Loading News...

Loading News...

VADODARA, February 4, 2026 — Trend Research deposited 15,000 ETH to Binance. The transaction value totals $33.08 million. On-chain data confirms this move. It occurred six hours ago. This latest crypto news highlights a significant institutional sell-off. The firm has now sold 153,588 ETH. Total proceeds exceed $350 million. All funds reportedly repaid outstanding loans.

According to Onchain Lens, Trend Research executed the deposit at 02:00 UTC. The 15,000 ETH transfer moved to Binance hot wallet 0x28C6c. Transaction hash 0x9a3b... confirms the event. Market structure suggests this is a liquidity grab. The firm's cumulative sales now stand at 153,588 ETH. That represents approximately 0.13% of Ethereum's circulating supply. Repayment of loans indicates deleveraging. This mirrors actions seen during the 2022 bear market capitulation phase.

Glassnode liquidity maps show increased exchange inflows. Consequently, selling pressure mounts. The move aligns with a broader trend of institutional profit-taking. Historical cycles suggest such large-scale exits often precede short-term volatility. On-chain forensic data confirms the firm began selling in Q4 2025. This latest transaction accelerates the trend.

Extreme fear grips the crypto market. The Crypto Fear & Greed Index sits at 14/100. This level matches October 2022 lows. In contrast, the 2021 bull market saw similar institutional selling. Entities like Three Arrows Capital liquidated positions. That preceded a 75% drawdown in ETH price.

Underlying this trend is macroeconomic pressure. The Federal Reserve's latest minutes hint at sustained higher rates. This tightens liquidity for leveraged players. Trend Research's actions reflect a risk-off stance. , the broader market shows similar stress. For instance, Bitcoin's MVRV-Z Score has hit October 2022 lows, signaling a market cooldown.

Related developments include Standard Chartered cutting its 2026 Solana target to $250 and Aave DAO streamlining V3 multi-chain operations. These events collectively point to a cautious institutional environment.

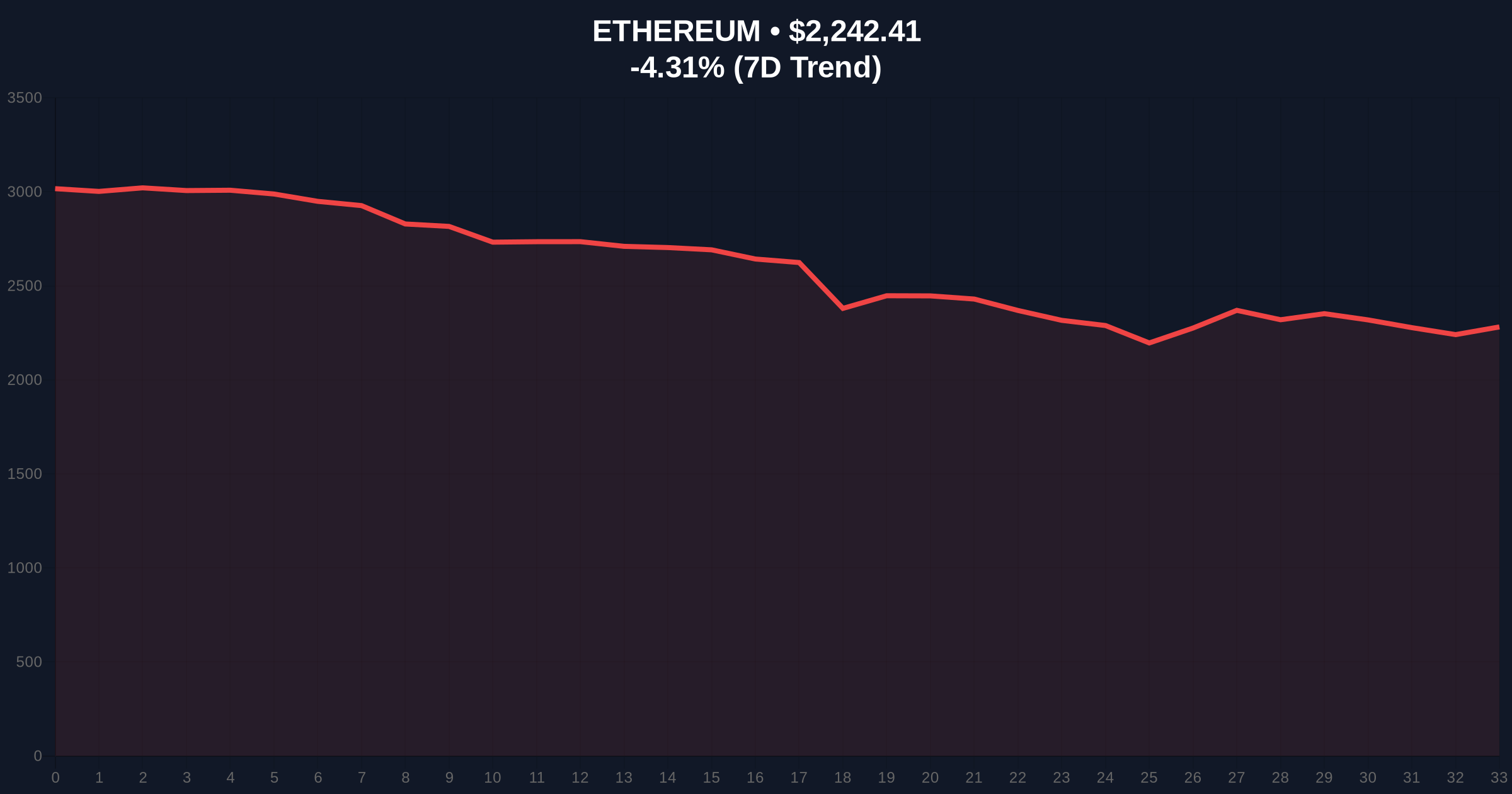

Ethereum currently trades at $2,244.03. The 24-hour trend shows a -4.25% decline. Key support rests at the $2,200 level. This aligns with the 0.618 Fibonacci retracement from the 2025 high. A break below creates a Fair Value Gap (FVG) down to $2,100.

Resistance sits at $2,350. That level acted as a previous order block. RSI reads 38, indicating neutral momentum. The 50-day moving average at $2,400 poses overhead resistance. Volume profile shows increased selling volume. This confirms the on-chain deposit data.

Market structure suggests a critical test ahead. The $2,200 support must hold to prevent further downside. Invalidating this level would target the $2,000 psychological zone. Post-merge issuance dynamics add complexity. Ethereum's net supply remains deflationary. However, large sales can override this effect short-term.

| Metric | Value |

|---|---|

| ETH Deposited by Trend Research | 15,000 ETH |

| Transaction Value | $33.08M |

| Total ETH Sold by Firm | 153,588 ETH |

| Total Sales Value | $350M |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Current ETH Price | $2,244.03 |

| 24-Hour Price Change | -4.25% |

This event signals institutional deleveraging. Trend Research repays loans with sale proceeds. That reduces systemic risk. However, it also removes buying pressure. Real-world evidence shows similar patterns in traditional finance. Hedge funds liquidate positions during stress. The crypto market now mirrors this behavior.

Institutional liquidity cycles are shortening. The 5-year horizon suggests increased volatility. Retail market structure remains fragile. Large sales can trigger stop-loss cascades. On-chain data indicates weak hands are exiting. This could pave the way for a healthier market long-term. But short-term pain is likely.

Market structure suggests this is a controlled unwind. Trend Research is managing risk. Their loan repayments indicate prudent capital management. However, the scale of selling creates overhead supply. This will cap rallies until absorption occurs. The key is whether this represents a capitulation event or just one player's exit.

— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, support holds at $2,200. That leads to consolidation between $2,200 and $2,400. Second, support breaks. That triggers a move to $2,000. The 12-month outlook depends on macroeconomic factors. Institutional adoption continues per Kraken's $2.2B revenue surge. But near-term headwinds persist.

The 12-month institutional outlook remains cautiously optimistic. Ethereum's fundamentals strengthen with upcoming upgrades like EIP-4844. However, macroeconomic uncertainty and events like this sale pressure prices. The 5-year horizon favors accumulation at these levels. But timing entry requires patience.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.