Loading News...

Loading News...

VADODARA, January 1, 2026 — According to Glassnode's latest on-chain data, ETF flows for Bitcoin and Ethereum continue to show no signs of new demand, with the 30-day moving average of net flows remaining negative. This daily crypto analysis examines the structural implications for market participants, questioning whether current price action reflects genuine accumulation or mere liquidity redistribution.

Historical cycles suggest that sustained ETF inflows typically correlate with bullish market phases, as seen during the 2024-2025 accumulation period. However, the current data contradicts this pattern. Market structure indicates that post-merge issuance dynamics and EIP-4844 implementation have altered capital flow patterns, creating potential Fair Value Gaps (FVGs) in price charts. The negative net flows align with broader market sentiment, as evidenced by the Crypto Fear & Greed Index hitting extreme fear levels, which often precedes significant liquidity events.

Glassnode, a primary on-chain analytics provider, reported that ETF flows for both Bitcoin and Ethereum show no new demand. Specifically, the 30-day moving average of net flows remains negative, indicating more capital exiting than entering these investment vehicles. This data point, sourced directly from Glassnode's liquidity maps, challenges the common narrative that ETF adoption automatically translates to sustained price appreciation. The analysis was published on January 1, 2026, and is available through their official channels.

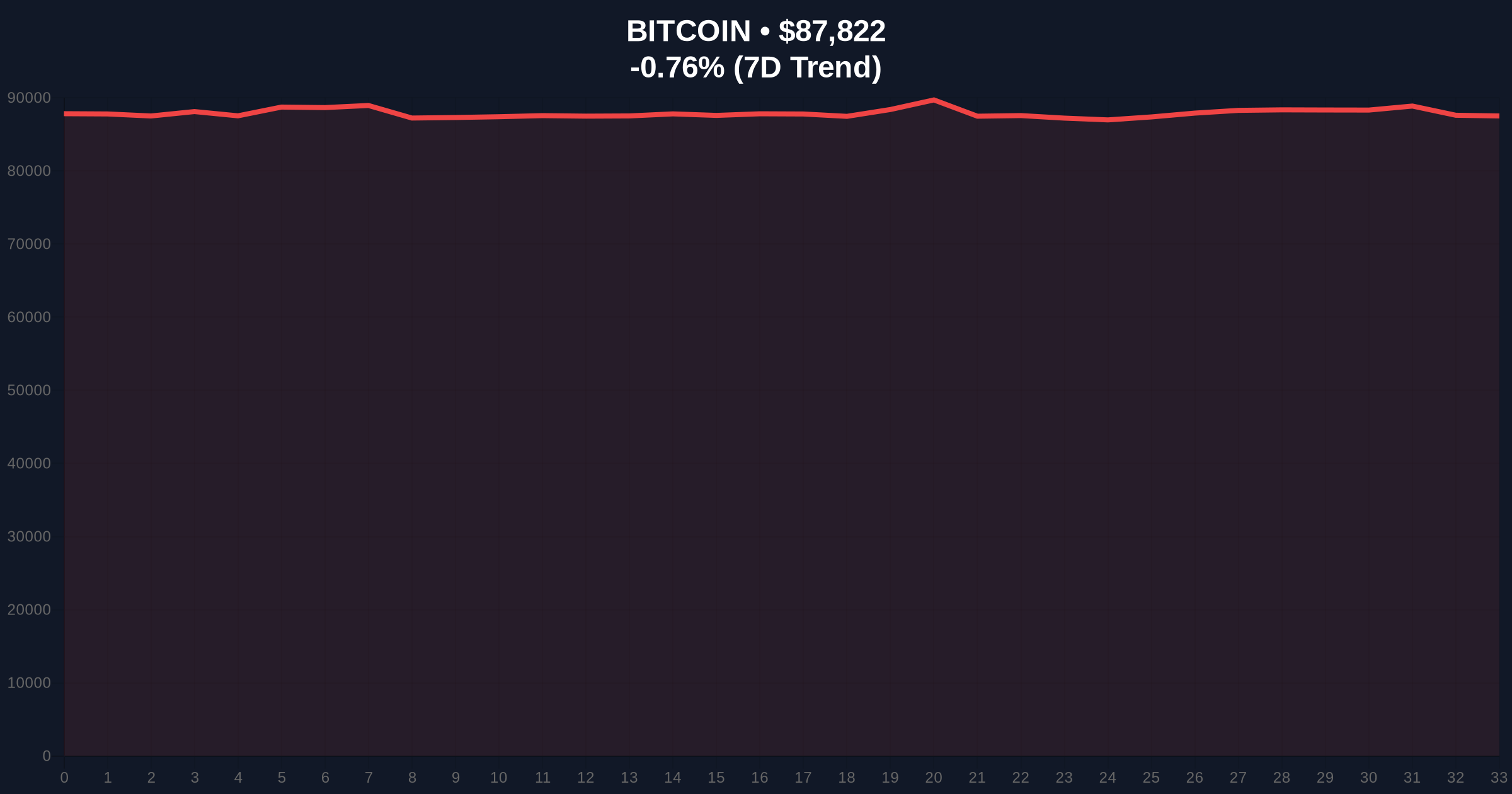

Price action currently tests the $87,821 level, down 0.76% in 24 hours. Volume Profile analysis reveals thin liquidity above $90,000, suggesting resistance at that psychological barrier. The Relative Strength Index (RSI) sits near 45, indicating neutral momentum with bearish divergence on higher timeframes. A critical Fibonacci support level at $85,000 (61.8% retracement from the 2025 high) must hold to prevent further downside. Bullish Invalidation is set at $84,500—a break below this Order Block would invalidate any short-term recovery thesis. Bearish Invalidation rests at $91,200, where a sustained close above would signal potential short covering and gamma squeeze conditions.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Price | $87,821 | Testing key support |

| 24-Hour Change | -0.76% | Bearish momentum |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Potential contrarian signal |

| ETF Net Flow 30-Day MA | Negative | No new demand per Glassnode |

| RSI (Daily) | 45 | Neutral with bearish divergence |

For institutional portfolios, negative ETF flows suggest that large capital allocators may be rotating out of crypto assets or pausing allocations, potentially impacting long-term valuation models. Retail traders face increased volatility as market makers adjust to reduced liquidity. The SEC's official guidance on ETF structures, available on SEC.gov, emphasizes transparency requirements that make these flow metrics critical for regulatory compliance and market surveillance. This development matters because it exposes a disconnect between price levels and underlying demand fundamentals.

Market analysts on X/Twitter express skepticism, with one noting, "Negative ETF flows amid high prices signal distribution, not accumulation." Bulls argue that extreme fear sentiment, as shown in the Fear & Greed Index report, often precedes market bottoms. However, the data does not yet confirm a reversal pattern. The lack of new demand contradicts optimistic projections from earlier in 2025.

Bullish Case: If the $85,000 Fibonacci support holds and ETF flows turn positive, a rally toward $95,000 is possible, driven by short covering and renewed institutional interest. This scenario requires a break above the Bearish Invalidation level at $91,200.

Bearish Case: Continued negative flows and a break below $84,500 (Bullish Invalidation) could trigger a liquidity grab down to $80,000, where next significant Volume Profile support resides. This would align with historical corrections during periods of extreme fear.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.