Loading News...

Loading News...

VADODARA, January 29, 2026 — The U.S. Federal Open Market Committee (FOMC) meetings serve primarily as catalysts for clearing over-leveraged market positions rather than determining Bitcoin's medium-term direction, according to a new analysis. This daily crypto analysis reveals that historical data shows FOMC events trigger sharp short-term price swings but rarely set lasting trends. Market structure suggests the current focus should shift to leverage reduction and liquidity recovery.

XWIN Research Japan, a contributor to CryptoQuant, provided the analysis. According to their research, FOMC meetings consistently draw significant attention from the crypto market. Historical data indicates they rarely decide Bitcoin's medium-term trend. Instead, they typically act as triggers for market repositioning. For instance, when interest rates were held steady last year, Bitcoin showed no clear directional movement. Conversely, rate cuts between September and December led to price declines of 6% to 8%. This phenomenon stemmed from pre-existing expectations turning into liquidations post-announcement.

The research further explains that ahead of a meeting, the market often enters a period of temporary stability. During this phase, leverage and open interest rise while liquidity and volatility fall. However, if no clear catalyst emerges post-meeting, position clearing begins in earnest. This process causes sharp short-term price swings. Profit-taking accelerates rapidly in the event of a rate cut. The core argument is that the FOMC exposes and helps resolve over-leveraged positions rather than setting Bitcoin's trajectory.

Historically, Bitcoin has demonstrated resilience to macroeconomic policy shifts when underlying on-chain fundamentals remain strong. In contrast, the 2021 cycle saw similar leverage-driven volatility around Fed announcements, but long-term trends were dictated by adoption metrics like active addresses and hash rate. Underlying this trend is Bitcoin's evolving correlation with traditional markets, which has decreased post-2023 as institutional custody solutions matured.

Consequently, the analysis concludes that key variables for Bitcoin's direction over the next 30 days will not be political rhetoric. Instead, leverage reduction, easing selling pressure, and liquidity recovery will dominate. This aligns with broader market patterns where post-FOMC volatility often creates Fair Value Gaps (FVGs) that algorithmic traders exploit for short-term gains.

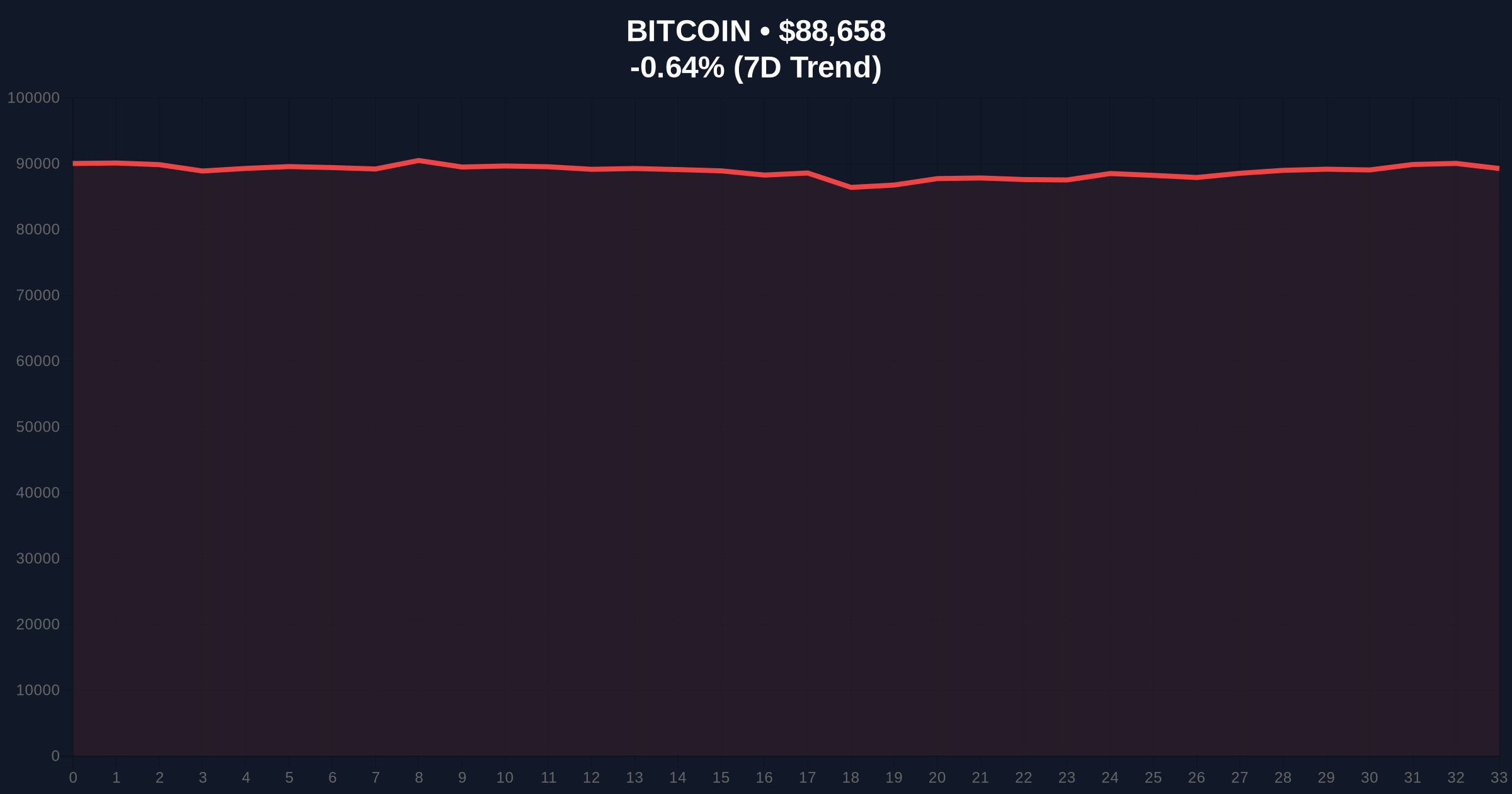

Market structure suggests Bitcoin's current price action around $88,726 reflects this leverage-clearing dynamic. Technical indicators show the 50-day moving average at $86,500 acting as immediate support, while resistance consolidates near the $92,000 Fibonacci 0.618 retracement level from the 2025 high. On-chain data from Glassnode indicates a surge in short-term holder supply, signaling potential distribution pressure. , the Relative Strength Index (RSI) sits at 45, indicating neutral momentum with a slight bearish bias.

This technical setup mirrors past FOMC events where volatility compression preceded explosive moves. For example, the order block between $87,000 and $88,000 now acts as a critical liquidity zone. A breakdown below this level could trigger cascading liquidations, similar to the 6-8% declines observed in late 2025. The Federal Reserve's official FOMC calendar shows upcoming meetings, which market participants will monitor for further leverage adjustments.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Current Price | $88,726 | Testing key support zone |

| 24-Hour Trend | -0.57% | Minor bearish pressure |

| Crypto Fear & Greed Index | 26/100 (Fear) | High anxiety, potential for sharp moves |

| Market Rank | #1 | Dominance intact amid volatility |

| Post-FOMC Decline (Sep-Dec 2025) | 6-8% | Historical leverage-clearing precedent |

This analysis matters because it shifts focus from macroeconomic noise to on-chain health. Institutional liquidity cycles now prioritize leverage metrics over Fed rhetoric. Retail market structure often misinterprets FOMC events as directional signals, leading to misplaced entries. Real-world evidence shows that during the 2025 rate cuts, Bitcoin's price fell due to liquidations, not fundamental policy shifts. Consequently, traders who monitor funding rates and open interest avoid false breakouts.

, the easing of selling pressure and recovery of liquidity are critical for sustainable rallies. Market analysts note that when leverage unwinds, it creates cleaner price discovery. This process reduces systemic risk from over-extended positions. In the current environment, with fear gripping markets, understanding this dynamic prevents reactive trading. Historical cycles suggest that post-leverage-clearing phases often precede strong upward moves as healthier capital enters.

"FOMC meetings act as pressure valves for crypto leverage. They don't dictate Bitcoin's path but expose weak hands. Our data shows that medium-term trends are driven by adoption flows, not Fed statements. The key is monitoring liquidation clusters and liquidity maps post-announcement." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, a bullish scenario where leverage reduction completes without breaking critical support. Second, a bearish scenario where prolonged selling pressure erodes liquidity further. Technical analysis indicates the following invalidation levels:

The 12-month institutional outlook remains cautiously optimistic. Bitcoin's trajectory over the next five years will likely hinge more on technological upgrades like Taproot adoption and layer-2 scaling than Fed policy. However, short-term volatility around FOMC events will persist as a leverage-clearing mechanism. Consequently, strategic positioning should focus on long-term holder accumulation patterns rather than reactionary trades.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.