Loading News...

Loading News...

VADODARA, January 30, 2026 — Ethereum founder Vitalik Buterin announced a major fiscal shift. The Ethereum Foundation (EF) enters moderate budget tightening. It allocates 16,384 ETH to open-source hardware and software. This daily crypto analysis examines the strategic implications.

Vitalik Buterin detailed the plan on X. According to his statement, the EF implements "moderate fiscal tightening." The foundation commits 16,384 ETH (approximately $44.9 million at current prices) to open-source ecosystems. This allocation targets hardware and software development.

Buterin explained the rationale. The move aims to complete Ethereum's roadmap. It focuses on performance, scalability, robustness, sustainability, and decentralization. The foundation seeks long-term sustainability. It also protects user sovereignty and privacy.

Future investments will prioritize specific areas. These include open silicon, encrypted messaging, and privacy-preserving operating systems. The foundation will avoid corporate-led closed ecosystems. Ethereum will serve as decentralized collaborative infrastructure.

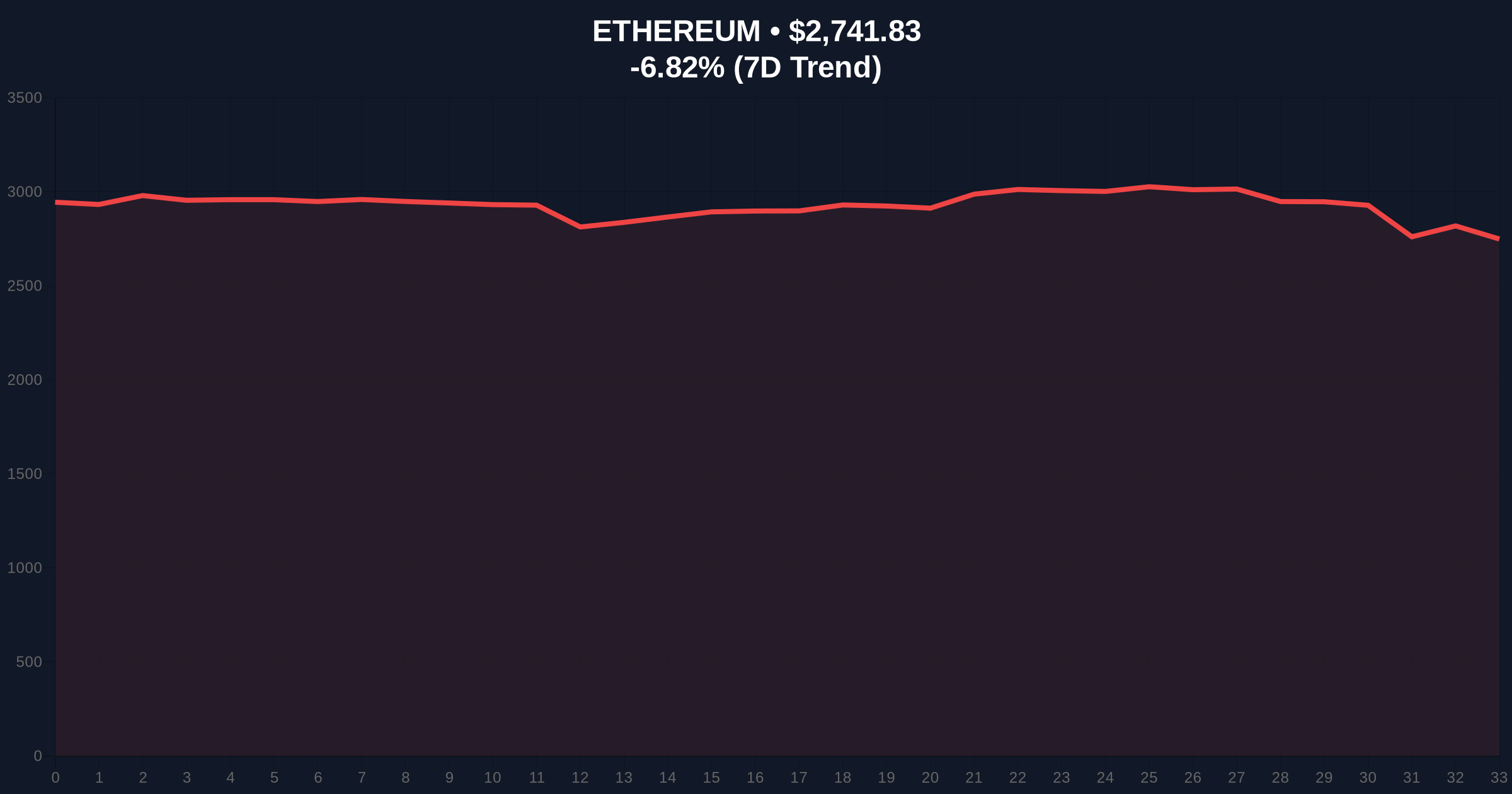

This announcement coincides with extreme market fear. The Crypto Fear & Greed Index sits at 16/100. Ethereum's price dropped -6.91% in 24 hours to $2,740.32. Historically, foundation sell-offs create short-term selling pressure.

In contrast, strategic ecosystem funding often precedes network upgrades. The EF's previous allocations supported critical infrastructure like EIP-4844. This new focus on open-source hardware mirrors early Bitcoin development cycles.

Related developments intensify the market context. US stock indices opened lower, amplifying crypto fear. Bitcoin plunged as dollar liquidity contracted. Meanwhile, ZK-powered scaling solutions advance for Ethereum.

Market structure suggests immediate liquidity concerns. The 16,384 ETH allocation represents a potential sell-side pressure. On-chain data indicates increased exchange inflows following the announcement.

Technical analysis reveals critical levels. Ethereum faces resistance at the 50-day moving average of $2,850. Support holds at the Fibonacci 0.618 retracement level of $2,650. The RSI sits at 32, approaching oversold territory.

A Fair Value Gap (FVG) exists between $2,800 and $2,900. This gap may act as a magnet for price action. Volume profile shows weak accumulation below $2,700. The Order Block at $2,600 must hold to prevent further decline.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Ethereum Current Price | $2,740.32 |

| 24-Hour Price Change | -6.91% |

| ETH Allocation Amount | 16,384 ETH |

| Allocation USD Value | ~$44.9 million |

This decision impacts Ethereum's long-term trajectory. Fiscal tightening reduces immediate liquidity but enhances sustainability. The open-source focus strengthens decentralization against corporate capture.

Institutional liquidity cycles may shift. Short-term selling pressure could create buying opportunities. The allocation to privacy-preserving systems aligns with growing regulatory scrutiny. According to Ethereum's official documentation, such investments support network resilience.

Retail market structure faces volatility. The extreme fear sentiment amplifies price swings. However, strategic funding often precedes major protocol upgrades like the upcoming Pectra hard fork.

Market analysts note the strategic timing. "Foundation actions during fear periods signal long-term conviction," stated the CoinMarketBuzz Intelligence Desk. "The shift from corporate ecosystems to open-source hardware reflects Ethereum's core ethos. This could reduce dependency on centralized validators post-merge."

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Foundation austerity typically precedes network upgrades. The 5-year horizon suggests enhanced scalability and privacy features. This could position Ethereum for increased institutional adoption despite current fear.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.