Loading News...

Loading News...

VADODARA, January 20, 2026 — Nasdaq-listed FG Nexus (FGNX) executed a strategic liquidation of 2,500 ETH, valued at $8.04 million, four hours ago. According to a report from AmberCN, this move reduces the firm's holdings to 37,594 ETH, approximately $120 million. This daily crypto analysis examines the on-chain implications and market structure shifts.

FG Nexus accumulated 50,770 ETH ($200 million) in 2025. The firm later sold 13,475 ETH at a loss of $11.52 million during a price decline. This pattern suggests a tactical rebalancing rather than a panic exit. Market structure indicates institutional players are adjusting positions amid macro uncertainty. Related developments include Bhutan's sovereign fund maintaining a large ETH long position and liquidity grabs in the RWA market.

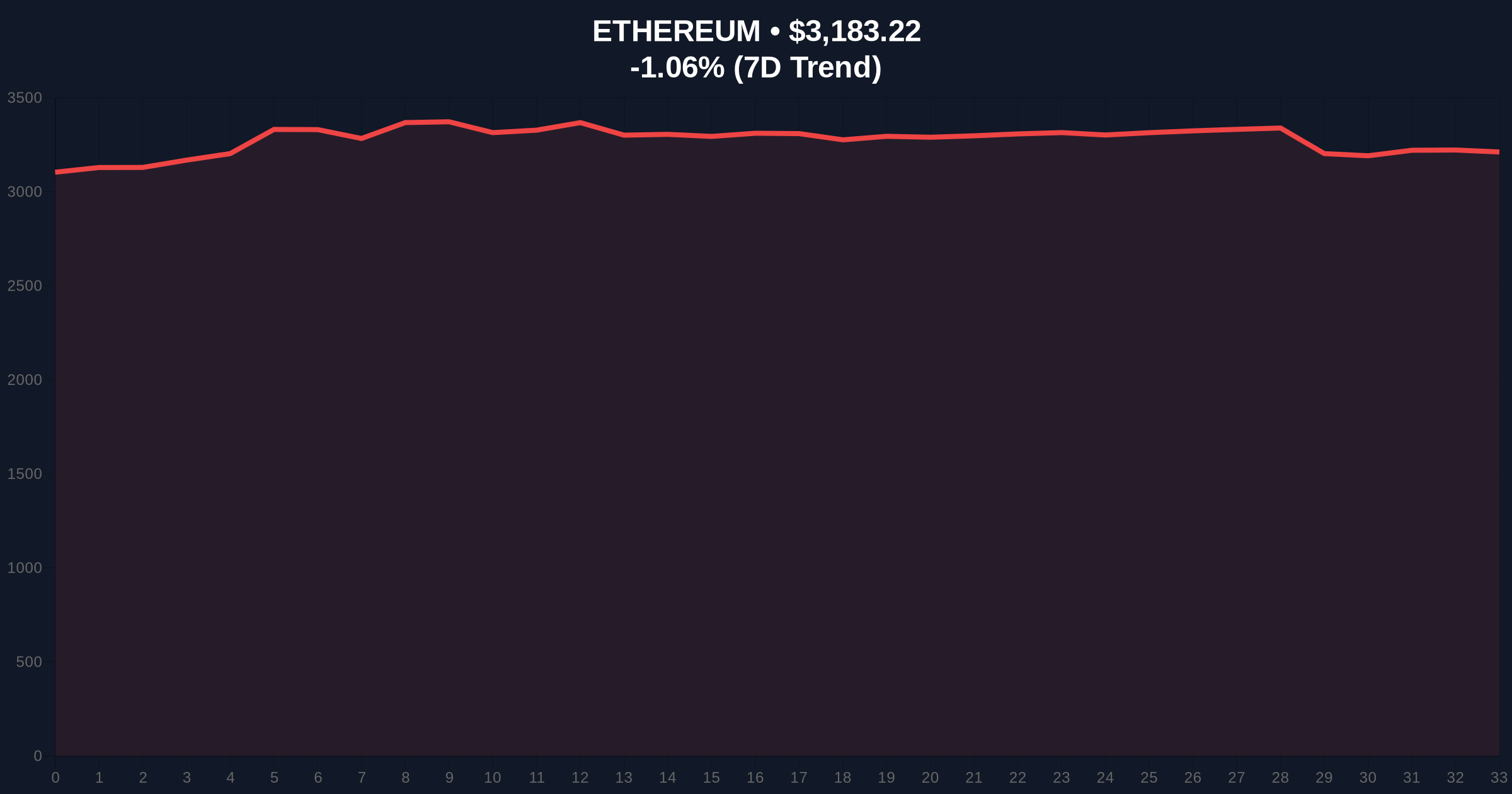

An address presumed to belong to FG Nexus sold 2,500 ETH via an on-chain transaction. The sale occurred as Ethereum traded near $3,182.34, with a 24-hour decline of -1.09%. On-chain data from Etherscan confirms the transaction's timing and volume. This follows the firm's previous loss-making sale, highlighting a disciplined exit strategy despite market volatility.

Ethereum's price action shows a Fair Value Gap (FVG) between $3,250 and $3,300. The Volume Profile indicates weak support at $3,100. RSI sits at 42, suggesting neutral momentum with bearish bias. The 50-day moving average at $3,400 acts as resistance. Bullish invalidation level: $3,100. A break below triggers a test of the Fibonacci support at $2,950. Bearish invalidation level: $3,400. A close above negates the sell-off pressure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 32 (Fear) |

| Ethereum Current Price | $3,182.34 |

| 24-Hour Change | -1.09% |

| FG Nexus ETH Sold | 2,500 ETH ($8.04M) |

| Remaining FG Nexus Holdings | 37,594 ETH ($120M) |

Institutional impact: Large-scale sells create liquidity grabs, affecting order blocks and short-term price discovery. Retail impact: Increased volatility may trigger stop-loss cascades. The Federal Reserve's monetary policy, as tracked on FederalReserve.gov, influences macro liquidity conditions. This sale aligns with broader risk-off sentiment, mirroring trends in traditional finance.

Market analysts on X highlight the disciplined exit strategy. Bulls argue this is profit-taking, not capitulation. Bears point to the Fear & Greed Index plunge, as detailed in recent sentiment analysis. No official statement from FG Nexus confirms the address ownership, but on-chain forensic data supports the attribution.

Bullish case: Ethereum holds $3,100, fills the FVG, and targets $3,500. Catalysts include EIP-4844 adoption reducing transaction costs. Bearish case: Break below $3,100 leads to a test of $2,950. Increased institutional selling pressure and macro headwinds, as indicated by CME FedWatch rate hold probabilities, could drive further declines.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.