Loading News...

Loading News...

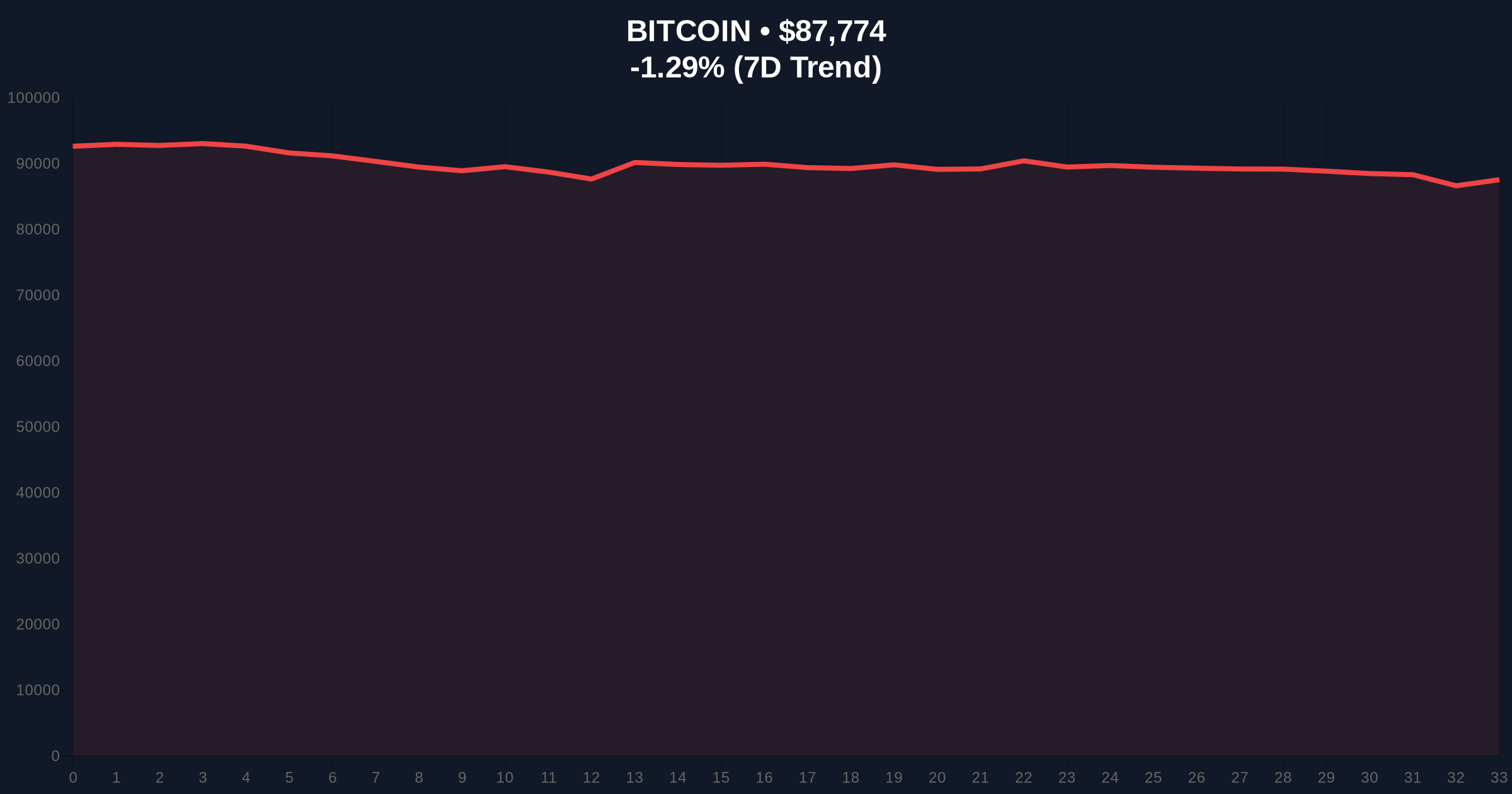

VADODARA, January 26, 2026 — Bitcoin price action breaks below $88,000. This latest crypto news reveals a direct correlation to US political instability. According to The Block analysis, a potential federal government shutdown drives the sell-off. Market participants price in a 75% probability of shutdown on prediction markets.

Rick Maeda of Presto Research identifies the catalyst. He states the BTC decline stems from macroeconomic factors. Specifically, US political uncertainty drives the move. Not crypto-specific issues. The US Congress faces a budget deadlock. Political conflict escalates. Consequently, shutdown chances increase sharply.

Vincent Liu, CIO at Kronos Research, confirms market pricing. He notes the market incorporates this political risk. Polymarket data shows probability rising to 75%. This creates a classic risk-off environment. Bitcoin and other risk assets face immediate pressure.

CoinMarketCap data confirms the price action. BTC trades at $87,781. That marks a 1.25% decline from the previous day. The move reflects broader asset class behavior. Traditional equities and commodities show similar weakness.

Historically, US government shutdowns create volatility. The 2013 and 2018-2019 events saw Bitcoin correlation spikes. In contrast, the 2021 cycle decoupled during fiscal debates. Underlying this trend is liquidity flow. Federal budget impasses often precede Treasury General Account drawdowns. This impacts dollar liquidity.

Market structure suggests a repeat pattern. Risk assets sell off first. Safe-haven flows into US Treasuries follow. Bitcoin's role as a risk-on proxy remains intact. The upcoming key financial events this week amplify uncertainty. Fed decisions and political speeches will shape near-term direction.

, extreme fear dominates sentiment. The Crypto Fear & Greed Index hits 20/100. This aligns with broader market reports highlighting defensive positioning. For instance, the LBank Labs 2026 Crypto Outlook Report notes AI and DeFi sectors face pressure amid similar conditions.

Technical analysis reveals critical levels. The current price sits near the daily 50 EMA. A break below $87,000 opens a Fair Value Gap (FVG) down to $85,000. This $85,000 level represents the Fibonacci 0.618 retracement from the recent swing high. It acts as major support.

Volume Profile shows weak buying interest. The Point of Control (POC) shifts lower. RSI on the 4-hour chart prints 38. That indicates neutral momentum with bearish bias. The 200-day moving average holds at $82,500. This serves as long-term structural support.

On-chain metrics from Glassnode add context. Exchange net flows turn negative. Short-term holders realize losses. UTXO age bands show younger coins moving. This suggests panic selling from recent entrants. The technical setup mirrors past liquidity crises, like those noted in the Entropy shutdown report on startup liquidity.

| Metric | Value | Insight |

|---|---|---|

| Bitcoin Current Price | $87,778 | Down 1.29% in 24h |

| 24-Hour Trend | -1.29% | Consistent risk-off move |

| Market Rank | #1 | Dominance holds at ~52% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Lowest sentiment since Q4 2025 |

| US Shutdown Probability (Polymarket) | 75% | Market pricing high political risk |

This event tests Bitcoin's macro narrative. Institutional adoption faces a liquidity test. A government shutdown disrupts Treasury operations. It may delay ETF approvals or regulatory clarity. According to the Federal Reserve's financial stability reports, such events strain dollar funding markets.

Retail market structure shows fragility. Many altcoins face amplified selling. The altcoin bull run unlikely in 2026 thesis gains traction. Capital dilution and FDV pressure mount during risk-off cycles. Consequently, Bitcoin dominance may rise as capital rotates to quality.

"The market is repricing risk premiums. Political uncertainty creates a vacuum for safe-haven flows. Bitcoin's correlation to traditional risk assets remains elevated. A break below $85k would signal a deeper correction." – CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, a relief rally if political deadlock eases. Second, continued downside if shutdown occurs. The 12-month outlook hinges on fiscal resolution and Fed policy.

Institutional outlook for the next 5 years remains constructive. Short-term volatility does not alter long-term adoption trends. However, regulatory delays could slow institutional inflows. Market participants should monitor Treasury General Account levels on FederalReserve.gov for liquidity signals.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.