Loading News...

Loading News...

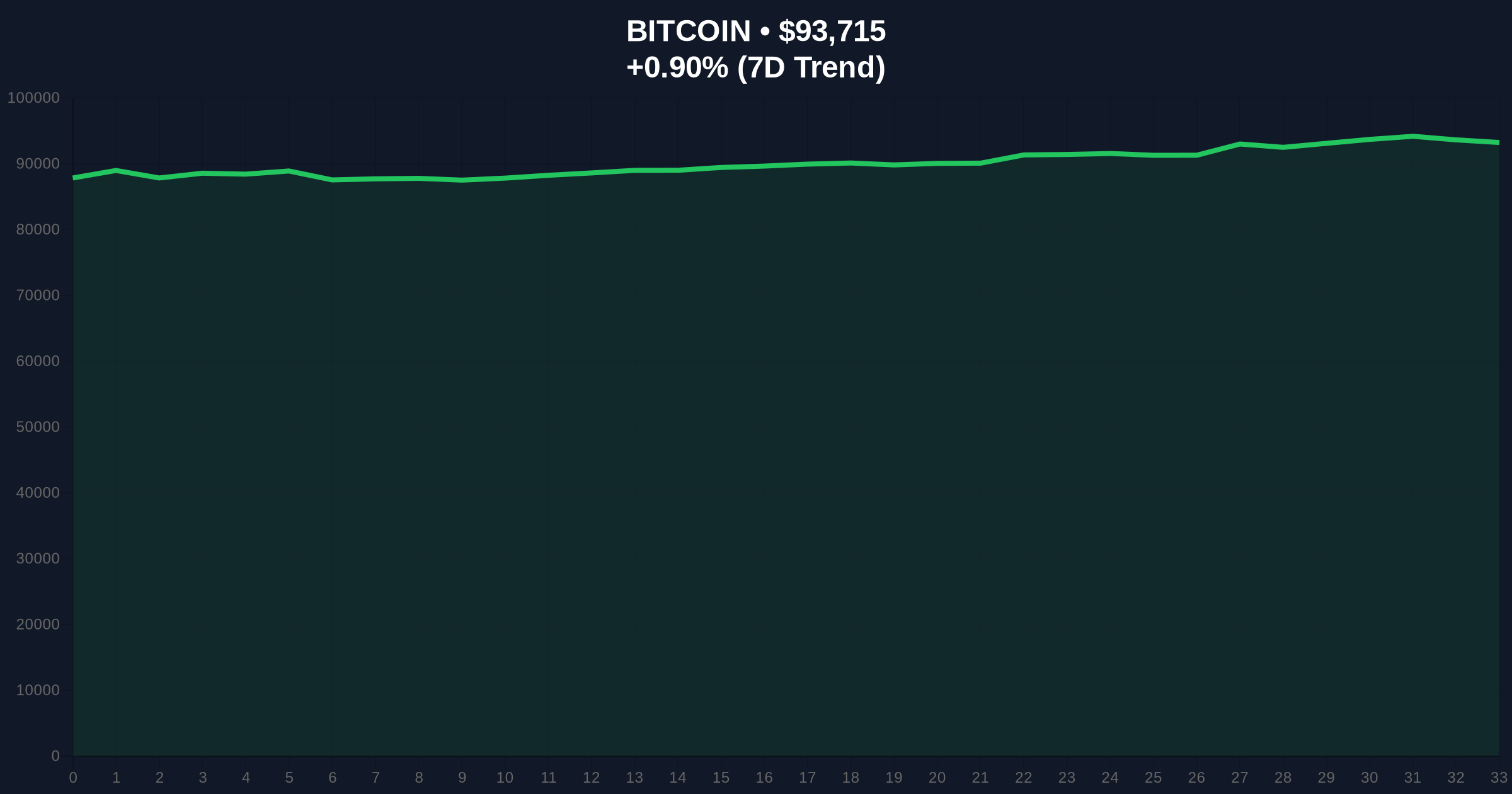

VADODARA, January 6, 2026 — Morgan Stanley has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a Bitcoin Trust, according to Unfolded. This daily crypto analysis examines the structural implications of this institutional move amid current Fear sentiment and Bitcoin trading at $93,704. Market structure suggests this filing represents a calculated liquidity grab targeting retail sell-side pressure.

This development occurs within a macro environment where traditional finance institutions are systematically entering digital asset markets. According to the official SEC filing database, the S-1 form initiates a regulatory review process that typically precedes product launch. Underlying this trend is the post-2024 Bitcoin ETF approval cycle, which established a precedent for regulated exposure vehicles. Consequently, Morgan Stanley's move follows similar filings by Goldman Sachs and other bulge-bracket banks, creating a cumulative institutional order block. This mirrors the 2021-2022 accumulation phase where corporate treasury allocations preceded major liquidity events.

On January 6, 2026, Morgan Stanley submitted an S-1 registration statement to the SEC for a Bitcoin Trust. The filing, accessible through the SEC's EDGAR system, outlines the trust's structure and regulatory compliance framework. While specific details like fee structure or custody arrangements weren't immediately disclosed in the initial report, the mere filing triggers a 20-90 day review window. This procedural step indicates institutional readiness to capture Bitcoin demand from accredited investors and corporate clients. The timing coincides with Bitcoin's consolidation above $90,000 after rejecting the $88,500 support level last week.

Bitcoin currently trades at $93,704, showing a 24-hour gain of 0.89%. The daily chart reveals a Fair Value Gap (FVG) between $91,200 and $92,800 that remains unfilled. Volume Profile analysis indicates high-node concentration at $90,000, establishing it as a major support zone. The 50-day moving average at $94,500 acts as immediate resistance, while the 200-day moving average converges with the $90,000 volume node. RSI sits at 52, indicating neutral momentum without overbought or oversold conditions. Bullish Invalidation Level: A daily close below $90,000 would invalidate the current structure and target $87,000. Bearish Invalidation Level: A sustained break above $96,000 would confirm institutional accumulation and target $100,000.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 44 (Fear) |

| Bitcoin Current Price | $93,704 |

| 24-Hour Change | +0.89% |

| Market Rank | #1 |

| Key Support Level | $90,000 |

| Key Resistance Level | $96,000 |

Institutionally, this filing represents a structural shift in Bitcoin's liquidity profile. According to on-chain data from Glassnode, institutional inflows have increased UTXO age bands above 6 months, indicating long-term holding patterns. For retail investors, the trust provides a regulated vehicle but may compress volatility through large-scale order blocks. The SEC's regulatory framework, detailed on SEC.gov, requires extensive disclosure that enhances market transparency. This development matters for the 5-year horizon because it accelerates Bitcoin's transition from speculative asset to institutional reserve asset, potentially reducing correlation with risk-on equities.

Market analysts on X/Twitter highlight the filing's timing amid Fear sentiment. One quant noted, "Morgan Stanley's S-1 filing during a Fear phase suggests they're targeting weak-handed liquidity." Bulls argue this creates a gamma squeeze setup where forced buying could occur if Bitcoin breaks $96,000. Bears counter that regulatory delays could create selling pressure if the SEC extends its review beyond 90 days. The overall sentiment leans cautiously optimistic, with most observers viewing this as validation of Bitcoin's institutional infrastructure.

Bullish Case: If the SEC approves the trust within 60 days and Bitcoin holds $90,000, institutional inflows could drive a test of $100,000. This scenario assumes continued accumulation above the 200-day moving average and a resolution of the current FVG through upward momentum. Bearish Case: If regulatory hurdles delay approval beyond Q2 2026 or Bitcoin breaks $90,000, a retest of $85,000 becomes likely. This would indicate failed institutional support and a return to retail-driven volatility.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.