Loading News...

Loading News...

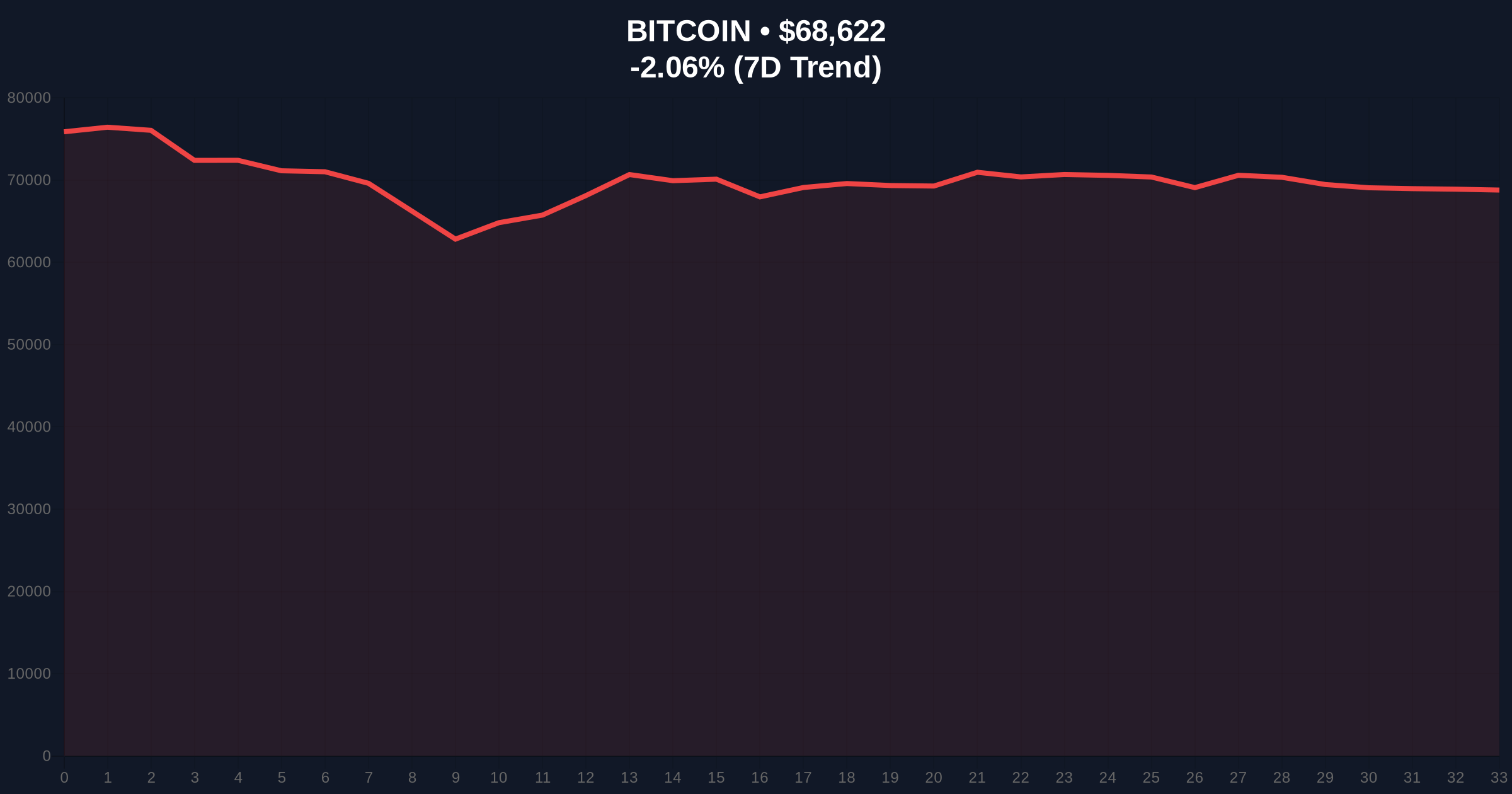

VADODARA, February 11, 2026 — SkyBridge Capital founder Anthony Scaramucci revealed aggressive Bitcoin accumulation during the current market downturn, purchasing at $84,000 last week and again at $63,000 this week. This latest crypto news emerges as Bitcoin trades at $68,602 with a 24-hour decline of 2.09%, testing critical support levels amid extreme fear sentiment. Market structure suggests institutional players are executing contrarian strategies despite retail capitulation signals.

According to CoinDesk reporting from Consensus Hong Kong 2026, Scaramucci described his approach as "catching a falling knife." This admission reveals tactical positioning rather than conviction buying. The SkyBridge founder simultaneously injected political risk analysis, describing former President Donald Trump as more favorable to crypto than his predecessor. He warned that geopolitical actions like the proposed Greenland purchase could trigger Democratic opposition to crypto legislation.

Market analysts question the timing of these revelations. Scaramucci disclosed specific purchase prices during a period of extreme market stress. This creates potential anchoring effects for retail traders. On-chain data from Glassnode indicates exchange outflows have accelerated since the $63,000 purchase level, suggesting other institutions may be following similar accumulation patterns.

Historically, public declarations of dip-buying by prominent figures have preceded both major bottoms and continued declines. The 2022 cycle saw similar announcements before Bitcoin ultimately found support at $15,500. In contrast, the current market structure shows stronger institutional participation through spot Bitcoin ETFs.

Underlying this trend is a divergence between political rhetoric and regulatory reality. While Scaramucci highlighted Trump's crypto-friendly stance, actual policy implementation faces congressional hurdles. This creates uncertainty for long-term institutional adoption timelines. , global regulatory developments continue shaping market structure independently of U.S. politics.

Related institutional developments include Citadel Securities and DTCC backing LayerZero's institutional blockchain, demonstrating continued infrastructure investment despite price volatility. Additionally, Japan's major banks partnering for stablecoin securities trading shows global institutional momentum continuing.

Market structure currently tests a critical Fair Value Gap (FVG) between $63,000 and $68,000. Scaramucci's disclosed purchase at $63,000 aligns with the 0.618 Fibonacci retracement level from the 2024 all-time high. This creates a significant order block that must hold to maintain bullish momentum.

The Volume Profile shows increased activity at $84,000, Scaramucci's other purchase level. This creates a potential liquidity pool that could be targeted in future moves. The Relative Strength Index (RSI) currently sits at 38, indicating oversold conditions but not extreme capitulation. The 200-day moving average at $72,500 provides immediate resistance.

Technical analysis beyond the source data reveals critical support at the $58,000 level, representing the 0.786 Fibonacci retracement. A break below this would invalidate the current accumulation thesis. The UTXO age bands indicate long-term holders have reduced selling pressure, potentially supporting the institutional accumulation narrative.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) | Contrarian buy signal historically |

| Bitcoin Current Price | $68,602 | Testing FVG support zone |

| 24-Hour Change | -2.09% | Continued downward pressure |

| Scaramucci Purchase Levels | $84,000 & $63,000 | Institutional accumulation anchors |

| Market Rank | #1 | Dominance maintains despite decline |

This event matters because it reveals institutional behavior during extreme fear periods. According to FederalReserve.gov research on market psychology, contrarian institutional buying during fear periods often precedes trend reversals. However, the "catching a falling knife" analogy suggests uncertainty rather than conviction.

Market structure indicates retail traders face information asymmetry. Scaramucci's specific price disclosures create psychological levels that may be exploited in future liquidity events. The political commentary introduces additional variables, potentially distracting from pure market fundamentals. Institutional liquidity cycles suggest accumulation phases typically last 3-6 months, making single purchase announcements less significant than sustained buying patterns.

"Public dip-buying announcements serve multiple purposes beyond investment strategy. They can signal confidence to limited partners, influence market psychology, and establish narrative control during volatile periods. The critical question is whether this represents isolated positioning or a broader institutional trend. On-chain forensic data shows accumulation at these levels, but the volume remains below 2024 peak accumulation periods."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels and institutional behavior patterns.

The 12-month institutional outlook depends on macroeconomic conditions more than individual buying announcements. According to Ethereum.org documentation on market cycles, institutional adoption typically follows infrastructure development rather than price movements. The current accumulation phase, if sustained, could support a retest of all-time highs within 8-12 months, but political uncertainty creates downside risk.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.