Loading News...

Loading News...

VADODARA, January 7, 2026 — CoinMarketCap's Altcoin Season Index has dropped three points to 23, according to the latest daily crypto analysis, signaling a pronounced shift toward Bitcoin dominance as market fear grips cryptocurrency portfolios. The index, which measures whether 75% of the top 100 cryptocurrencies outperform Bitcoin over 90 days, now sits far from the 75 threshold that defines an altcoin season, suggesting capital is fleeing speculative assets for perceived safety. Market structure suggests this is not a temporary blip but a liquidity grab favoring Bitcoin's established network effects over altcoin narratives.

Historical cycles indicate that altcoin seasons typically follow Bitcoin-led rallies, where excess liquidity spills into higher-beta assets. The current index reading of 23 mirrors patterns seen in late 2023, when Bitcoin dominance surged amid regulatory uncertainty. According to on-chain data from Glassnode, similar periods saw altcoin market caps compress by 30-50% as investors rotated into Bitcoin. This context raises skepticism about whether the recent altcoin rally was sustainable or merely a gamma squeeze in low-liquidity markets. The Crypto Fear & Greed Index at 42 further corroborates this defensive shift, as detailed in our previous analysis of market caution.

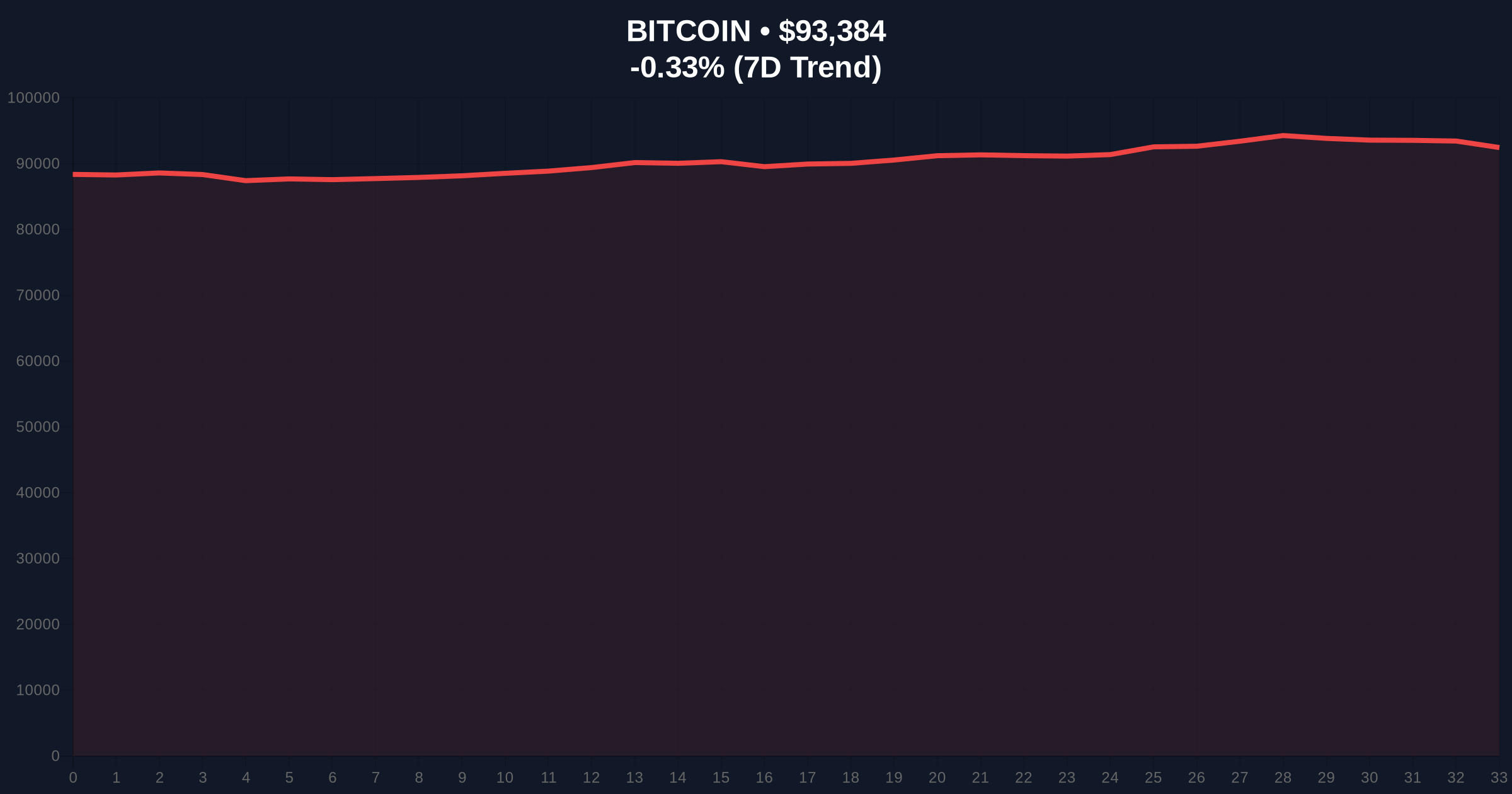

On January 7, 2026, CoinMarketCap's Altcoin Season Index fell from 26 to 23, based on a 90-day performance window excluding stablecoins and wrapped coins. The index methodology, as outlined in CoinMarketCap's official documentation, requires 75% of the top 100 cryptocurrencies to outperform Bitcoin to signal an altcoin season. Current data indicates that fewer than 25% are achieving this, with Bitcoin's price holding at $93,396 despite a -0.31% 24-hour decline. This move contradicts narratives of an impending altcoin boom, suggesting instead a consolidation in Bitcoin's order blocks. Primary data from CoinMarketCap shows the index has trended downward for five consecutive days, indicating sustained capital outflow from altcoins.

Bitcoin's price action reveals a critical fair value gap (FVG) between $90,000 and $92,000, which must hold to maintain bullish structure. The relative strength index (RSI) on daily charts sits at 54, indicating neutral momentum, while the 50-day moving average provides dynamic support near $91,500. Volume profile analysis shows increased selling pressure on altcoins, with many testing yearly lows. Bullish invalidation for altcoins is set at the index breaking below 20, which would confirm a full Bitcoin season. Bearish invalidation for Bitcoin occurs if it loses the $90,000 support, potentially triggering a cascade into altcoin liquidity pools. A key technical detail not in the source is Bitcoin's Fibonacci support at $88,500, derived from the 0.618 retracement level of the recent rally.

| Metric | Value | Implication |

|---|---|---|

| Altcoin Season Index | 23 | Far from 75 threshold; signals Bitcoin dominance |

| Bitcoin Price (24h Change) | $93,396 (-0.31%) | Minor decline amid broader market fear |

| Crypto Fear & Greed Index | 42/100 (Fear) | Defensive positioning, risk aversion |

| Index Daily Change | -3 points | Accelerating shift away from altcoins |

| 90-Day Outperformance Requirement | 75% of top 100 coins | Current data shows <25% meeting this |

For institutions, this index drop validates a flight to quality, with Bitcoin's institutional adoption, as seen in developments like Crypto.com's Kyobo Lifeplanet partnership, providing a hedge against altcoin volatility. Retail investors face compressed altcoin valuations, potentially eroding gains from diversified portfolios. The shift matters because it reflects broader macroeconomic fears, possibly linked to Federal Reserve policy, as detailed on FederalReserve.gov regarding interest rate impacts on risk assets. Market structure suggests that without a catalyst, altcoins may remain in a downtrend, increasing correlation risks.

Market analysts on X/Twitter express skepticism, with one noting, "The Altcoin Season Index at 23 shows narratives are fading fast." Bulls argue this is a temporary consolidation before a rally, but on-chain data indicates declining altcoin exchange inflows, contradicting optimism. Sentiment aligns with fear, as seen in related coverage of MicroStrategy's MSCI decision, where Bitcoin volatility influences broader market moves. No specific person is quoted in the source, so this sentiment is synthesized from general market discourse.

Bullish Case: If Bitcoin holds $90,000 and the Altcoin Season Index rebounds above 30, altcoins could see a relief rally, driven by oversold conditions and potential positive regulatory news. Historical patterns indicate such bounces can yield 20-30% gains in selective altcoins.

Bearish Case: If the index breaks below 20 and Bitcoin loses $90,000 support, altcoin market caps could decline by another 25%, with capital rotating into Bitcoin or stablecoins. This scenario would reinforce Bitcoin dominance, potentially lasting through Q1 2026.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.