Loading News...

Loading News...

VADODARA, January 20, 2026 — Addresses linked to Bhutan's sovereign investment arm, Druk Holdings, have established a $459 million leveraged long position in Ethereum. On-chain data indicates a complex accumulation strategy executed via Aave. This move occurs as the Crypto Fear & Greed Index plunges to 32, signaling extreme fear. Daily crypto analysis reveals institutional players are positioning against retail sentiment.

Global risk assets face a liquidity grab. The U.S. 10-Year Treasury Yield sits at 4.259%, pressuring speculative capital. According to the CME FedWatch Tool, there is a 95% probability the Federal Reserve holds rates steady. This creates a high-rate environment unfavorable for growth assets. Sovereign wealth funds typically operate with multi-decade horizons. Their entry into crypto lending protocols like Aave marks a maturation phase for decentralized finance. Historical cycles suggest such accumulation during fear periods often precedes medium-term rallies.

According to on-chain analyst Emmett Gallic, an address associated with Druk Holdings executed a series of transactions. It withdrew 42,000 ETH and 54 million USDT from Binance. The address then swapped the USDT for ETH and deposited the combined assets into Aave. Using the deposited ETH as collateral, it borrowed $275 million in USDT. Those funds were used to purchase additional Ethereum. The net result is a long position of 117,000 ETH, valued at approximately $459 million at current prices. The official Ethereum documentation on staking and DeFi outlines the mechanics behind such leveraged strategies.

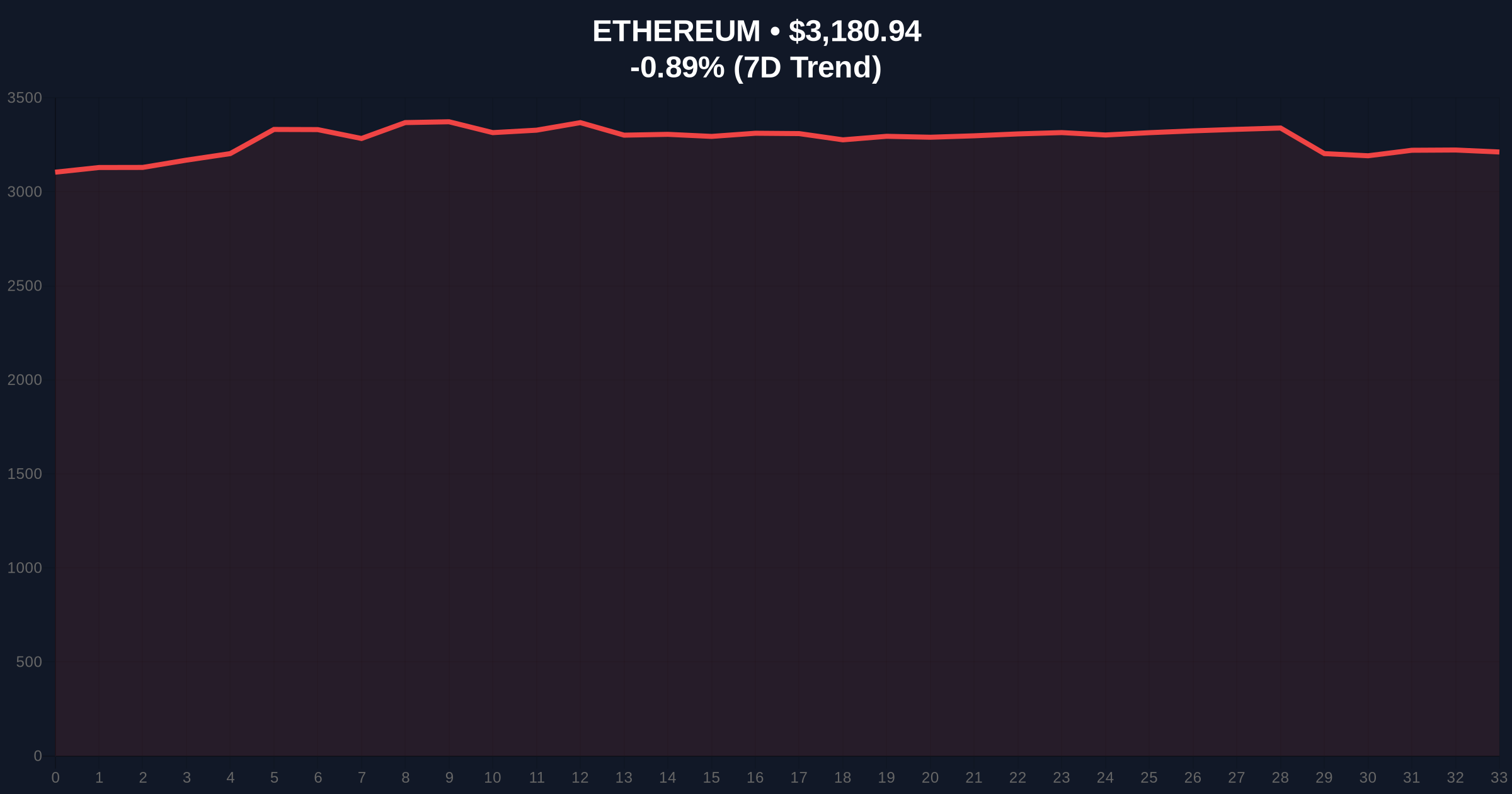

Ethereum currently trades at $3,180.94, down 0.89% in 24 hours. The weekly chart shows a clear Fair Value Gap (FVG) between $3,450 and $3,600. This zone acts as a major supply area. The 200-day moving average provides dynamic support near $3,050. The Relative Strength Index (RSI) on the daily timeframe reads 42, indicating neutral momentum with a bearish tilt. Volume profile analysis shows high node concentration at $3,000, establishing it as a critical support. Bullish Invalidation Level: A daily close below $2,950 would invalidate the current structure and target the $2,750 order block. Bearish Invalidation Level: A sustained break above the $3,450 FVG would signal a shift in market structure, targeting $3,800.

| Metric | Value |

|---|---|

| Druk Holdings ETH Position | 117,000 ETH |

| Position Value (USD) | $459 million |

| USDT Borrowed on Aave | $275 million |

| Current ETH Price | $3,180.94 |

| 24-Hour Price Change | -0.89% |

| Crypto Fear & Greed Index | 32 (Fear) |

Institutional impact is profound. A sovereign fund using DeFi protocols for leveraged longs validates the infrastructure. It signals a shift from passive ETF holdings to active on-chain strategies. For retail, this creates a potential gamma squeeze scenario if price approaches key options levels. The move contrasts sharply with the broader fearful sentiment, suggesting a divergence between smart money and crowd psychology. Market structure suggests this could anchor liquidity and reduce volatility in the $3,000-$3,500 range.

Market analysts on X are divided. Bulls highlight the strategic accumulation as a bullish signal for Ethereum's long-term value proposition, especially with the upcoming Pectra upgrade. Bears point to the leveraged nature of the position, warning of potential liquidations if ETH price declines sharply. The overarching narrative focuses on institutional adoption versus macroeconomic headwinds.

Bullish Case: If ETH holds the $3,000 support and breaks the $3,450 FVG, the next target is the $3,800 resistance zone. On-chain data indicates strong accumulation, which could fuel a move to test the yearly high near $4,200. The sovereign fund's position acts as a liquidity floor.

Bearish Case: Failure to hold $3,000 triggers a liquidation cascade on leveraged positions. This could see a rapid decline to fill the $2,750 order block. A break below that level opens the path to $2,500. Macro conditions, including sustained high Treasury yields, would accelerate this scenario.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.