Loading News...

Loading News...

VADODARA, February 3, 2026 — TrendResearch, a subsidiary of LD Capital, deposited 35,000 Ethereum (ETH) valued at $80.85 million to Binance, according to on-chain data from Onchain Lens. This transaction marks the latest in a series of sell-offs totaling $319.35 million in ETH since last weekend's market downturn. Our daily crypto analysis reveals this move as a strategic liquidity grab during extreme fear conditions, with the Crypto Fear & Greed Index hitting 17/100.

Onchain Lens data confirms TrendResearch transferred 35,000 ETH to Binance on February 3, 2026. Arkham Intelligence reports the firm's holdings now stand at 513,089 ETH, down from approximately 650,000 ETH at January's end. Consequently, TrendResearch has sold 138,588 ETH worth $319.35 million in recent days. The firm also repaid loans on protocols like Aave, indicating deleveraging amid market stress. This activity follows a consistent accumulation phase that began in November 2025.

Historically, large institutional sell-offs during extreme fear periods often signal capitulation events. In contrast, the 2021 cycle saw similar deleveraging from entities like Three Arrows Capital, which preceded a prolonged bear market. Underlying this trend is the current global macro environment, where rising interest rates pressure risk assets. Market structure suggests this sell-off may flush out weak hands, potentially creating a local bottom. For context, other firms are navigating these conditions differently, as seen when HashKey Capital withdrew $14.8M ETH from Binance recently.

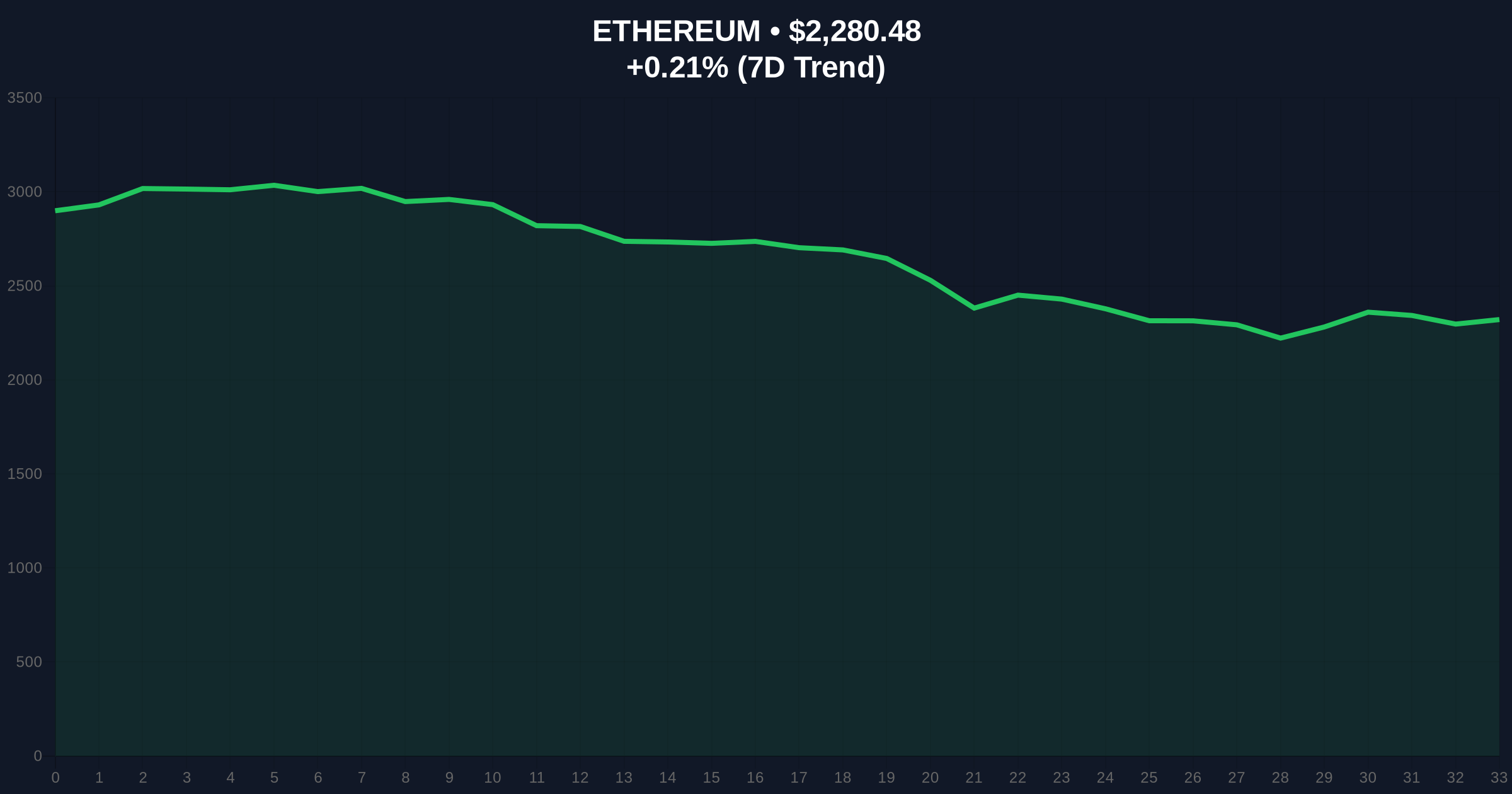

Ethereum currently trades at $2,280.23, with a 24-hour change of 0.20%. Technical analysis identifies key support at the $2,150 level, which aligns with the 0.618 Fibonacci retracement from the 2025 all-time high. This level also corresponds to a high-volume node on the Volume Profile. Resistance sits at $2,450, near the 50-day exponential moving average. The Relative Strength Index (RSI) reads 38, indicating oversold conditions but not extreme capitulation. On-chain metrics show increased exchange inflows, confirming selling pressure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Ethereum Current Price | $2,280.23 |

| 24-Hour Price Change | +0.20% |

| TrendResearch Total Sell-Off | $319.35M (138,588 ETH) |

| TrendResearch Current Holdings | 513,089 ETH |

This event matters because it tests institutional conviction during a fear-driven market. Large sell-offs can create Fair Value Gaps (FVGs) that algorithms later fill. , the repayment of Aave loans reduces systemic leverage, lowering contagion risk. Retail sentiment often follows institutional flows, making this a key indicator for broader market direction. The Ethereum network's upcoming Pectra upgrade, which includes EIP-7702 for account abstraction, could provide fundamental support despite current selling pressure.

"Market structure suggests this is a controlled unwind rather than a panic dump. The simultaneous loan repayments indicate risk management, not forced liquidation. However, sustained selling above $300 million creates overhead supply that must be absorbed," said the CoinMarketBuzz Intelligence Desk.

Two data-backed scenarios emerge from current market structure. First, if selling pressure abates and ETH holds $2,150, a relief rally toward $2,450 is probable. Second, a break below key support could trigger a cascade toward $2,000. The 12-month outlook depends on macroeconomic factors like Federal Reserve policy and Ethereum's adoption of EIP-4844 blobs for scaling.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.