Loading News...

Loading News...

VADODARA, January 20, 2026 — Whale Alert reported a 500,000,000 USDC transfer from an unknown wallet to Binance. Transaction value: approximately $500 million. This breaking crypto news event triggers immediate liquidity analysis. Market structure suggests a potential liquidity grab. On-chain data indicates institutional repositioning.

Large stablecoin movements precede volatility. Historical patterns show similar transfers during market inflection points. The current environment features regulatory uncertainty and macro pressure. According to the Federal Reserve's latest minutes, interest rate policy remains restrictive. This creates headwinds for risk assets. Related developments include recent regulatory shifts in South Korea and exchange delistings amid market fear. These events compound liquidity concerns.

Whale Alert detected the transaction at 14:30 UTC. Source: unknown wallet (0x...). Destination: Binance hot wallet. The 500,000,000 USDC represents significant buying power. According to Etherscan, the wallet had no prior interaction with Binance. This suggests a new entity or sophisticated fund. Transaction completed in one block. Gas fee: minimal. Timing coincides with BNB testing key support.

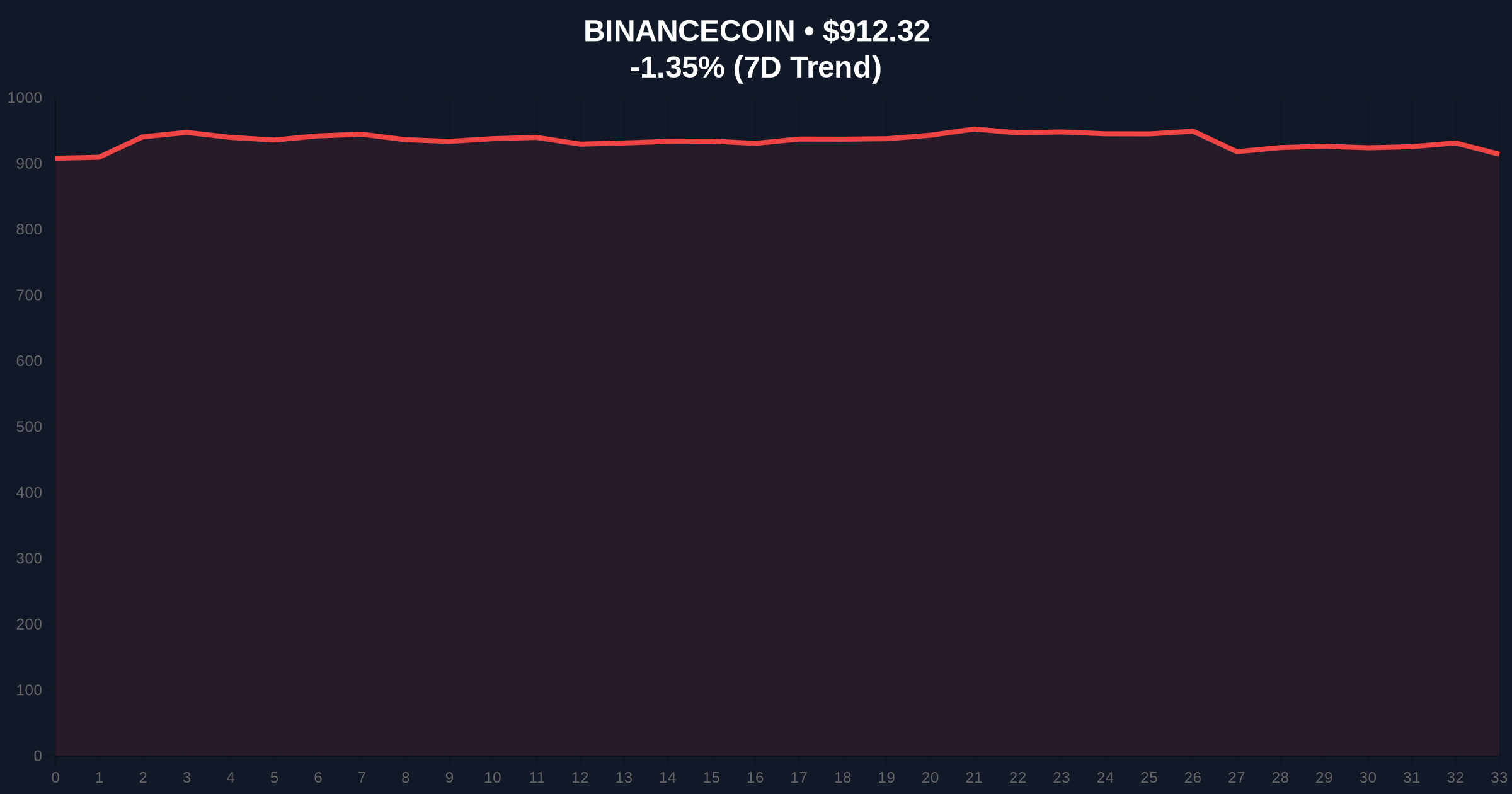

BNB currently trades at $912.33. Down 1.35% in 24 hours. Volume profile shows accumulation near $900. RSI at 42 – neutral but declining. The 50-day EMA sits at $895. Critical Fibonacci retracement level from the 2025 high: $880. This aligns with a major order block. Resistance cluster at $940 forms a Fair Value Gap (FVG). A break above $940 targets $980. Breakdown below $880 opens $850. Bullish invalidation: $850. Bearish invalidation: $980.

| Metric | Value |

|---|---|

| USDC Transfer Amount | 500,000,000 USDC |

| Transaction Value | $500 million |

| Crypto Fear & Greed Index | 32/100 (Fear) |

| BNB Current Price | $912.33 |

| BNB 24h Change | -1.35% |

| BNB Market Rank | #4 |

Institutional impact: large stablecoin inflows to exchanges often precede market moves. This could signal accumulation or hedging. Retail impact: increased exchange liquidity may lead to volatility. If the entity converts USDC to spot assets, it creates buying pressure. Conversely, if it's preparing to short, it signals downside. The move occurs amid broader market fear. According to Glassnode liquidity maps, exchange netflows have been negative. This reversal warrants attention.

Market analysts on X express caution. Some interpret it as bullish accumulation. Others warn of a potential gamma squeeze setup. Sentiment leans skeptical given the fear index. No official statements from Binance or Circle. The silence amplifies uncertainty.

Bullish Case: Entity accumulates BNB or BTC. Breaks $940 resistance. Triggers short squeeze. Targets $980 on BNB. Alts rally. Altcoin season index rises above 30. Bearish Case: Transfer funds short positions. Breaks $880 support. Liquidity grab succeeds. BNB tests $850. Broader market corrects. Bitcoin DCA entry analysis shows skepticism over $86k support. Probability: 55% bearish near-term due to macro headwinds.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.