Loading News...

Loading News...

VADODARA, January 9, 2026 — Bitcoin perpetual futures markets reveal a structural bearish tilt across major exchanges, with aggregate long positions at 48.92% versus 51.08% short. This daily crypto analysis examines the implications for price action and market structure.

Futures long/short ratios serve as a leading indicator for institutional positioning. Historical data from Glassnode shows ratios below 50% long often precede consolidation phases. The current environment mirrors patterns observed during the 2024 Q2 correction when similar positioning preceded a 15% drawdown. Market structure suggests this data must be contextualized within broader macro conditions, including Federal Reserve policy and ETF flows.

Related developments include US Bitcoin ETFs recording significant outflows and Ethereum ETFs facing similar pressure, indicating cross-asset institutional caution.

According to exchange data from Binance, OKX, and Bybit, the 24-hour Bitcoin perpetual futures long/short ratios show consistent bearish bias. Binance reports 49.13% long versus 50.87% short. OKX shows 47.48% long against 52.52% short. Bybit displays 48.98% long compared to 51.02% short. These figures represent aggregate open interest across the three largest futures platforms by volume.

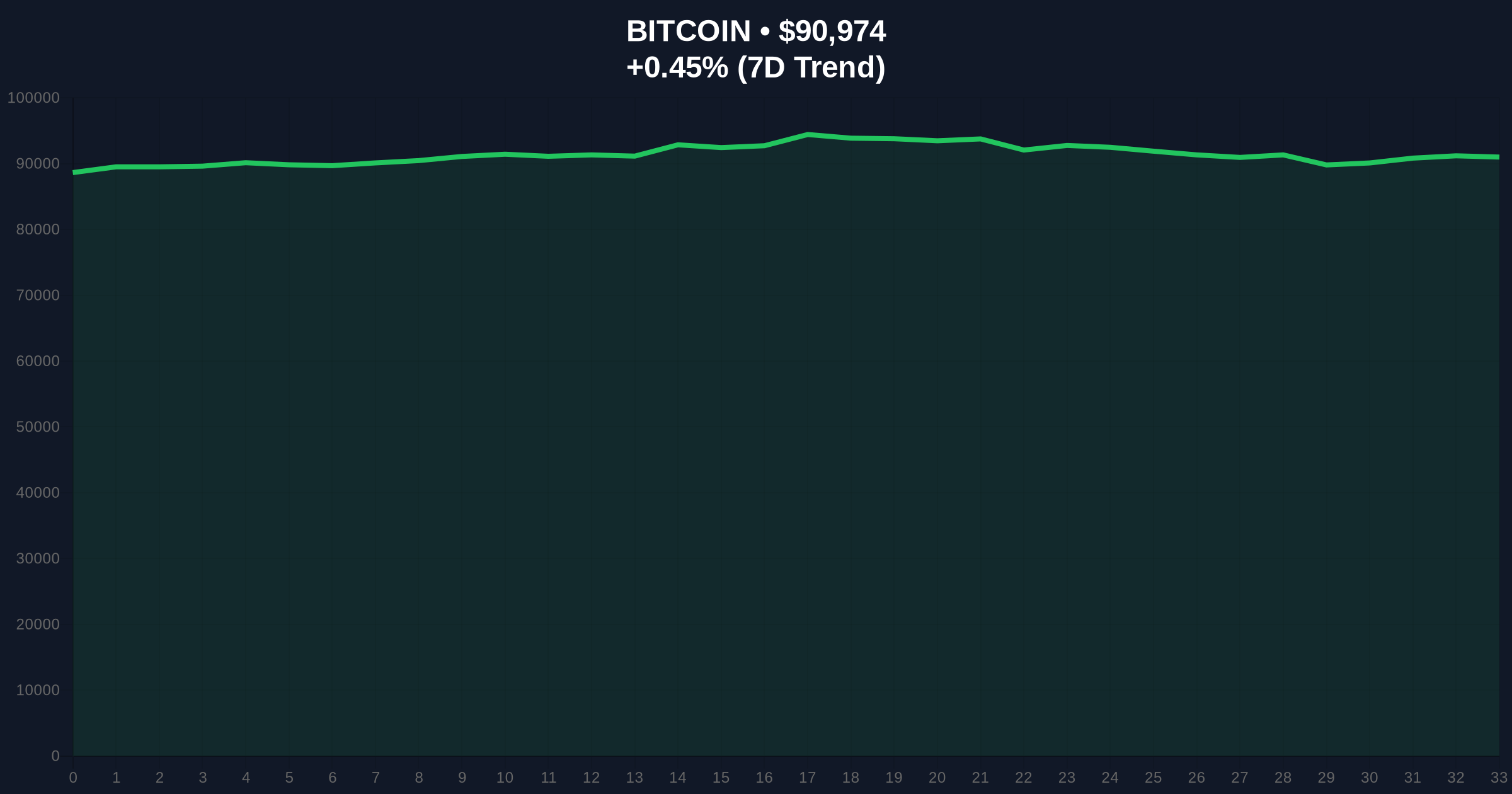

Bitcoin currently trades at $90,980, up 0.30% in 24 hours. The price sits above the 50-day exponential moving average at $89,200 but faces resistance at the $92,500 order block. Volume profile analysis indicates weak accumulation near current levels. The RSI at 54 suggests neutral momentum, but futures data points to underlying weakness.

Bullish invalidation level: $88,500. A break below this Fibonacci support would negate the current uptrend structure. Bearish invalidation level: $93,200. A sustained move above this resistance would signal a liquidity grab and potential short squeeze.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) |

| Bitcoin Current Price | $90,980 |

| 24-Hour Change | +0.30% |

| Aggregate Futures Long/Short | 48.92% / 51.08% |

| Market Rank | #1 |

For institutions, this data suggests hedging activity and potential gamma squeeze setups. According to the Commodity Futures Trading Commission (CFTC) historical reports, similar positioning has preceded volatility expansions. For retail traders, the bearish bias indicates crowded shorts that could fuel sharp reversals if triggered. The divergence between spot price stability and futures pessimism creates a Fair Value Gap that may resolve through price movement.

Market analysts on X highlight the technical significance. One quant trader noted, "OKX's 52.52% short ratio is the highest among majors—watch for liquidation cascades if price breaks $93k." Bulls point to Bitcoin's resilience above $90,000 despite negative futures data, suggesting spot market strength.

Bullish Case: If Bitcoin holds the $88,500 support and breaks $93,200, a short squeeze could propel prices toward $96,000. This scenario requires ETF inflows to reverse, as detailed in South Korea's institutionalization plans potentially boosting demand.

Bearish Case: Failure to hold $88,500 could trigger a liquidation cascade toward the $85,000 volume node. Persistent futures shorting and ETF outflows, as seen in broader market caution despite venture funding, would amplify downside risk.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.