Loading News...

Loading News...

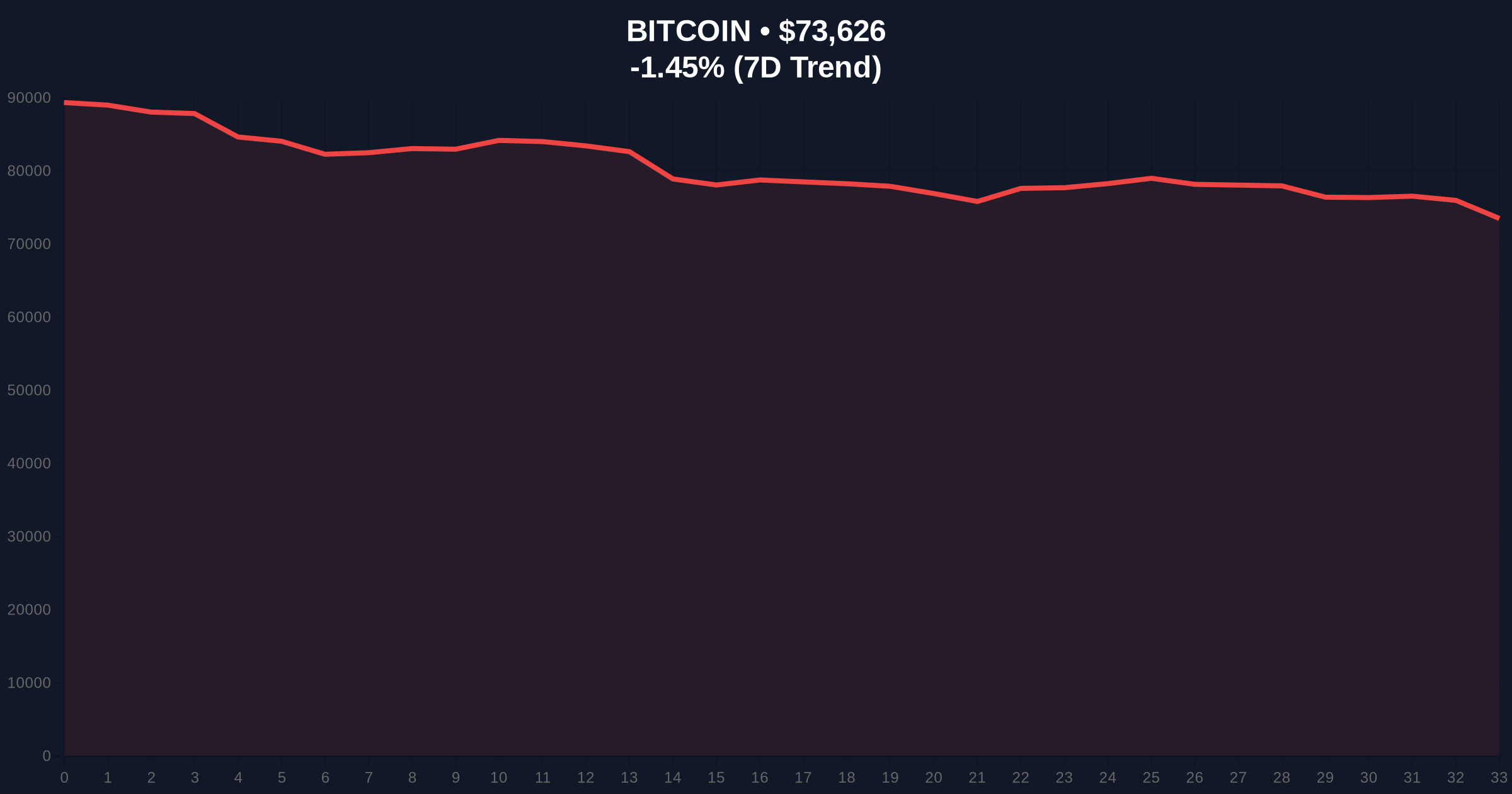

VADODARA, February 4, 2026 — President Donald Trump explicitly tied his Federal Reserve Chairman nominee to a dovish monetary policy. According to Walter Bloomberg, citing NBC, Trump stated Kevin Warsh "understands his desire for interest rate cuts." The President added Warsh would not have been appointed if he wanted to raise rates. This Latest crypto news event intersects with Bitcoin trading at $73,697, down 1.35% in 24 hours. The Crypto Fear & Greed Index registers Extreme Fear at 14/100.

President Trump's comments, reported by Walter Bloomberg, directly link Fed leadership to his policy preferences. The statement clarifies the administration's stance. It signals an intent to maintain or accelerate an accommodative monetary stance. Market analysts interpret this as a pre-emptive move to influence the Fed's rate trajectory. The Federal Reserve's official mandate, as outlined on FederalReserve.gov, emphasizes price stability and maximum employment. Political pressure introduces a new variable.

Historically, dovish Fed signals correlate with capital inflows into speculative assets. The 2020-2021 cycle demonstrated this clearly. Rate cuts and quantitative easing fueled a historic rally in Bitcoin and altcoins. In contrast, the 2022 tightening cycle triggered a prolonged crypto winter. Underlying this trend is the liquidity correlation. Cheap money seeks yield, often finding it in high-beta digital assets. Current market fear, however, tempers immediate bullish reactions. Related developments highlight this tension:

Bitcoin's current price sits at a critical technical juncture. Market structure suggests a battle between the 50-day simple moving average (SMA) and local support. On-chain data indicates a significant volume node near $72,000. A break below this level would invalidate the short-term bullish structure. Conversely, resistance clusters around the $75,000 to $76,500 range. This zone represents a prior Fair Value Gap (FVG) from last week's sell-off. The Relative Strength Index (RSI) on the daily chart reads 42, indicating neutral momentum with a bearish bias. Fibonacci retracement levels from the recent swing high to low place the 0.618 level at $71,200, a key support not mentioned in source data.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically a contrarian buy signal zone |

| Bitcoin Price (24h Change) | $73,697 (-1.35%) | Testing 50-day SMA support |

| Key Technical Support | $72,000 (Volume Node) | Breakdown target for bears |

| Key Technical Resistance | $75,000 (FVG Close) | Breakout confirmation for bulls |

| Fed Funds Rate (Current) | 4.50% - 4.75% (Estimate) | Subject to potential cuts per Trump |

Monetary policy directly impacts crypto market liquidity. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin. They also weaken the US dollar, historically bullish for dollar-denominated crypto prices. This news matters for the 5-year horizon. It signals potential sustained accommodative policy. Institutional capital allocators model Fed policy into their long-term crypto thesis. A dovish pivot could accelerate institutional adoption cycles. Retail market structure, however, remains fragile amid extreme fear. The divergence creates a potential liquidity grab opportunity.

"Political influence on Fed policy introduces short-term volatility but long-term structural support for risk assets. The market is pricing extreme fear, but the macro setup is shifting. Watch for a break of the $75k level as confirmation of a sentiment reversal." – CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook hinges on Fed policy confirmation. If Trump's signaled rate cuts materialize, expect a re-rating of crypto valuations. Historical cycles suggest a 6-9 month lag between policy announcement and full market price discovery. The current extreme fear reading often precedes significant rallies when coupled with a positive macro catalyst.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.