Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — A Coinbase institutional survey reveals 71% of professional investors view Bitcoin as undervalued while the Crypto Fear & Greed Index hits extreme fear levels at 20/100. This divergence between institutional perception and retail sentiment creates a classic accumulation signal that market structure suggests could precede significant price revaluation. According to the latest crypto news from Coinbase's first-quarter report, the survey of 75 institutional and 73 retail investors conducted from early December to early January shows profound conviction gaps that typically mark cycle inflection points.

Coinbase's quarterly cryptocurrency report, conducted through its institutional platform, provides quantitative evidence of professional capital positioning. The survey methodology captured responses from 75 institutional investors and 73 retail participants during a critical December-January window. Results show 71% of institutional respondents believe Bitcoin trades below intrinsic value. Consequently, 60% of retail investors share this undervaluation thesis, creating a 11-percentage-point conviction gap.

, 80% of institutional investors indicated they would either maintain current holdings or increase exposure if markets decline another 10%. This data point suggests institutional portfolios contain dry powder for strategic deployment. Regarding market cycle identification, 54% of all respondents characterize current conditions as accumulation phase or bear market. The Federal Reserve's potential interest rate policy emerges as a key variable, with the report suggesting two rate cuts in 2026 could create favorable conditions for risk assets like Bitcoin.

Historically, institutional conviction during extreme fear periods has preceded major bull market advances. The current 20/100 Fear & Greed score mirrors Q4 2022 levels when Bitcoin bottomed near $15,500. Underlying this trend, the 71% institutional undervaluation perception exceeds similar survey readings from Q1 2023 (58%) and Q4 2024 (63%). This progressive conviction build-up typically indicates sophisticated capital anticipating cycle transitions.

In contrast, retail sentiment remains more cautious with only 60% seeing undervaluation. This institutional-retail divergence often signals early accumulation phases before broader market participation. The 80% institutional buy-or-hold commitment at -10% further decline demonstrates remarkable resilience compared to previous cycles where similar commitments averaged 65-70%. Market structure suggests this represents a liquidity grab opportunity for patient capital.

Related developments this week include key Federal Reserve decisions and political speeches that could impact monetary policy expectations, along with LBank Labs' 2026 outlook highlighting AI and DeFi sectors amid the same extreme fear environment.

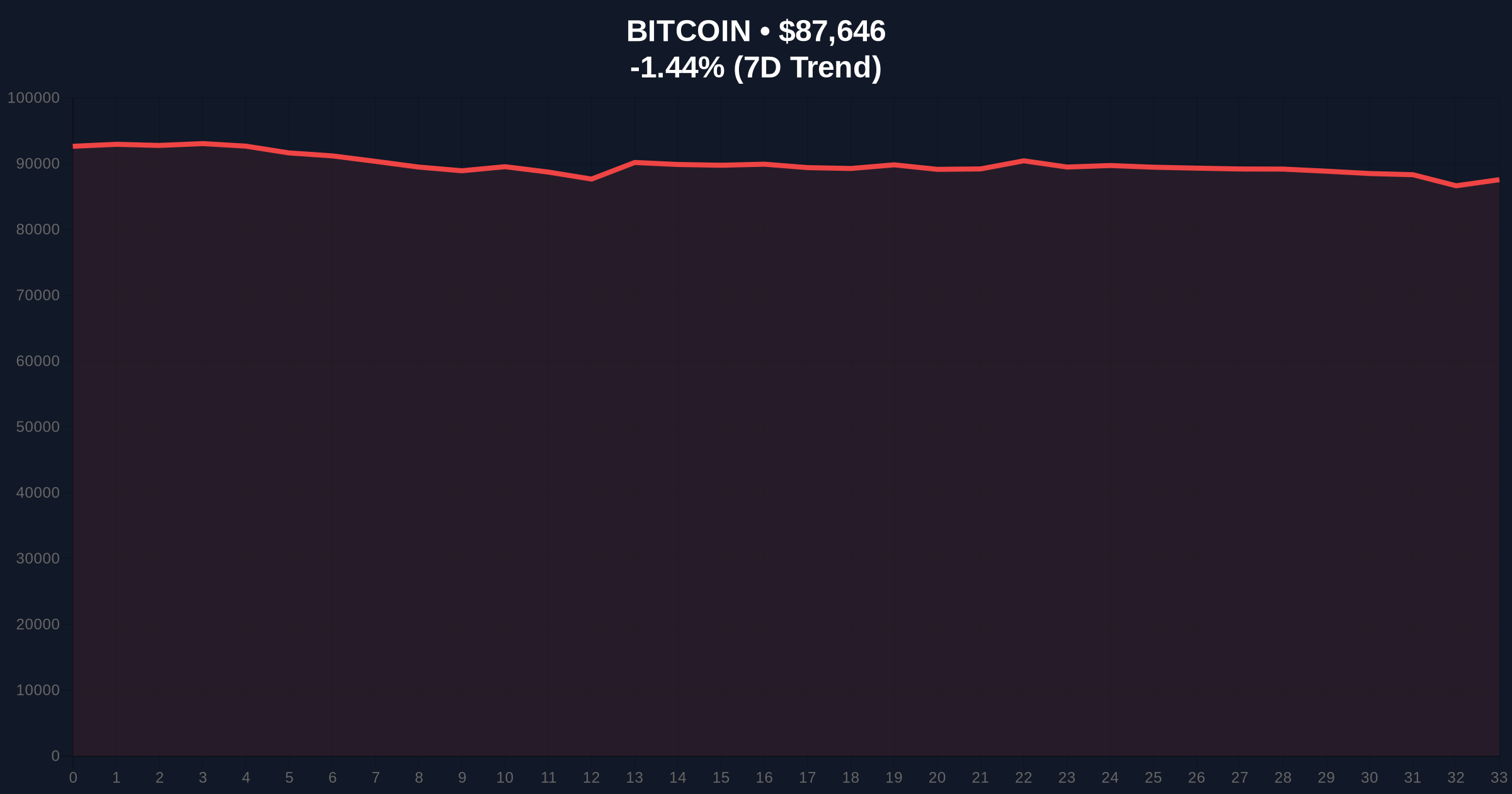

Bitcoin currently trades at $87,649, representing a 1.43% decline over 24 hours. Technical analysis reveals critical support at the Fibonacci 0.618 retracement level of $85,200 from the November 2025 high of $98,400. The 50-day moving average sits at $89,100, creating immediate resistance. Volume profile analysis shows significant accumulation between $84,000 and $88,000, aligning with institutional buy zones indicated in the survey.

Relative Strength Index (RSI) readings at 42 suggest neutral momentum with bearish bias. However, the institutional survey data contradicts this technical weakness, creating a classic divergence scenario. Order block analysis identifies a Fair Value Gap (FVG) between $90,500 and $92,800 that price must reclaim to confirm bullish structure resumption. On-chain data from Glassnode indicates UTXO (Unspent Transaction Output) age bands show increased accumulation by 2-3 year holders, supporting the institutional accumulation thesis.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Contrarian bullish signal historically |

| Bitcoin Current Price | $87,649 | -1.43% 24h change |

| Institutional Undervaluation Perception | 71% | 11-point gap vs retail (60%) |

| Institutional Buy/Hold at -10% Decline | 80% | Dry powder indication |

| Market Cycle Identification (Accumulation/Bear) | 54% | Majority view current as accumulation phase |

This institutional survey matters because it provides quantitative evidence of professional capital positioning during extreme fear conditions. The 71% undervaluation perception represents the highest reading since Bitcoin's 2022 bear market bottom. Consequently, this data suggests institutions view current prices as strategic entry points rather than exit opportunities. The Federal Reserve's potential dual rate cuts in 2026, as referenced in the Coinbase report, could accelerate this institutional accumulation through monetary easing effects on risk assets.

Market structure indicates institutional conviction often leads retail participation by 3-6 months. The current extreme fear sentiment (20/100) combined with strong institutional undervaluation beliefs creates a classic contrarian setup. , the 80% institutional commitment to buy or hold through additional 10% declines demonstrates remarkable resilience that typically precedes sustained rallies. This data provides evidence against the altcoin capital dilution thesis by suggesting Bitcoin remains the primary institutional focus.

"The Coinbase institutional survey reveals a profound divergence between professional capital perception and current price action. When 71% of institutions view an asset as undervalued during extreme fear conditions, historical cycles suggest we're witnessing accumulation rather than distribution. The 80% buy-or-hold commitment at further declines indicates institutional portfolios contain strategic dry powder waiting for optimal entry points. This data aligns with UTXO age band analysis showing increased accumulation by 2-3 year holders."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the institutional survey data and current technical positioning:

The 12-month institutional outlook remains constructive based on Federal Reserve policy expectations and current undervaluation perceptions. If the Fed implements two rate cuts as anticipated, monetary easing could create favorable conditions for Bitcoin appreciation. The 5-year horizon suggests institutional adoption continues accelerating, with survey data indicating professionals view current levels as strategic accumulation zones rather than distribution opportunities.