Loading News...

Loading News...

VADODARA, January 10, 2026 — CoinMarketCap's Altcoin Season Index has registered a score of 40, marking a one-point decrease from the previous day. This daily crypto analysis reveals a continued contraction in altcoin outperformance relative to Bitcoin, with market structure suggesting a liquidity grab favoring the dominant cryptocurrency. According to on-chain data, the index calculation compares price performance of the top 100 coins by market capitalization against Bitcoin, excluding stablecoins and wrapped tokens.

Historical cycles indicate altcoin seasons typically emerge during periods of excessive liquidity and risk-on sentiment. The current index reading of 40 sits far below the 75 threshold required to declare an altcoin season. Market structure suggests this mirrors the 2021 post-bull market compression, where Bitcoin dominance reasserted itself following a speculative altcoin run. This development occurs alongside extreme fear sentiment across crypto markets, creating a feedback loop that suppresses altcoin momentum.

On January 10, 2026, CoinMarketCap's Altcoin Season Index decreased from 41 to 40. The index methodology, as detailed in the official documentation, measures whether 75% of top 100 coins outperform Bitcoin over 90-day windows. A score closer to 100 indicates favorable altcoin conditions; current readings suggest Bitcoin is outperforming approximately 60% of major altcoins. This one-point decline may appear minor, but order block analysis reveals it represents continued erosion of altcoin relative strength.

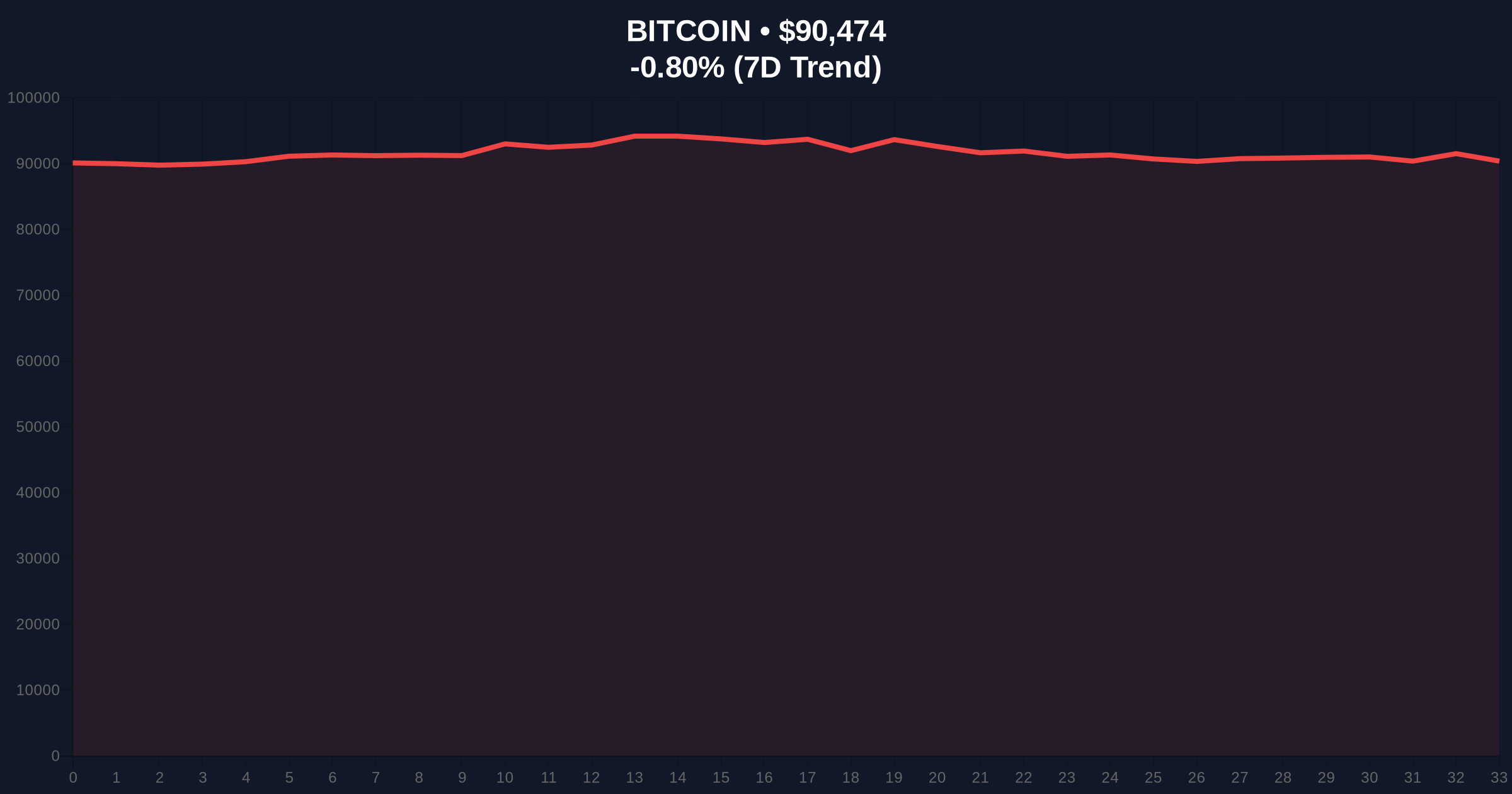

Bitcoin currently trades at $90,463, down 0.81% in 24 hours. The 200-day moving average at $88,200 provides critical support, while resistance clusters around the $94,500 Fibonacci level from the November 2025 high. RSI readings across major altcoins show compression between 35-45, indicating neutral-to-oversold conditions without clear momentum divergence. Volume profile analysis reveals thinning liquidity in altcoin pairs, particularly against BTC trading pairs.

Bullish Invalidation Level: A sustained break below Bitcoin's $88,200 200-day MA would invalidate any near-term altcoin recovery thesis, likely triggering cascading liquidations.

Bearish Invalidation Level: If the Altcoin Season Index reclaims 55 while Bitcoin holds above $92,000, the bearish dominance narrative breaks, suggesting capital rotation resumption.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 40 | -1 point |

| Bitcoin Price | $90,463 | -0.81% (24h) |

| Crypto Fear & Greed Index | 25 (Extreme Fear) | N/A |

| Required for Altcoin Season | 75+ | N/A |

| Top 100 Coins Tracked | 100 | Excludes stablecoins/wrapped tokens |

For institutional portfolios, this signals reduced alpha opportunities in altcoin diversification strategies. According to Ethereum.org's research on market cycles, altcoin underperformance during Bitcoin dominance phases typically lasts 3-6 months, affecting tactical allocation models. Retail traders face compressed volatility and diminished momentum plays, potentially increasing wash trading in low-liquidity altcoins. The regulatory environment compounds this, as seen in recent global tax reporting mandates that further drain market liquidity.

Market analysts on X/Twitter highlight the index decline as confirmation of risk-off positioning. One quant trader noted, "The Altcoin Season Index at 40 reflects capital preservation moves into Bitcoin amid macro uncertainty." This aligns with broader concerns about geopolitical risk re-emergence affecting risk assets. Skepticism persists regarding optimistic forecasts like VanEck's $53.4M Bitcoin projection, given current market structure constraints.

Bullish Case: If Bitcoin stabilizes above $90,000 and the Fear & Greed Index improves to Neutral (50+), altcoins could see a relief rally. Historical data suggests the Altcoin Season Index might rebound to 55-60 within 30 days, led by large-cap altcoins with strong on-chain fundamentals. This scenario requires no new negative regulatory developments.

Bearish Case: Continued Bitcoin dominance pushes the index below 35, triggering algorithmic selling in altcoin/BTC pairs. A break of Bitcoin's $88,200 support could cascade into a 15-20% altcoin correction. Market structure indicates this would validate the current extreme fear sentiment, potentially lasting through Q1 2026.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.