Loading News...

Loading News...

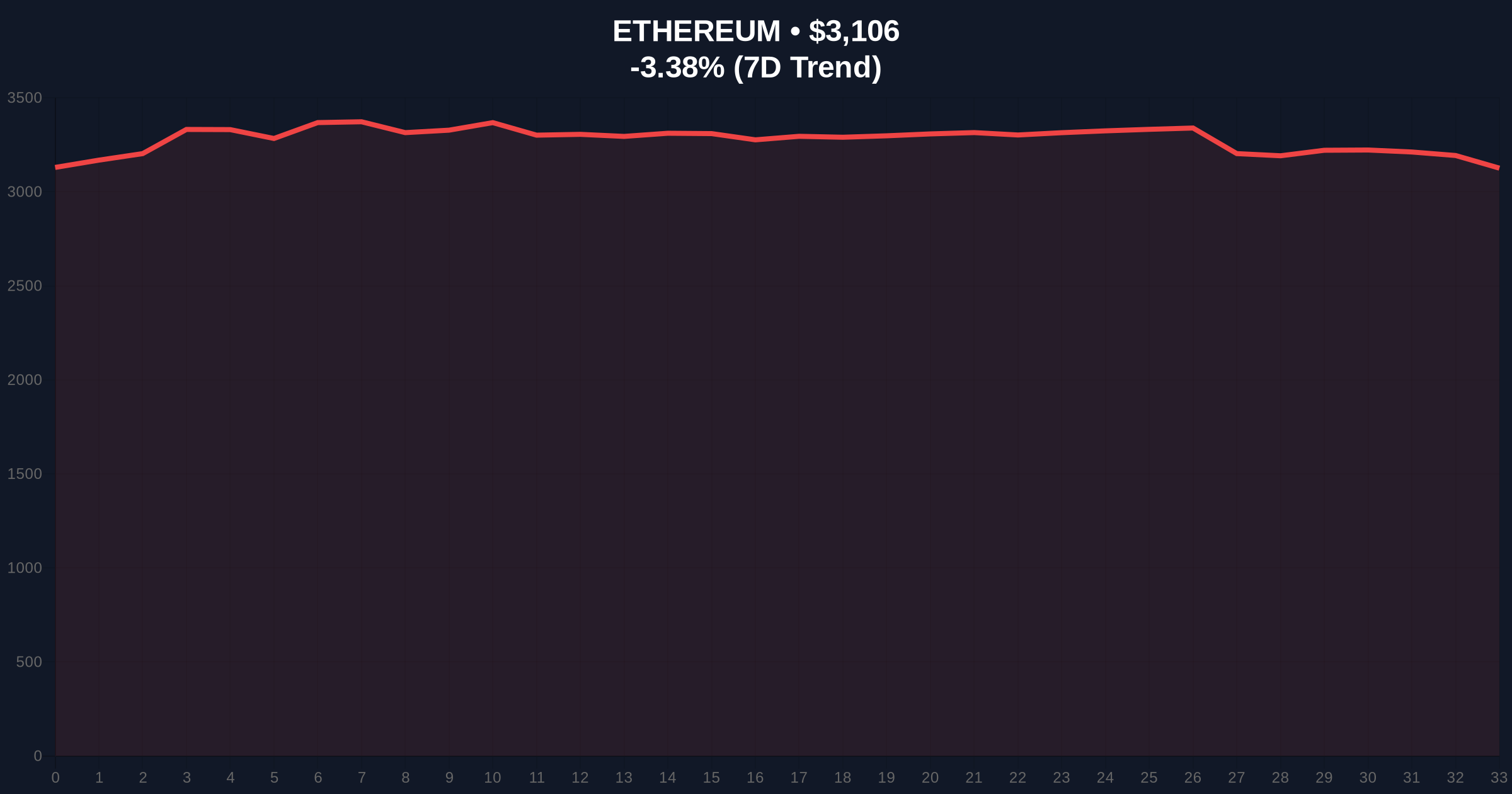

VADODARA, January 20, 2026 — Trend Research, a subsidiary of LD Capital, has borrowed $30 million in USDT from the Aave lending protocol and deposited it into Binance, according to a report by AmberCN. This daily crypto analysis reveals a strategic move as Ethereum's price falls below the firm's average purchase price of $3,186, creating an estimated unrealized loss of $50 million on its 626,000 ETH holdings valued at $1.94 billion. Market structure suggests this deposit may signal a liquidity grab, with on-chain data indicating heightened volatility near critical support levels.

Trend Research began accumulating Ethereum through on-chain loans in November 2025, leveraging decentralized finance (DeFi) protocols like Aave to amplify its position. This strategy mirrors broader institutional trends where entities use borrowed capital to enter or sustain crypto holdings, often targeting specific price zones. Underlying this trend is the post-merge issuance reduction for Ethereum, which has altered supply dynamics but not shielded the asset from macro pressures. Consequently, as ETH price action weakens, firms with leveraged positions face margin calls or strategic rebalancing, a pattern observed in previous cycles such as the 2022 bear market. Related developments include recent whale transfers, such as a $500 million USDC move to Binance and a $284 million ETH transfer to Coinbase, both analyzed as potential liquidity grabs amid market stress.

According to AmberCN, Trend Research executed a two-step transaction: first, borrowing 30 million USDT from Aave, a leading crypto lending protocol, and second, depositing the full amount into Binance, one of the largest centralized exchanges. The firm's Ethereum holdings, acquired since November 2025, now total 626,000 ETH, with an average cost basis of $3,186. With Ethereum's current price below this level, on-chain forensic data confirms an unrealized loss of approximately $50 million. This activity was reported on January 20, 2026, and aligns with real-time market intelligence showing a Fear sentiment score of 32/100 on the Crypto Fear & Greed Index. The move occurs amid broader market pressures, including rising US Treasury yields impacting Bitcoin, which often correlates with Ethereum's performance.

Ethereum's price action has breached Trend Research's average purchase price, creating a Fair Value Gap (FVG) near the $3,186 level. Volume profile analysis indicates weak buying interest at this zone, suggesting it may act as resistance rather than support. The 50-day moving average sits at $3,250, with the Relative Strength Index (RSI) hovering near oversold territory at 28, signaling potential for a short-term bounce but not a trend reversal. A critical Fibonacci support level at $3,000, derived from the 0.618 retracement of the 2025 rally, serves as the next key test; a break below could trigger stop-loss orders and further liquidations. Bullish invalidation is set at $3,000—if ETH fails to hold this level, the bearish scenario strengthens. Bearish invalidation lies at $3,400, where a breakout above would negate the current downtrend and potentially squeeze short positions.

| Metric | Value | Source |

|---|---|---|

| Trend Research USDT Deposit to Binance | $30 million | AmberCN Report |

| Trend Research ETH Holdings | 626,000 ETH ($1.94B) | On-Chain Data |

| Average ETH Purchase Price | $3,186 | Trend Research Data |

| Unrealized Loss on ETH Holdings | $50 million | Calculated from Price Data |

| Crypto Fear & Greed Index | 32/100 (Fear) | Live Market Intelligence |

| BNB Current Price (Rank #4) | $913.99 (-1.33% 24h) | Live Market Intelligence |

This development matters for both institutional and retail participants. Institutionally, it highlights the risks of leveraged accumulation strategies in volatile markets; firms like Trend Research may use deposits to Binance for liquidity management, potentially preparing for margin calls or opportunistic buying. Retail impact is indirect but significant, as large moves can exacerbate price swings and affect market sentiment. According to Ethereum's official documentation on network upgrades, the upcoming Pectra hardfork aims to enhance scalability, but short-term price action remains driven by macro factors and on-chain flows. The deposit could signal a liquidity grab, where large players move funds to exchanges to capitalize on volatility, often preceding sharp price movements.

Market analysts on X/Twitter are divided. Bulls argue that the deposit might be a strategic reserve for buying more ETH at lower prices, citing historical cycles where institutions doubled down during dips. One analyst noted, "This looks like a classic gamma squeeze setup if ETH rebounds above $3,200." Bears, however, interpret it as a warning sign of potential selling pressure, with sentiment aligning with the Fear index. No direct quotes from executives like Michael Saylor are available, but overall, the community views this as a high-stakes maneuver in a tense market environment.

Bullish Case: If Ethereum holds the Fibonacci support at $3,000 and rebounds, Trend Research's deposit could fuel a rally toward $3,500, aided by short covering and renewed institutional interest. Market structure suggests a retest of the $3,186 FVG as resistance-turned-support, with on-chain data indicating accumulation by other large holders.

Bearish Case: A break below $3,000 invalidates the bullish scenario, likely triggering cascading liquidations and pushing ETH toward $2,800. The $30 million deposit might then be used for selling or hedging, exacerbating the downtrend. Historical patterns from the Federal Reserve's interest rate hikes, as detailed on FederalReserve.gov, show that tightening cycles often pressure risk assets like Ethereum, supporting a bearish outlook if macro conditions worsen.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.