Loading News...

Loading News...

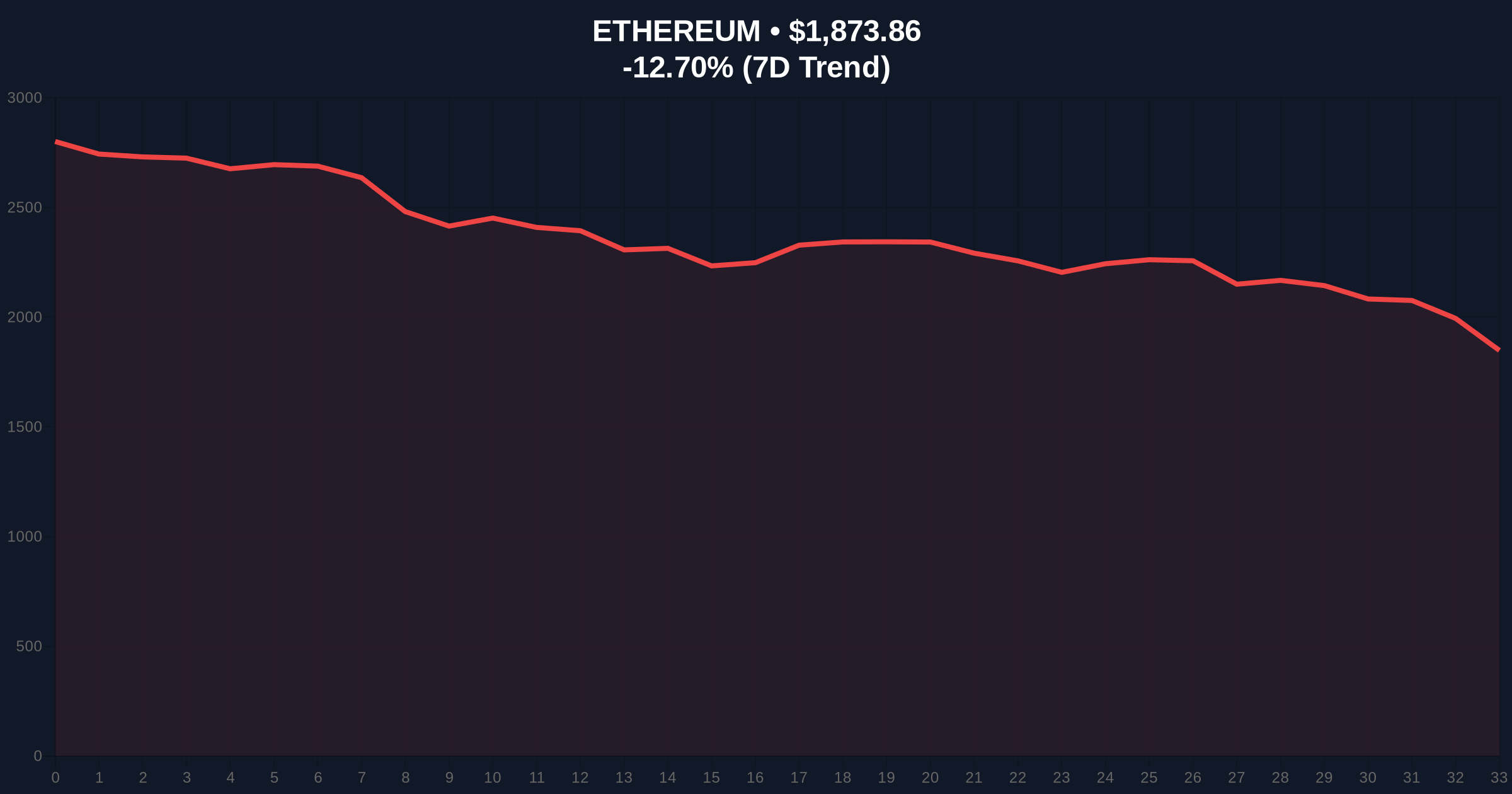

VADODARA, February 6, 2026 — Trend Research deposited an additional 8,000 ETH, valued at $14.81 million, to Binance earlier today, according to on-chain data from OnchainLenz. This latest crypto news highlights the firm's continued deleveraging, bringing its total deposits to 196,588 ETH ($440 million) for loan repayment purposes. The transaction occurred as Ethereum's price plunged 12.40% in 24 hours to $1,880.28, amid a global crypto sentiment reading of "Extreme Fear."

OnchainLenz, a primary data provider for blockchain analytics, reported the deposit in real-time. Trend Research executed the transfer of 8,000 ETH to Binance's known exchange wallet. Market structure suggests this move represents a strategic liquidity grab to meet margin calls or repay overcollateralized loans. The firm has now moved $440 million worth of Ethereum to exchanges since beginning its repayment cycle. This activity aligns with broader market stress, where institutional players face pressure to reduce leverage amid declining prices.

Consequently, the deposit adds to selling pressure on centralized exchanges. Historical cycles indicate such large inflows often precede short-term price declines as assets become available for immediate sale. According to Etherscan data, exchange balances have increased by approximately 3% in the past week, correlating with Ethereum's sharp drop from recent highs near $2,400.

This event mirrors the 2021 correction, where similar institutional deleveraging triggered cascading liquidations. In contrast, the current cycle features more sophisticated lending protocols and higher total value locked (TVL), amplifying systemic risk. Underlying this trend is a global shift toward tighter monetary policy, as detailed in the Federal Reserve's latest minutes on interest rates, which have increased borrowing costs across risk assets.

, the Extreme Fear sentiment score of 9/100 reflects panic similar to March 2020's COVID crash. Market analysts note that such readings often precede short-term bottoms, but require confirmation through price action. Related developments include massive futures liquidations exceeding $500 million and Bitcoin options expiry events testing key levels, indicating broad-based stress.

Ethereum's price action shows a clear breakdown below the 50-day moving average at $1,950. The Relative Strength Index (RSI) sits at 28, signaling oversold conditions but not yet extreme capitulation. Critical support resides at the Fibonacci 0.618 retracement level of $1,750, drawn from the 2024 low to the 2025 high. A breach of this level would invalidate the current bullish structure and target $1,550.

Volume profile analysis indicates weak buying interest at current levels, with most activity concentrated in the $1,800-$1,900 range. The Fair Value Gap (FVG) created between $2,050 and $1,950 acts as immediate resistance. Market structure suggests this gap must be filled for any sustainable recovery. Post-merge issuance dynamics, where Ethereum's net supply turns deflationary during high activity, provide a fundamental cushion but are currently overshadowed by macro pressures.

| Metric | Value |

|---|---|

| Ethereum Current Price | $1,880.28 |

| 24-Hour Price Change | -12.40% |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Trend Research Total ETH Deposited | 196,588 ETH ($440M) |

| Latest Deposit Value | 8,000 ETH ($14.81M) |

This deposit matters because it signals ongoing institutional distress. Large-scale movements to exchanges typically increase available sell-side liquidity, pressuring prices lower. Real-world evidence includes rising funding rates in perpetual swap markets and increased open interest in put options. Institutional liquidity cycles suggest that such deleveraging can persist for weeks, similar to the Luna/UST collapse in 2022.

Retail market structure often follows institutional leads, with small traders exacerbating moves through stop-loss cascades. The current environment mirrors Q2 2022, where Ethereum fell 60% from peak to trough amid similar on-chain outflows. Consequently, monitoring exchange net flows becomes critical for anticipating short-term volatility.

"The sequential nature of these deposits indicates a structured unwind rather than panic selling. However, in an Extreme Fear market, even orderly liquidations can trigger reflexive selling from leveraged participants. The key is whether the $1,750 support holds—a break could see accelerated capitulation." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, a bullish reversal requires reclaiming the $1,950 resistance and filling the FVG. Second, a bearish continuation targets the $1,550 support if critical levels fail.

The 12-month institutional outlook remains cautious. Historical patterns indicate that deleveraging events of this magnitude often precede prolonged consolidation phases. For the 5-year horizon, Ethereum's fundamental upgrades, including EIP-4844 for scalability, provide long-term tailwinds, but near-term price action depends on macro liquidity conditions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.