Loading News...

Loading News...

VADODARA, January 26, 2026 — Stablecoin issuers generated an estimated $5 billion in revenue during 2025. This daily crypto analysis reveals Ethereum's critical role as the primary settlement layer. According to data from Token Terminal, the supply of stablecoins on Ethereum increased by $50 billion over the year. It surpassed $180 billion in Q4 2025.

Token Terminal data confirms the revenue figure. Issuers' quarterly revenue grew consistently. It reached approximately $1.4 billion in Q4 2025 alone. This represents a significant acceleration from earlier quarters. The Ethereum network processed these transactions as the foundational layer. Market structure suggests issuers captured value through minting, redemption fees, and yield strategies. On-chain data indicates heavy utilization of smart contracts for settlement.

Historically, stablecoin growth correlates with broader crypto adoption cycles. The 2021 bull run saw similar expansion. In contrast, 2025's growth occurred amid a market in Extreme Fear. This decoupling signals a maturation phase. Underlying this trend is Ethereum's post-merge security model. Validators now earn fees from these stablecoin transactions. Consequently, network security strengthens with each settlement. Related developments include institutional swaps into Ethereum and rising Bitcoin whale holdings during the same fear-driven period.

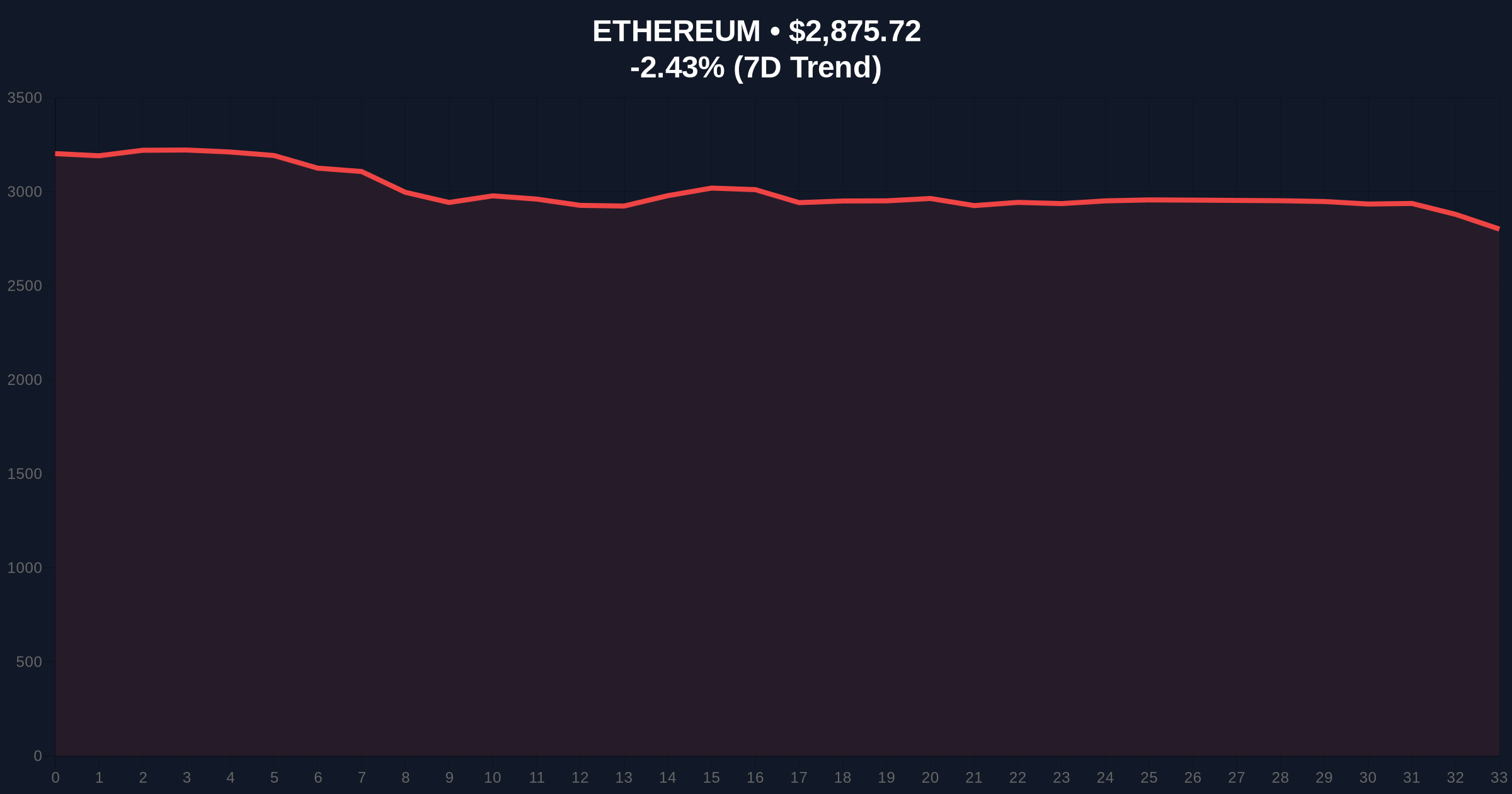

Ethereum's current price sits at $2,874.57. It shows a 24-hour trend of -2.47%. Market structure suggests a liquidity grab below the $2,900 level. A Fair Value Gap (FVG) exists between $2,820 and $2,850. This zone may act as a magnet for price. The 200-day moving average provides dynamic support near $2,800. , Fibonacci retracement levels from the 2024 high indicate key confluence at $2,750. This level aligns with a high-volume node on the Volume Profile. RSI readings hover near 45, showing neutral momentum despite the fear sentiment.

| Metric | Value | Source |

|---|---|---|

| 2025 Stablecoin Issuer Revenue | $5 Billion | Token Terminal |

| Ethereum Stablecoin Supply Increase (2025) | $50 Billion | Token Terminal |

| Q4 2025 Stablecoin Supply | $180 Billion | Token Terminal |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Alternative.me |

| Ethereum (ETH) Current Price | $2,874.57 (-2.47% 24h) | CoinMarketCap |

This revenue stream directly funds Ethereum's proof-of-stake security. Validators earn fees from these transactions. Consequently, the network becomes more resilient. Institutional liquidity cycles now depend on stablecoin efficiency. Retail market structure benefits from lower slippage in DeFi pools. The Ethereum Foundation's roadmap, including EIP-4844 for blob transactions, aims to further reduce settlement costs. This could amplify revenue potential in 2026.

"The $5 billion figure isn't just revenue—it's a direct measure of Ethereum's economic bandwidth. Each dollar represents trust in the network's finality. In an Extreme Fear market, this fundamental strength often precedes a technical reversal. We're watching the $2,750 level as a critical liquidity pool." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains positive. Stablecoin revenue growth supports Ethereum's fee burn mechanism. This reduces net issuance over time. For the 5-year horizon, Ethereum's role as a global settlement layer appears cemented. Regulatory clarity, as seen in developments like Japan's ETF plans, could accelerate this trend.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.