Loading News...

Loading News...

VADODARA, January 21, 2026 — Ethereum exchange reserves have plummeted to approximately 16.2 million ETH, marking the lowest level since 2016 according to CryptoQuant data analyzed by Arab Chain. This daily crypto analysis reveals a critical supply-side dynamic where decreasing liquidity on centralized exchanges could trigger a gamma squeeze if buying pressure materializes. Market structure suggests that the narrowing gap between price action and reserve depletion indicates accumulation patterns rather than distribution.

Historical cycles demonstrate that exchange reserve declines often precede medium-term price appreciation for Ethereum. The current environment mirrors patterns observed during the 2020-2021 bull run, where sustained outflows from exchanges created supply bottlenecks. Underlying this trend is the maturation of Ethereum's staking ecosystem post-merge, with validators locking ETH in proof-of-stake contracts, further reducing circulating supply. Consequently, the combination of technical upgrades and behavioral shifts creates a foundation for volatile price discovery. Related developments include Nansen's launch of AI on-chain trading tools and Bithumb's delisting of Bonfida, reflecting broader market recalibration amid regulatory scrutiny.

According to Arab Chain's contribution to CryptoQuant, Binance's ETH holdings decreased from 4.168 million to 4 million ETH this month, driving the total exchange reserve to an 8-year low. On-chain data indicates no significant inflow spikes, confirming weak selling pressure. This movement aligns with investors migrating ETH to DeFi protocols or cold storage for long-term holding, as detailed in the original analysis from Coinness. The Ethereum.org documentation on staking mechanics explains how reduced liquid supply can impact market dynamics, supporting the analyst's observations.

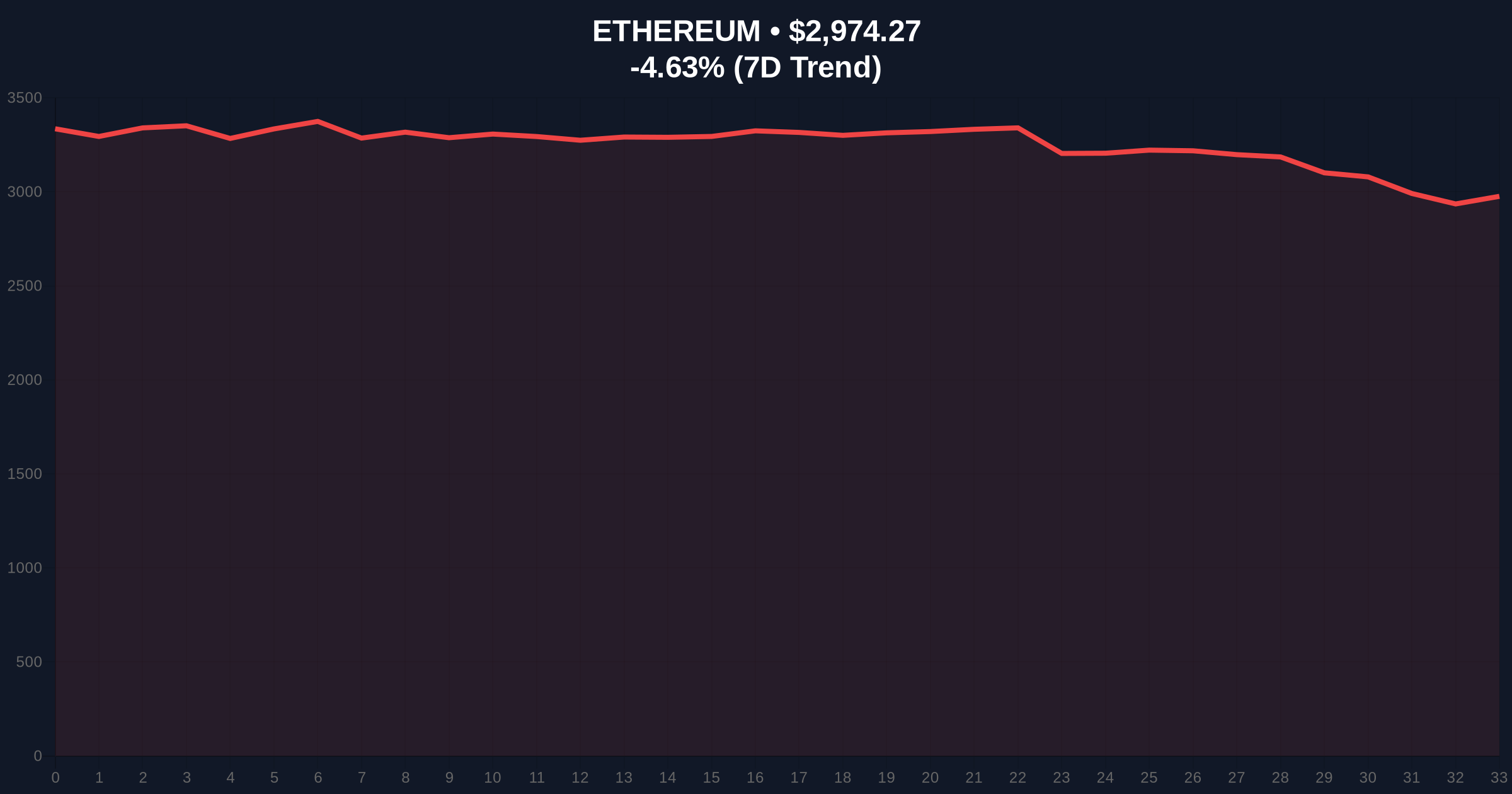

Ethereum currently trades at $2,973.92, down 4.64% in 24 hours despite bullish reserve data. A Fair Value Gap (FVG) exists between $3,100 and $3,250, representing an order block where liquidity may be grabbed. The Relative Strength Index (RSI) sits near oversold territory at 32, suggesting potential for a short-term bounce. The 50-day moving average at $3,150 acts as immediate resistance, while the 200-day moving average provides support at $2,900. Bullish Invalidation is set at $3,250; a break above confirms accumulation thesis. Bearish Invalidation is $2,850; a breakdown invalidates the supply shock narrative and signals deeper correction.

| Metric | Value | Implication |

|---|---|---|

| Exchange Reserves | 16.2M ETH | Lowest since 2016 |

| Binance Holdings Change | -168K ETH (Month) | Acceleration of outflows |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Contrarian signal |

| ETH Current Price | $2,973.92 | -4.64% (24h) |

| Market Rank | #2 | Maintains dominance |

For institutions, a supply shortage heightens execution risk for large orders, potentially increasing slippage costs. Retail investors face amplified volatility if demand surges against limited exchange liquidity. The structural shift toward non-custodial solutions, like those highlighted in House of Doge's payment app launch, reinforces this trend. Market analysts attribute the divergence between price action and on-chain fundamentals to macroeconomic headwinds, including potential Federal Reserve policy shifts detailed on FederalReserve.gov.

Bulls on social media platforms emphasize the historical correlation between reserve declines and price rallies, citing EIP-4844's upcoming implementation as a catalyst. Bears counter that regulatory uncertainty, as seen in Bithumb's deposit suspensions, could suppress demand. Overall sentiment remains cautious despite the bullish data, reflecting the Extreme Fear market conditions.

Bullish Case: If exchange reserves continue declining and demand picks up, Ethereum could test the $3,500 resistance level within Q1 2026. A gamma squeeze scenario becomes plausible if short positions are forced to cover amid low liquidity. Historical patterns suggest a 15-20% appreciation potential over six months.

Bearish Case: Should macroeconomic pressures intensify or the Bearish Invalidation level at $2,850 break, Ethereum may retreat to the $2,600 support zone. This would indicate that reserve outflows are driven by capitulation rather than accumulation, extending the current correction phase.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.