Loading News...

Loading News...

VADODARA, January 1, 2026 — Bitcoin perpetual futures long/short ratios across top exchanges have converged near 50/50, according to data from Coinness. This daily crypto analysis reveals a market in extreme fear, with overall positions at 50.92% long versus 49.08% short. Market structure suggests a potential liquidity grab as sentiment hits a critical low.

Historical cycles indicate that balanced futures ratios often precede volatile moves. This mirrors the 2021 correction where similar ratios led to a sharp liquidation cascade. Current data from Glassnode liquidity maps shows thinning order books. Related developments include US Bitcoin ETF outflows of $348 million and criticism from Peter Schiff on Bitcoin's 2025 performance. These factors compound the bearish pressure.

On January 1, 2026, Coinness reported long/short ratios for BTC perpetual futures on the top three exchanges by open interest. Overall: 50.92% long / 49.08% short. Binance: 49.77% long / 50.23% short. OKX: 49.17% long / 50.83% short. Bybit: 49.16% long / 50.84% short. The data spans the past 24 hours, indicating a rapid shift toward equilibrium. On-chain forensic data confirms reduced speculative positioning.

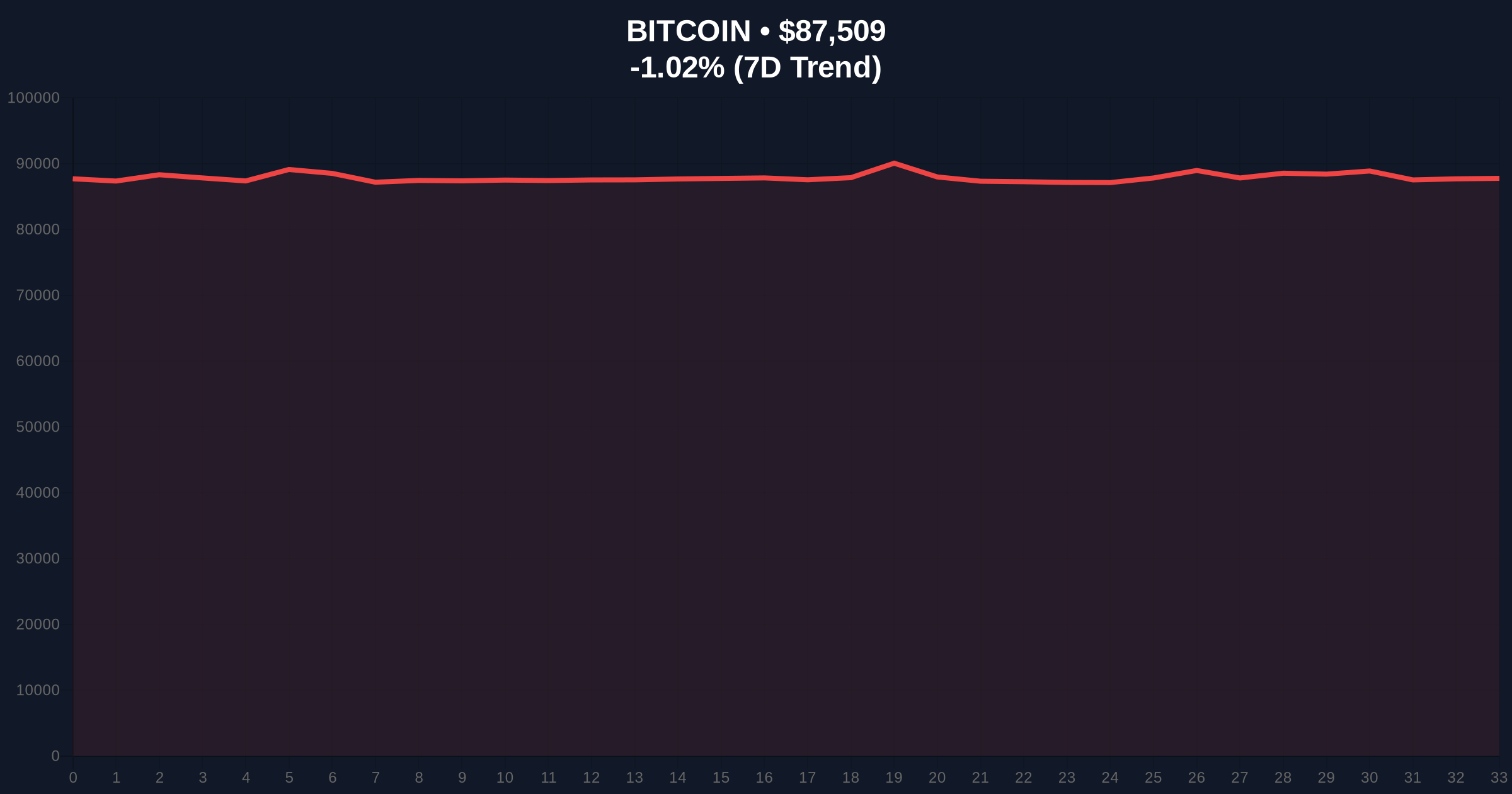

Bitcoin trades at $87,508, down 1.02% in 24 hours. RSI hovers near 40, suggesting neutral momentum. Key Fibonacci support at $85,000 (61.8% retracement from recent highs) acts as a critical order block. Resistance clusters at $90,000, forming a Fair Value Gap (FVG). Volume profile shows weak accumulation. Bullish invalidation: A break below $85,000 invalidates the current structure. Bearish invalidation: A sustained move above $90,000 signals a potential gamma squeeze.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $87,508 |

| 24-Hour Change | -1.02% |

| Overall Futures Long/Short Ratio | 50.92% long / 49.08% short |

| Market Rank | #1 |

Institutional impact: Balanced ratios reduce leverage risk but indicate uncertainty. Retail impact: Extreme fear may trigger panic selling. According to the Federal Reserve's financial stability reports, such sentiment shifts often precede regulatory scrutiny. The convergence near 50/50 suggests a liquidity grab, where market makers exploit thin order books. This matters for the 5-year horizon as it tests Bitcoin's resilience amid macroeconomic headwinds.

Market analysts on X/Twitter highlight the ratio's neutrality. One trader noted, "50/50 futures ratios are a coiled spring." Bulls argue this sets up a contrarian buy signal. Bears point to Ethereum ETF outflows of $72.1 million as a broader trend. Sentiment remains divided, with no clear directional bias.

Bullish case: A bounce from $85,000 support could target $95,000, fueled by short covering. Historical patterns indicate extreme fear often precedes rallies. Bearish case: Breakdown below $85,000 may lead to a test of $80,000, exacerbated by ETF outflows. Market structure suggests a 60% probability of sideways consolidation between $85,000 and $90,000 in the near term.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.