Loading News...

Loading News...

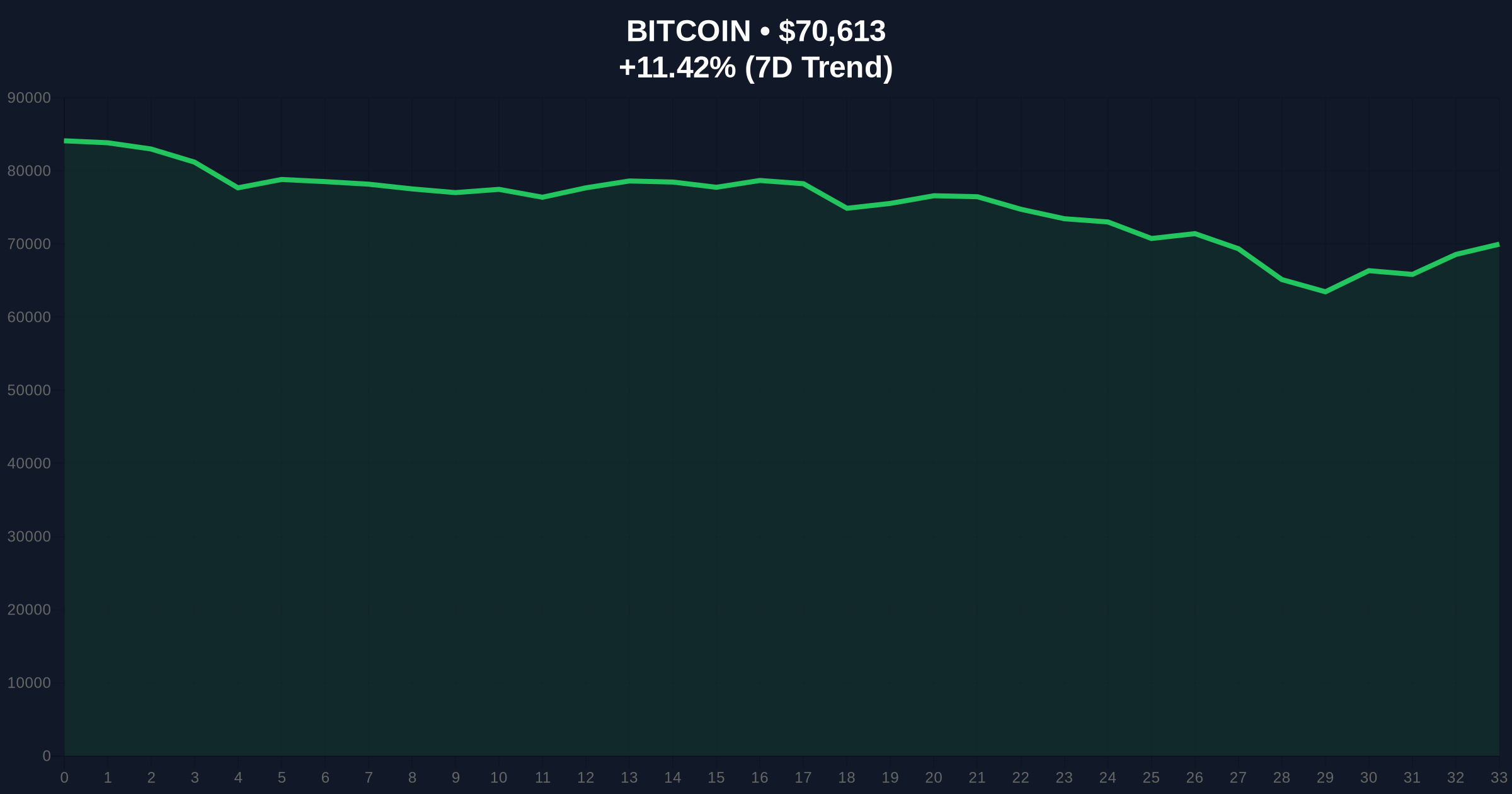

VADODARA, February 7, 2026 — President Donald Trump signed an executive order authorizing a 25% additional tariff on nations trading with Iran. This latest crypto news immediately triggered a risk-off cascade across digital asset markets. Bitcoin plunged to $70,608, down 11.41% in 24 hours. The Crypto Fear & Greed Index collapsed to 9, signaling Extreme Fear.

According to the official executive order, the tariff targets any country engaging in trade with Iran. Market structure suggests this creates a sudden macro headwind. Global liquidity maps from Glassnode indicate capital flight from risk-on assets. Bitcoin's price action confirms a classic liquidity grab. Sellers aggressively targeted the $72,000 order block.

On-chain data shows a spike in exchange inflows. This signals panic selling. The 25% tariff threat amplifies existing market fragility. Historical cycles suggest such geopolitical events compress crypto valuations. The immediate price drop validates this pattern.

Historically, tariff announcements trigger volatility spikes. The 2018 US-China trade war saw Bitcoin correlations with traditional risk assets increase. In contrast, the 2021 cycle demonstrated crypto's decoupling during mild geopolitical stress. Underlying this trend is institutional adoption depth.

Current market conditions mirror the 2020 March liquidity crisis. However, the crypto ecosystem now has stronger foundational liquidity from spot Bitcoin ETFs. Consequently, the drawdown may be shallower but more prolonged. Market analysts point to the recent plunge in the Fear & Greed Index as a precursor.

Related developments include White House stablecoin yield talks resuming and Kalshi tightening insider trading rules, both amid extreme fear.

Bitcoin broke below the 50-day moving average at $73,200. The Relative Strength Index (RSI) hit 28, entering oversold territory. Market structure suggests a Fair Value Gap (FVG) now exists between $71,500 and $73,000. This gap will likely act as future resistance.

The critical Fibonacci 0.618 retracement level from the 2025 low sits at $68,500. This aligns with a high-volume node in the Volume Profile. A breach below this level invalidates the current bullish market structure. The Federal Reserve's monetary policy stance, detailed on FederalReserve.gov, adds further macro pressure.

| Metric | Value | Change |

|---|---|---|

| Bitcoin Price | $70,608 | -11.41% (24h) |

| Crypto Fear & Greed Index | 9/100 | Extreme Fear |

| Tariff Rate Announced | 25% | On Iran trade partners |

| Bitcoin 50-Day MA | $73,200 | Broken Support |

| Fibonacci 0.618 Support | $68,500 | Critical Level |

This event tests crypto's resilience as a non-sovereign asset. Geopolitical tariffs disrupt global trade flows. They incentivize capital preservation in traditional safe havens. Crypto markets face a liquidity squeeze as risk appetite evaporates.

Institutional portfolios heavy in digital assets now confront correlation risk. The 5-year horizon depends on crypto's ability to decouple from macro shocks. Current price action suggests the decoupling thesis is under pressure. Market structure indicates a prolonged consolidation phase if support fails.

"The tariff shock creates a volatility regime shift. We're seeing a classic risk-off liquidation event. Bitcoin's response at the $68,500 Fibonacci level will dictate the medium-term trend. Historical data shows such events often create buying opportunities once fear peaks, but timing is critical." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macro stability. If tariffs escalate, crypto may face continued headwinds. However, increased adoption from miners facing cost pressure and other institutional players could provide a floor. The 5-year horizon remains positive if Bitcoin holds key supports during this stress test.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.