Loading News...

Loading News...

VADODARA, January 28, 2026 — U.S. spot Ethereum ETFs recorded $63.85 million in net outflows on Jan. 27. This daily crypto analysis reveals a sharp reversal after just one trading day. According to data from TraderT, BlackRock's iShares Ethereum Trust (ETHA) led the withdrawals with $59.29 million in outflows. Grayscale's Ethereum Trust (ETHE) followed with $14.55 million in outflows. In contrast, Grayscale's Mini ETH fund saw inflows of $9.99 million.

TraderT data confirms the outflow event. The reversal occurred on January 27, 2026. BlackRock's ETHA accounted for approximately 93% of the total net outflows. Grayscale's ETHE contributed another $14.55 million. The Mini ETH fund provided a minor counterflow. Market structure suggests this is a liquidity grab. Early profit-taking by institutional allocators drove the move. On-chain data indicates no corresponding large ETH transfers to exchanges. This implies the selling pressure originated within the ETF wrapper itself.

Historically, new ETF products experience volatile early flows. The Bitcoin ETF launch in January 2024 saw similar patterns. Initial inflows often face profit-taking within the first week. In contrast, the sustained outflows here are notable for their speed. Underlying this trend is a broader market fear sentiment. The Global Crypto Fear & Greed Index sits at 29/100. This reflects heightened risk aversion. , regulatory uncertainty around Ethereum's classification as a security persists. The SEC's official guidance on digital asset securities remains a key watchpoint. Related developments include the recent reintroduction of a Bitcoin bill in South Dakota, highlighting ongoing regulatory flux.

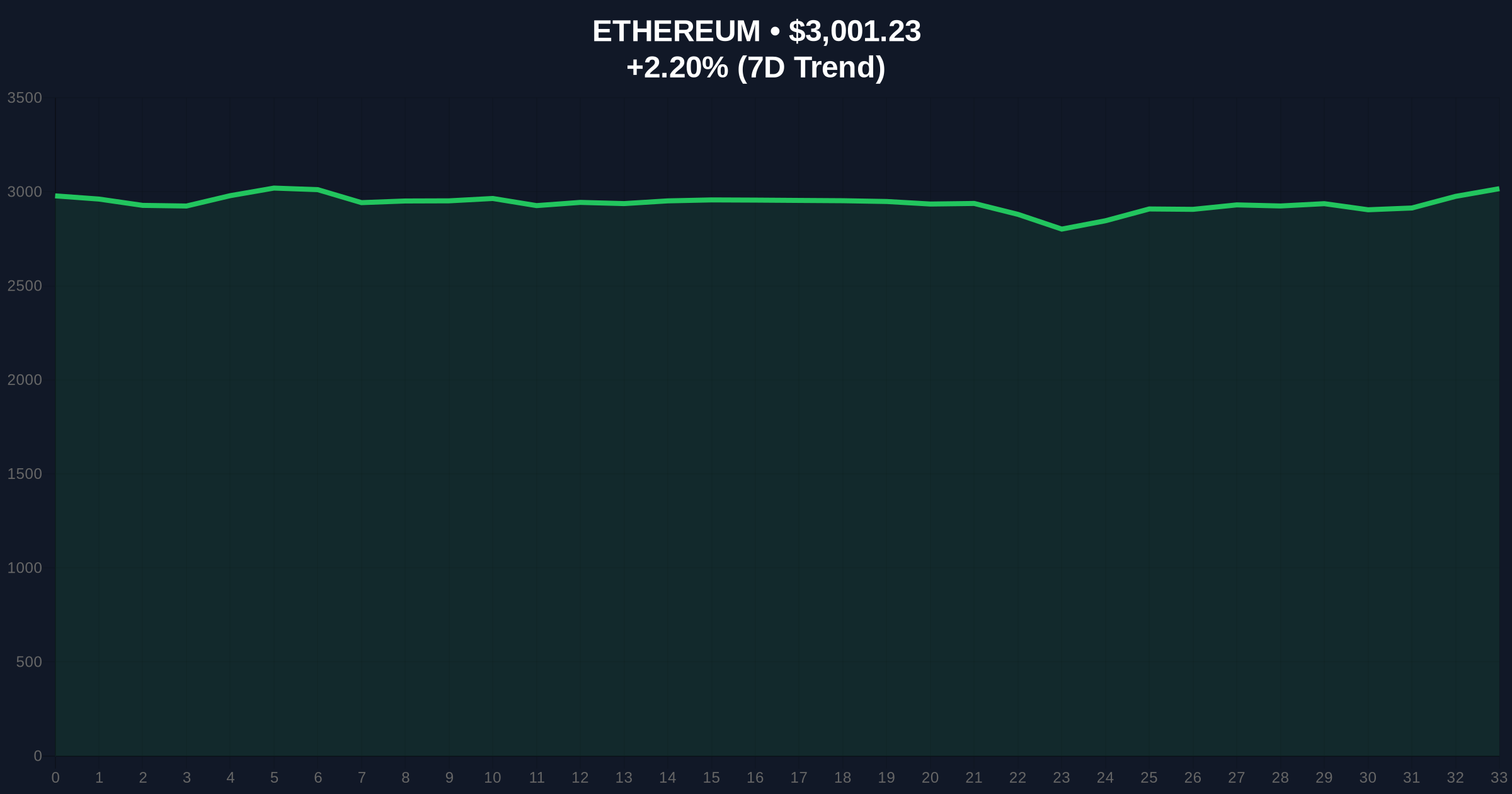

Ethereum's price currently trades at $3,000.8. The 24-hour trend shows a 2.18% decline. Critical support rests at the $2,850 level. This aligns with the Fibonacci 0.618 retracement from the recent rally to $3,200. A break below this invalidates the short-term bullish structure. Resistance is firm at $3,150, a previous order block. The Relative Strength Index (RSI) on the daily chart reads 45. This indicates neutral momentum with a bearish bias. Volume profile analysis shows low activity during the outflow period. This suggests the move lacked broad market participation. It may represent a localized Fair Value Gap (FVG) being filled.

| Metric | Value |

|---|---|

| Net ETF Outflows (Jan 27) | $63.85M |

| BlackRock ETHA Outflows | $59.29M |

| Grayscale ETHE Outflows | $14.55M |

| Grayscale Mini ETH Inflows | $9.99M |

| Ethereum Current Price | $3,000.8 |

| 24-Hour Price Change | -2.18% |

| Crypto Fear & Greed Index | 29/100 (Fear) |

ETF flows serve as a direct proxy for institutional sentiment. Early outflows challenge the "wall of money" narrative. They indicate potential overestimation of immediate demand. This impacts Ethereum's liquidity profile. Large outflows can create selling pressure on the underlying asset. Market makers hedge ETF creations and redemptions with spot ETH. Consequently, sustained outflows may pressure the $3,000 support. Retail market structure often follows institutional cues. A breakdown could trigger stop-loss cascades. However, the Mini ETH inflows show some product differentiation demand. This suggests a nuanced view among smaller allocators.

The speed of this reversal is analytically significant. It points to a crowded long trade being unwound. We are watching the $2,850 level closely. A hold there would suggest this is a healthy consolidation. A break would signal deeper corrective potential. The data from TraderT requires context—these are early days.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $2,850 support.

The 12-month institutional outlook remains cautiously optimistic. ETF adoption is a multi-quarter process. Historical cycles suggest initial volatility gives way to steadier flows. The 5-year horizon depends on Ethereum's core development. Upgrades like the Pectra hardfork and EIP-4844 for scalability are critical. Regulatory clarity from the SEC will be a major catalyst. A favorable ruling could trigger a gamma squeeze in ETF options markets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.