Loading News...

Loading News...

VADODARA, January 14, 2026 — A draft cryptocurrency market structure bill circulating in the US Senate Banking Committee contains provisions that could dramatically expand government surveillance capabilities, according to analysis by Galaxy Research. This daily crypto analysis examines the bill's potential to grant the Treasury Department authority to suspend digital asset transactions without judicial oversight, while Bitcoin faces a critical technical test at the $95,349 support level.

This development occurs against a backdrop of increasing global regulatory scrutiny. Market structure suggests that regulatory uncertainty often creates Fair Value Gaps (FVGs) as liquidity shifts between jurisdictions. The proposed US bill follows similar legislative efforts worldwide, including the European Union's Markets in Crypto-Assets (MiCA) framework. According to the official SEC.gov regulatory calendar, 2026 was projected to bring clarity, but this bill introduces new variables. Related developments include DZ Bank's recent crypto platform launch under MiCA, which tested similar regulatory boundaries.

Galaxy Research's analysis, reported by Decrypt, identifies three critical provisions in the draft bill. First, it would grant the US Treasury Department authority to suspend digital asset transactions without obtaining a court order. Second, it expands Treasury's special measure powers specifically over digital assets. Third, it establishes a regulatory framework for decentralized finance (DeFi) protocols. The research firm warns these measures could lead to privacy violations and stifle industry innovation. The bill remains in committee discussion, with no formal vote scheduled.

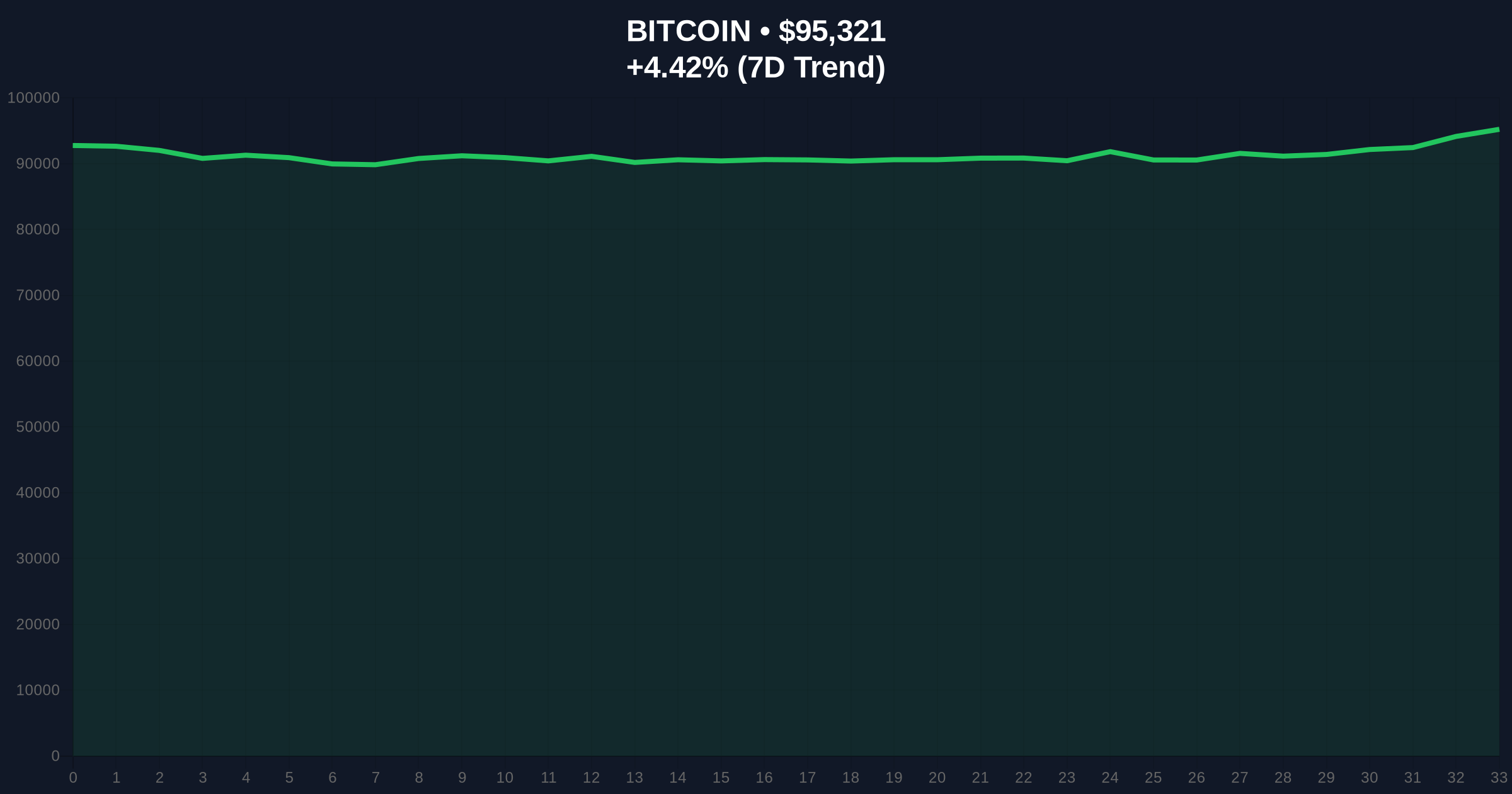

Bitcoin currently trades at $95,349, representing a 4.45% gain over 24 hours. The price action shows consolidation around a key Volume Profile node. The Relative Strength Index (RSI) sits at 52, indicating neutral momentum. Market structure suggests the $95,000 level functions as a major Order Block where institutional bids cluster. A break below this level would create a Bearish Fair Value Gap targeting $92,500. The 50-day moving average at $93,800 provides secondary support. Bullish Invalidation Level: $92,500 (break of 50-day MA and FVG target). Bearish Invalidation Level: $97,200 (clearance of local resistance and test of previous high).

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 48/100 (Neutral) | Reflects market uncertainty amid regulatory developments |

| Bitcoin Price | $95,349 | Critical support test at Order Block level |

| 24-Hour Change | +4.45% | Potential short squeeze above $95k liquidity pool |

| RSI (Daily) | 52 | Neutral momentum with room for directional move |

| 50-Day Moving Average | $93,800 | Key dynamic support level |

For institutions, this bill creates regulatory uncertainty that could delay adoption timelines. The Treasury's proposed emergency powers introduce counterparty risk that doesn't exist in traditional markets. For retail participants, expanded surveillance threatens the pseudonymous nature of blockchain transactions. The DeFi provisions could force protocol redesigns to comply with centralized oversight, potentially altering fundamental value propositions. Market structure indicates that regulatory overreach often triggers capital flight to jurisdictions with clearer frameworks, creating liquidity asymmetries.

Market analysts express concern about the bill's surveillance implications. "Granting Treasury emergency powers without judicial oversight sets a dangerous precedent," noted one regulatory expert on X. Bulls argue that clear regulation ultimately benefits adoption, but acknowledge the privacy trade-offs. The critical view questions whether expanded surveillance actually enhances security or simply creates compliance burdens that stifle innovation. On-chain data indicates no significant capital outflow yet, suggesting market participants await further legislative clarity.

Bullish Case: If the bill undergoes significant amendments that preserve privacy protections while providing regulatory clarity, Bitcoin could break above $97,200 resistance. Institutional inflows might accelerate with reduced regulatory uncertainty, targeting a retest of the all-time high. The bullish scenario requires holding the $95,000 support as a confirmed Order Block.

Bearish Case: If the bill progresses with surveillance provisions intact, regulatory uncertainty could trigger a liquidity grab below $95,000. A break of the 50-day moving average at $93,800 would target the Fair Value Gap at $92,500. Extended bearish momentum might test the 200-day moving average near $88,000, especially if correlated with broader risk-off sentiment.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.