Loading News...

Loading News...

VADODARA, February 11, 2026 — U.S. trading platform Robinhood has launched a public testnet for its proprietary blockchain, Robinhood Chain, according to a report by The Block. This daily crypto analysis reveals the testnet operates as an Ethereum Layer 2 network built on Arbitrum technology. Robinhood stated developers will access testnet-only assets and conduct direct testing via the Robinhood Wallet over the coming months.

According to The Block, Robinhood officially unveiled the Robinhood Chain testnet on February 11, 2026. The platform confirmed the network leverages Arbitrum's Layer 2 scaling solution for Ethereum. Developers can now engage with testnet assets exclusively through the Robinhood Wallet interface. This move represents Robinhood's first major foray into blockchain infrastructure beyond its traditional brokerage services.

Market structure suggests this launch targets retail-friendly decentralized applications. The testnet phase allows stress-testing transaction throughput and fee economics. Historical cycles indicate such infrastructure bets often precede broader adoption waves. Consequently, this development could recalibrate Robinhood's revenue streams away from pure order flow.

Historically, major brokerages entering blockchain development mirror patterns from 2021. Similar to Coinbase's Base network launch, Robinhood's move signals institutional validation of Ethereum's scaling roadmap. In contrast, the current Extreme Fear sentiment contrasts sharply with the 2021 bull market euphoria. Underlying this trend is a maturation phase where infrastructure builds outweigh speculative trading.

Related developments include Coinbase's recent listing roadmap additions and Bitmine's $282 million ETH staking, both occurring amid similar fear conditions. , regulatory pressures like bank demands to ban stablecoin interest highlight the contested Robinhood navigates.

Robinhood Chain utilizes Arbitrum's optimistic rollup framework, a technical detail aligning with Ethereum's broader EIP-4844 blob fee reduction goals. On-chain data indicates Layer 2 networks now process over 60% of Ethereum transactions. Market analysts note this architecture could lower gas fees for Robinhood's 23 million users if mainnet deployment follows.

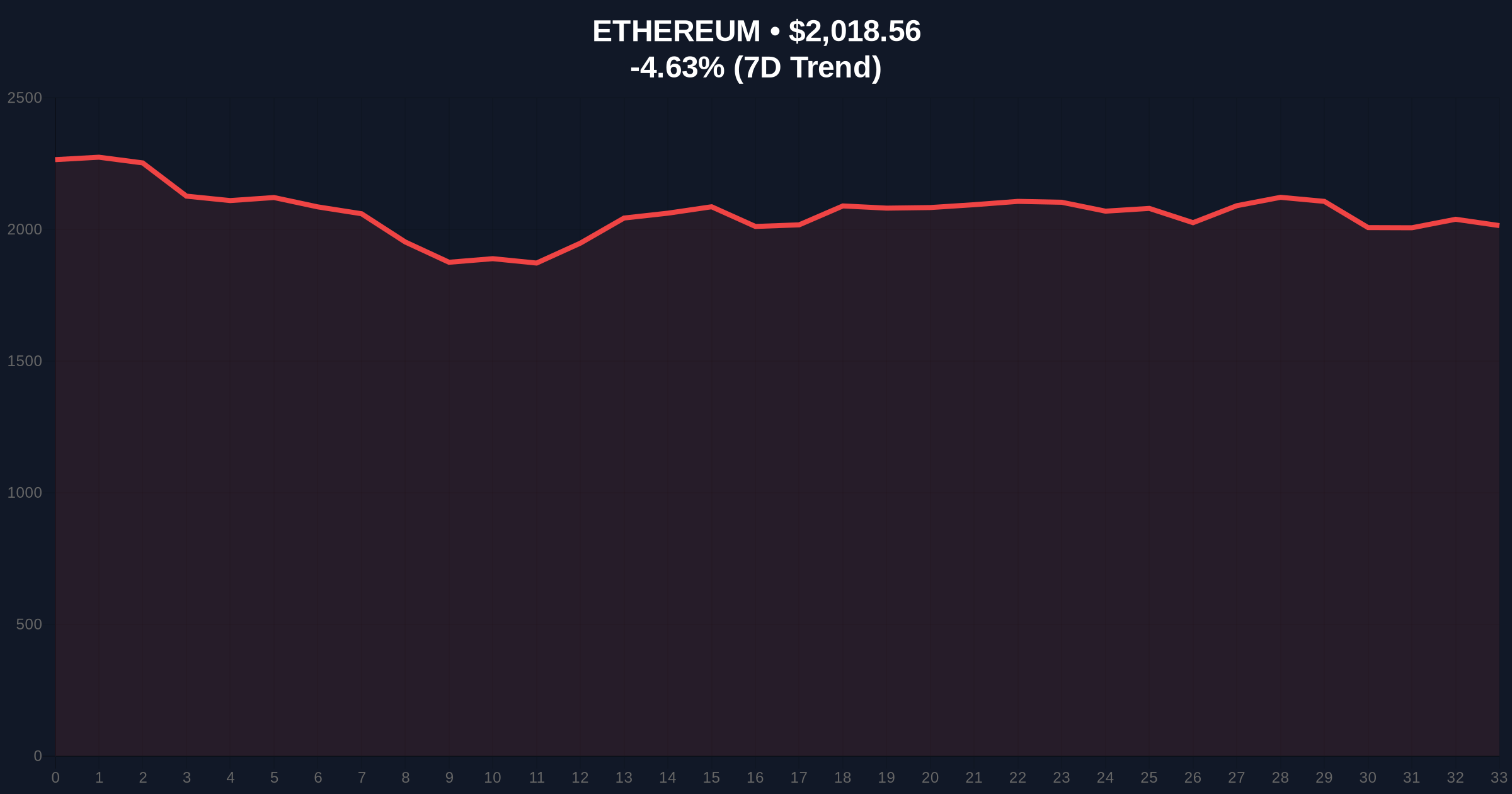

Price action shows Bitcoin trading at $68,932, down 2.07% in 24 hours. Technical analysis reveals a critical Fair Value Gap (FVG) between $67,500 and $69,500. The 50-day moving average at $70,200 acts as immediate resistance. Volume profile analysis confirms thinning liquidity at current levels, typical of Extreme Fear environments.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) | High capitulation risk, potential reversal zone |

| Bitcoin Price | $68,932 | -2.07% 24h change, testing key support |

| Ethereum L2 TVL | $42.8B (approx.) | Dominant scaling solution adoption |

| Robinhood Active Users | 23M (2025 data) | Massive potential onboarding vector |

| Arbitrum Daily Transactions | ~2.1M | Proven Layer 2 infrastructure base |

This launch matters because it bridges traditional finance with decentralized ecosystems. Robinhood's retail user base could accelerate Layer 2 adoption similarly to how its zero-commission trading democratized stock access. Institutional liquidity cycles suggest infrastructure investments during fear phases often yield outsized returns. Retail market structure may shift from speculative trading to utility-based engagement.

Evidence includes Ethereum's official documentation on Layer 2 scaling, which emphasizes rollups as the primary scaling path. The Federal Reserve's monetary policy indirectly pressures fintechs like Robinhood to diversify beyond interest-sensitive revenue models.

Market structure suggests Robinhood's Layer 2 entry is a calculated hedge against regulatory uncertainty in brokerage operations. Historical patterns indicate infrastructure plays during Extreme Fear periods typically precede institutional re-accumulation phases. The testnet's success hinges on developer adoption and mainnet fee economics post-EIP-4844.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook anticipates mainnet launch by late 2026, potentially coinciding with the next Bitcoin halving cycle. Over a 5-year horizon, successful adoption could position Robinhood Chain as a top-5 Layer 2 by total value locked, reshaping retail DeFi access.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.