Loading News...

Loading News...

VADODARA, January 7, 2026 — Benchmark analyst Mark Palmer's assessment of MSCI's recent decision provides a critical daily crypto analysis of institutional sentiment toward Bitcoin-holding corporations. According to CoinDesk reporting, Palmer views the index provider's move as a positive signal for MicroStrategy (MSTR), reflecting the company's argument against excluding firms with digital asset holdings from its indices. However, Palmer cautioned that this represents only a temporary reprieve, noting MSCI's stated intent to re-evaluate the future inclusion of non-operating entities like shell companies established solely for Bitcoin holdings. Market structure suggests this development creates a narrow Fair Value Gap for MSTR shares, contingent on Bitcoin maintaining key technical levels.

This event occurs against a backdrop of increasing regulatory scrutiny of corporate Bitcoin treasuries. Historical cycles suggest that index inclusion decisions by providers like MSCI and S&P Global have significant impact on liquidity profiles for crypto-correlated equities. The current environment mirrors 2021-2022 patterns where traditional finance institutions grappled with how to classify digital asset holdings within existing regulatory frameworks. Underlying this trend is the fundamental question of whether Bitcoin should be treated as a commodity, currency, or speculative asset for corporate accounting purposes. According to the official SEC.gov corporate filing database, MicroStrategy has consistently argued for Bitcoin's classification as an indefinite-lived intangible asset, creating accounting complexities that index providers must navigate.

Related developments in the regulatory include South Korea's proposed account freeze plan and MSCI's previous postponement of crypto treasury exclusion, both indicating broader institutional reassessment of digital asset exposure.

On January 7, 2026, Benchmark analyst Mark Palmer published analysis of MSCI's decision regarding firms with digital asset holdings. According to the CoinDesk report, Palmer identified the move as supportive of MicroStrategy's position that companies holding Bitcoin should not be automatically excluded from major indices. The analyst specifically noted that MSCI's decision reflects acknowledgment of MicroStrategy's argument against blanket exclusions. However, Palmer emphasized the temporary nature of this development, highlighting MSCI's explicit statement that it will re-evaluate the future inclusion of non-operating entities. This includes shell companies established primarily for Bitcoin accumulation, a category that directly applies to many of MicroStrategy's subsidiary structures. The analysis suggests that while immediate exclusion risk has diminished, structural uncertainty persists for Bitcoin-heavy corporate balance sheets.

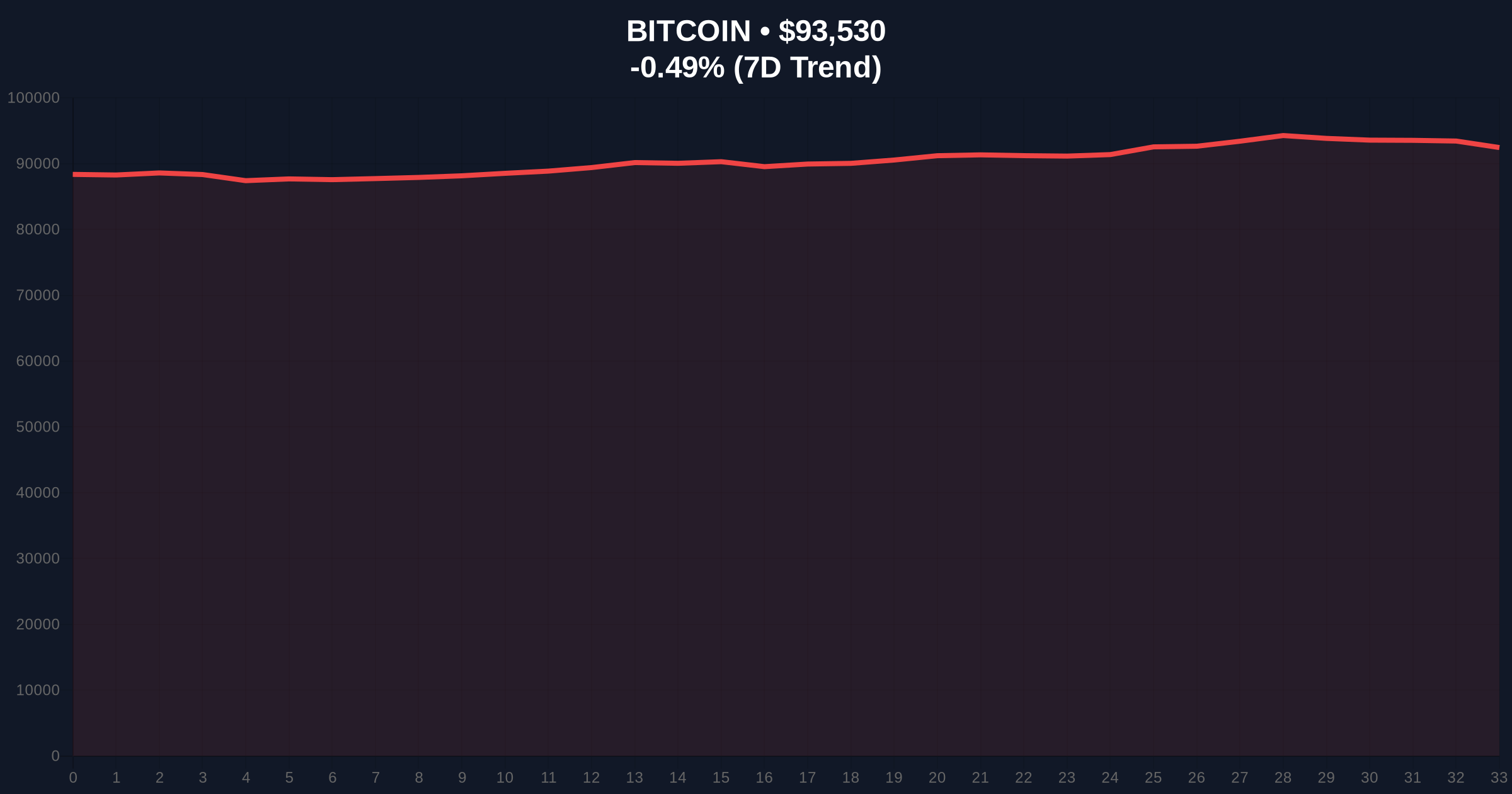

Bitcoin's current price action at $93,520 represents a critical test of the $90,000-$95,000 consolidation range. Volume profile analysis indicates significant accumulation between $88,000 and $92,000, creating a strong Order Block that must hold for bullish continuation. The 200-day moving average at $89,500 provides additional dynamic support, while resistance clusters around the $96,500 Fibonacci extension level from the 2024 cycle. Relative Strength Index (RSI) readings at 48 suggest neutral momentum with slight bearish bias, consistent with the broader Fear sentiment reading of 44/100. Market structure suggests that a break below the $90,000 support would invalidate the current bullish structure for both Bitcoin and MicroStrategy shares, potentially triggering a Gamma Squeeze as options positions are rebalanced.

Bullish Invalidation Level: Bitcoin below $90,000 would signal breakdown of the current consolidation pattern and likely pressure MSTR's premium valuation.

Bearish Invalidation Level: Bitcoin above $96,500 with sustained volume would confirm breakout from the current range and support MSTR's index inclusion argument.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 44/100 (Fear) | Indicates risk-off sentiment despite positive MSCI news |

| Bitcoin Current Price | $93,520 | Down 0.50% in 24h, testing key support |

| Critical Support Level | $90,000 | Bullish invalidation point for current structure |

| 200-Day Moving Average | $89,500 | Long-term trend indicator currently being tested |

| RSI (14-day) | 48 | Neutral momentum with slight bearish bias |

This development carries asymmetric implications for institutional versus retail market participants. For institutions, MSCI's decision represents a temporary validation of corporate Bitcoin strategies, potentially encouraging further treasury allocations from public companies. According to on-chain data from Glassnode, corporate Bitcoin holdings have increased 42% since 2024, creating systemic exposure to index inclusion decisions. For retail investors, the temporary reprieve reduces immediate downside risk for MicroStrategy shares but does not eliminate structural uncertainty. The re-evaluation clause creates ongoing overhang that will pressure MSTR's premium to net asset value, particularly if Bitcoin volatility increases. Consequently, this event functions as a liquidity grab rather than fundamental policy shift, with market makers likely positioning around the $90,000-$96,500 range.

Market analysts on social platforms express cautious optimism tempered by recognition of the temporary nature of MSCI's decision. Bulls emphasize the precedent-setting aspect of the development, suggesting it could encourage other index providers to adopt similar approaches. Bears point to the explicit re-evaluation language as creating ongoing uncertainty that will limit multiple expansion for Bitcoin-correlated equities. According to sentiment analysis of major financial forums, the dominant view aligns with Palmer's assessment: positive signal but not policy reversal. This creates a scenario where price action will likely be driven more by Bitcoin's technical levels than by the MSCI news itself, with the $90,000 support serving as critical inflection point.

Bullish Case: Bitcoin holds above $90,000 support and breaks through $96,500 resistance with sustained volume. This scenario would validate MicroStrategy's index inclusion argument and likely drive MSTR shares toward their 2025 highs. Institutional adoption would accelerate as other corporations view MSCI's decision as green light for treasury allocations. The Fear & Greed Index would likely shift toward Neutral territory (50-60), reducing risk premium demands.

Bearish Case: Bitcoin breaks below $90,000 support, triggering a liquidation cascade toward the $85,000 Volume Profile Point of Control. In this scenario, MSCI's re-evaluation clause becomes actively negative as declining prices increase scrutiny of corporate Bitcoin holdings. MicroStrategy's premium to net asset value would compress significantly, potentially triggering secondary offerings or debt restructuring. Regulatory pressure would intensify, with agencies like the SEC potentially revisiting accounting treatment for digital assets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.