Loading News...

Loading News...

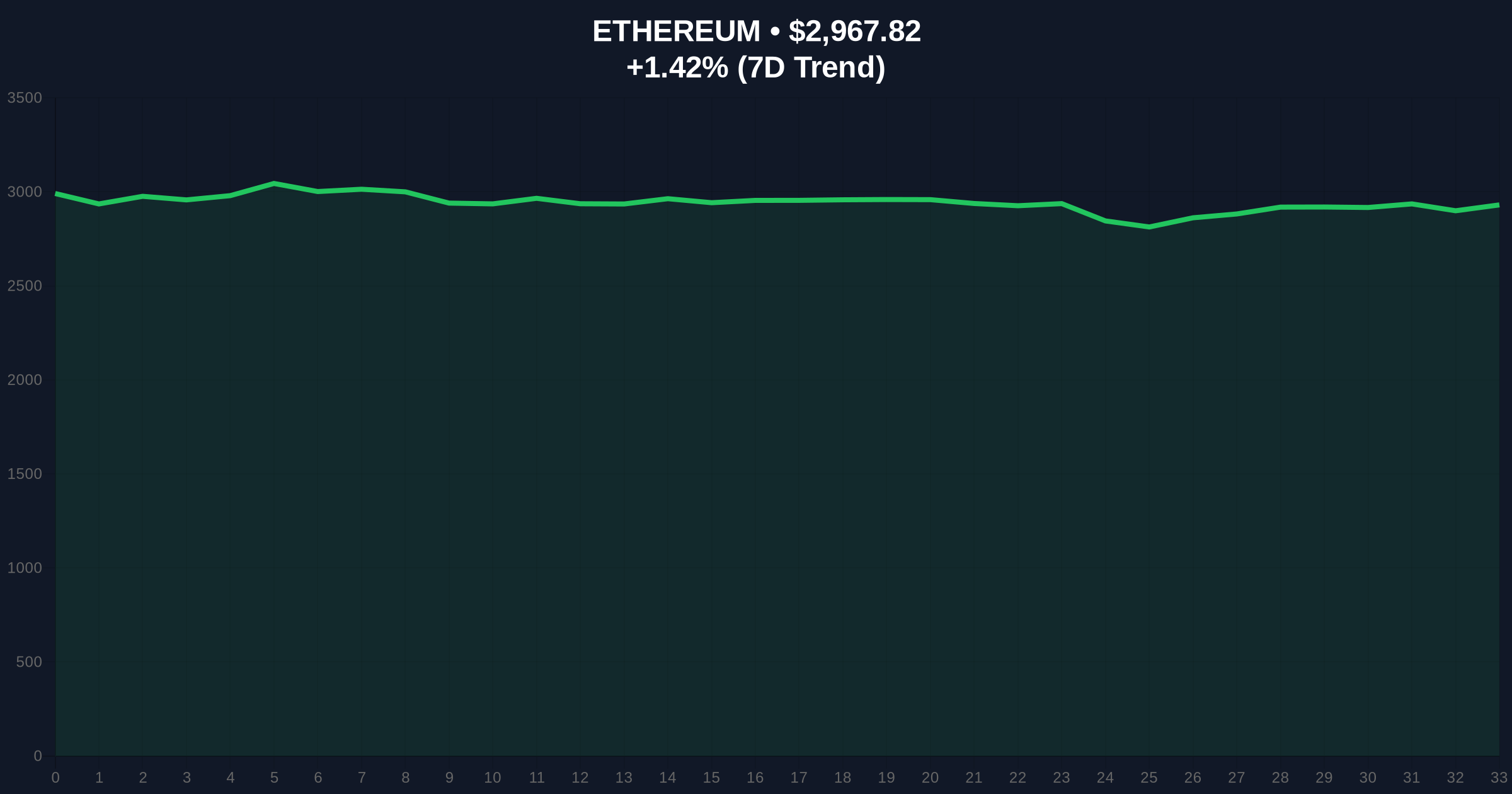

VADODARA, January 27, 2026 — Ethereum's on-chain metrics are flashing bullish divergence signals despite a 15% weekly price decline, according to a Cointelegraph analysis. This daily crypto analysis reveals that network fees and Layer 2 activity have increased while the broader crypto market remains in a downturn. Market structure suggests a potential rebound to $3,300 if key support holds.

According to on-chain data from Glassnode and Etherscan, Ethereum's price dropped approximately 15% over the past week. In contrast, network fees and Layer 2 transaction volumes have risen significantly. Trading volume on decentralized exchanges (DEXs) also increased during this period. Multiple analysts attribute this ecosystem growth to the late-2024 Pectra upgrade, which improved data processing capacity and lowered fees. Consequently, the derivatives market shows easing fear sentiment. The put/call ratio has returned to a neutral level, supporting rebound forecasts.

Historically, Ethereum has exhibited similar divergence patterns during corrective phases. For instance, the 2021 summer correction saw network activity remain robust while price corrected 50%. Underlying this trend, Layer 2 scaling solutions like Arbitrum and Optimism now process over 60% of Ethereum's transactions. This mirrors the 2023 adoption curve post-Merge. , the current fear sentiment, with a Crypto Fear & Greed Index score of 29, often precedes bullish reversals. Similar to the 2021 correction, institutional accumulation tends to accelerate during such periods.

Related Developments: This on-chain strength contrasts with broader market narratives. For example, Cathie Wood's analysis of Bitcoin consolidation highlights parallel institutional patience. Meanwhile, PayPal's survey on crypto payment adoption long-term utility growth. Corporate adoption continues, as seen in Steak 'n Shake's Bitcoin purchase. Regulatory shifts also persist, with Nomura's Laser Digital seeking a US banking license.

Market structure suggests Ethereum is testing a critical Fair Value Gap (FVG) between $2,900 and $3,100. The Relative Strength Index (RSI) on the daily chart reads 42, indicating neutral momentum. The 50-day moving average at $3,150 acts as immediate resistance. On-chain forensic data confirms large UTXO (Unspent Transaction Output) holders are accumulating near current levels. This creates a potential Order Block for institutional buyers. According to Ethereum's official Pectra documentation, the upgrade's fee reduction mechanisms are now fully operational. This technical improvement supports the rising network activity.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 29 (Fear) | Historically a contrarian buy signal |

| ETH Current Price | $2,968.51 | Testing FVG support |

| 24-Hour Price Trend | +1.44% | Early rebound attempt |

| Weekly Price Change | -15% | Macro correction phase |

| Market Rank | #2 | Maintains dominance vs. altcoins |

This divergence matters for institutional liquidity cycles. Rising network fees indicate real economic activity, not speculative trading. Layer 2 growth suggests scalability is achieving product-market fit. Consequently, retail market structure may be mispricing Ethereum's fundamental health. Historical cycles show that such on-chain strength during corrections often leads to violent rallies. The 5-year horizon benefits from these infrastructure improvements. Post-merge issuance remains at a deflationary rate, adding long-term scarcity pressure.

"The put/call ratio normalization and fee market activity create a bullish setup. Market participants are overlooking the structural improvements from Pectra. Similar to the 2021 cycle, this divergence often resolves upward." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish case targets a rebound to $3,300, filling the FVG. The bearish case involves a deeper correction if macro conditions worsen. Analysts suggest watching volume profile concentrations for confirmation.

The 12-month institutional outlook remains positive. Network upgrades and Layer 2 adoption should drive utility growth. This aligns with the 5-year horizon of increasing blockchain integration. However, regulatory developments, as tracked on SEC.gov, could impact short-term volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.