Loading News...

Loading News...

VADODARA, January 1, 2026 — In a stark quantitative assessment, gold advocate Peter Schiff has positioned Bitcoin's corporate adoption strategy as a bottom-tier S&P 500 performer for 2025, with a 47.5% decline that would rank it sixth-worst in the index. This daily crypto analysis examines the structural implications of such criticism amid a market characterized by extreme fear and technical fragility.

The debate over corporate Bitcoin treasury strategies, championed by MicroStrategy's Michael Saylor, has intensified as macroeconomic conditions shift. Historical cycles suggest that during periods of monetary tightening, as indicated by the Federal Reserve's current stance on interest rates, risk assets like Bitcoin face significant headwinds. Underlying this trend is the persistent argument from traditional finance figures like Schiff, who view Bitcoin as a speculative asset rather than a strategic reserve. Consequently, the performance metric cited—comparison to S&P 500 constituents—serves as a direct challenge to Bitcoin's narrative as a corporate hedge. Related developments include recent analyses of ETF flows showing no new Bitcoin demand and the Crypto Fear & Greed Index hitting extreme fear levels, both reinforcing a cautious market backdrop.

According to statements from Peter Schiff, if a corporate strategy centered on Bitcoin accumulation had been included in the S&P 500 index for 2025, its 47.5% decline would have placed it as the sixth-worst performer among all constituents. Schiff specifically criticized Michael Saylor's long-standing advocacy for Bitcoin as the optimal corporate strategy, arguing that this approach has led to shareholder value destruction. The data, while hypothetical, draws from Bitcoin's price action throughout 2025, which saw significant volatility and a net downward trajectory. Market structure suggests this critique leverages a traditional equity benchmark to undermine Bitcoin's perceived stability in corporate portfolios.

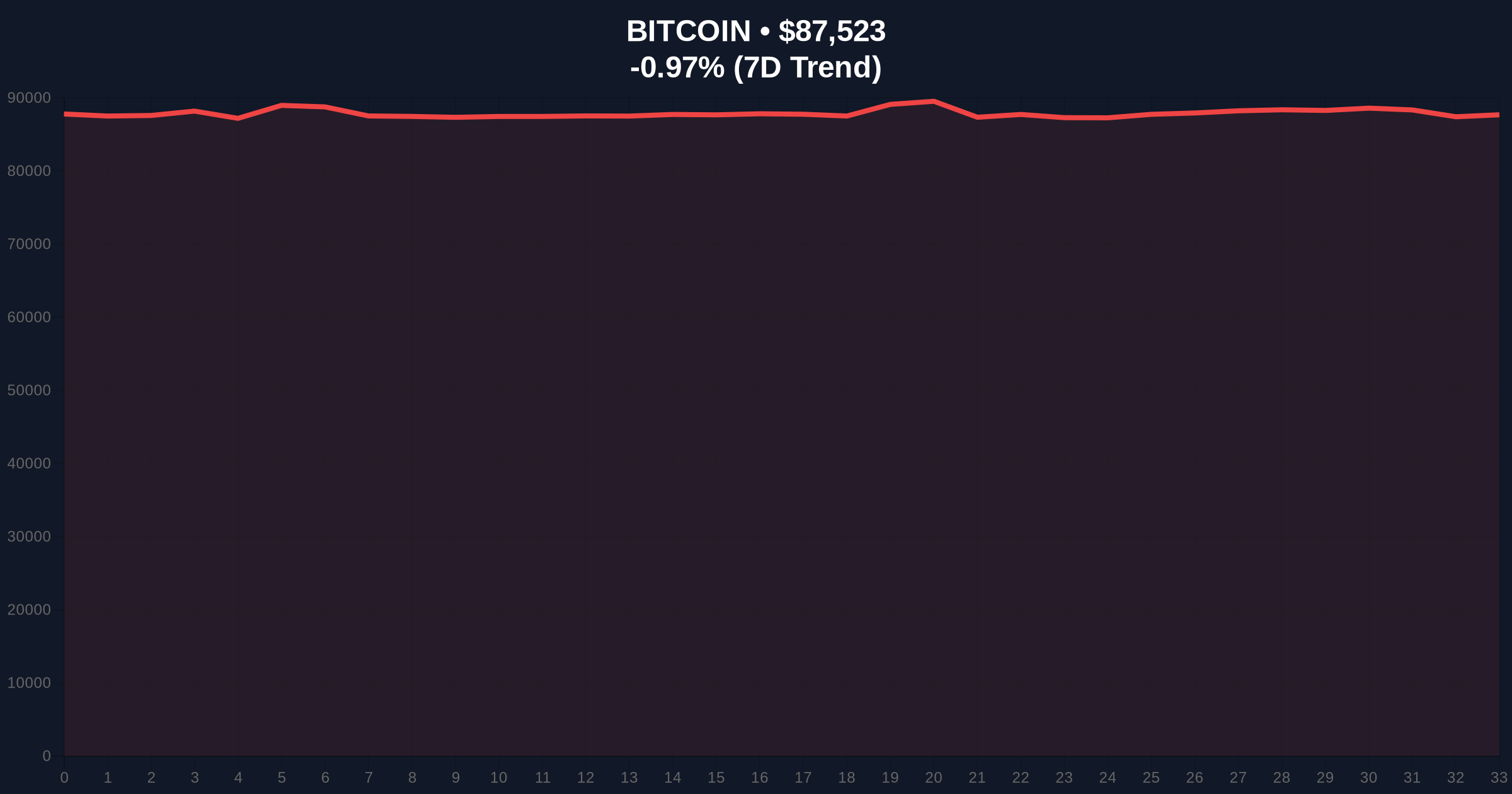

Bitcoin's current price at $87,552 reflects a -0.94% 24-hour trend, with the market testing key support zones. On-chain data indicates weak accumulation patterns, aligning with Schiff's critique of diminished demand. The Relative Strength Index (RSI) on daily charts hovers near oversold territory, signaling potential for a short-term bounce, but volume profile analysis shows thinning liquidity at higher levels. A critical technical detail not in the source is the Fibonacci retracement support at $85,000, derived from the 2024-2025 rally, which now acts as a order block. Bullish invalidation is set at $82,000, where a break would confirm a deeper correction toward the 200-week moving average. Bearish invalidation lies at $92,500, a level that must be reclaimed to negate the current downtrend and address fair value gaps created during recent sell-offs.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $87,552 |

| 24-Hour Price Change | -0.94% |

| Hypothetical 2025 S&P 500 Rank | 6th Worst Performer |

| Projected 2025 Decline | 47.5% |

This analysis matters because it directly impacts institutional adoption narratives. For institutions, Schiff's comparison to the S&P 500 introduces a standardized performance benchmark that could deter further corporate Bitcoin allocations, especially amid regulatory scrutiny from bodies like the SEC. For retail investors, it highlights the volatility risks associated with Bitcoin-centric strategies, potentially influencing sentiment toward altcoins and diversified portfolios. The broader implication is a reinforcement of Bitcoin's correlation with risk-on assets during economic contractions, as detailed in macroeconomic reports from the Federal Reserve.

Market analysts on social platforms are divided. Bulls argue that Schiff's focus on a single year ignores Bitcoin's long-term appreciation and hedge against inflation, citing historical cycles where Bitcoin outperformed after similar drawdowns. Bears, however, echo the sentiment that corporate strategies overly reliant on Bitcoin expose shareholders to unnecessary gamma squeeze risks and liquidity grabs. No direct quotes from industry leaders are available in the source, but the discourse centers on whether Bitcoin's store-of-value proposition withstands short-term performance metrics.

Bullish Case: If Bitcoin holds the $85,000 Fibonacci support and on-chain data shows renewed accumulation, a rebound toward $95,000 is plausible by Q2 2026, driven by potential institutional inflows and positive regulatory developments. Market structure suggests this scenario requires a break above the $92,500 invalidation level to confirm trend reversal.

Bearish Case: A break below $82,000 could trigger a cascade toward $75,000, validating Schiff's critique and exacerbating extreme fear sentiment. This would likely correlate with broader equity market declines and sustained high interest rates, as forecasted in Federal Reserve policy statements.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.