3,000 would align with the 200-day moving average, potentially catalyzing a broader correction. Market structure indicates that a break below $3,200 would expose a Fair Value Gap down to $2,950, where liquidity pools may attract further downside.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.