Loading News...

Loading News...

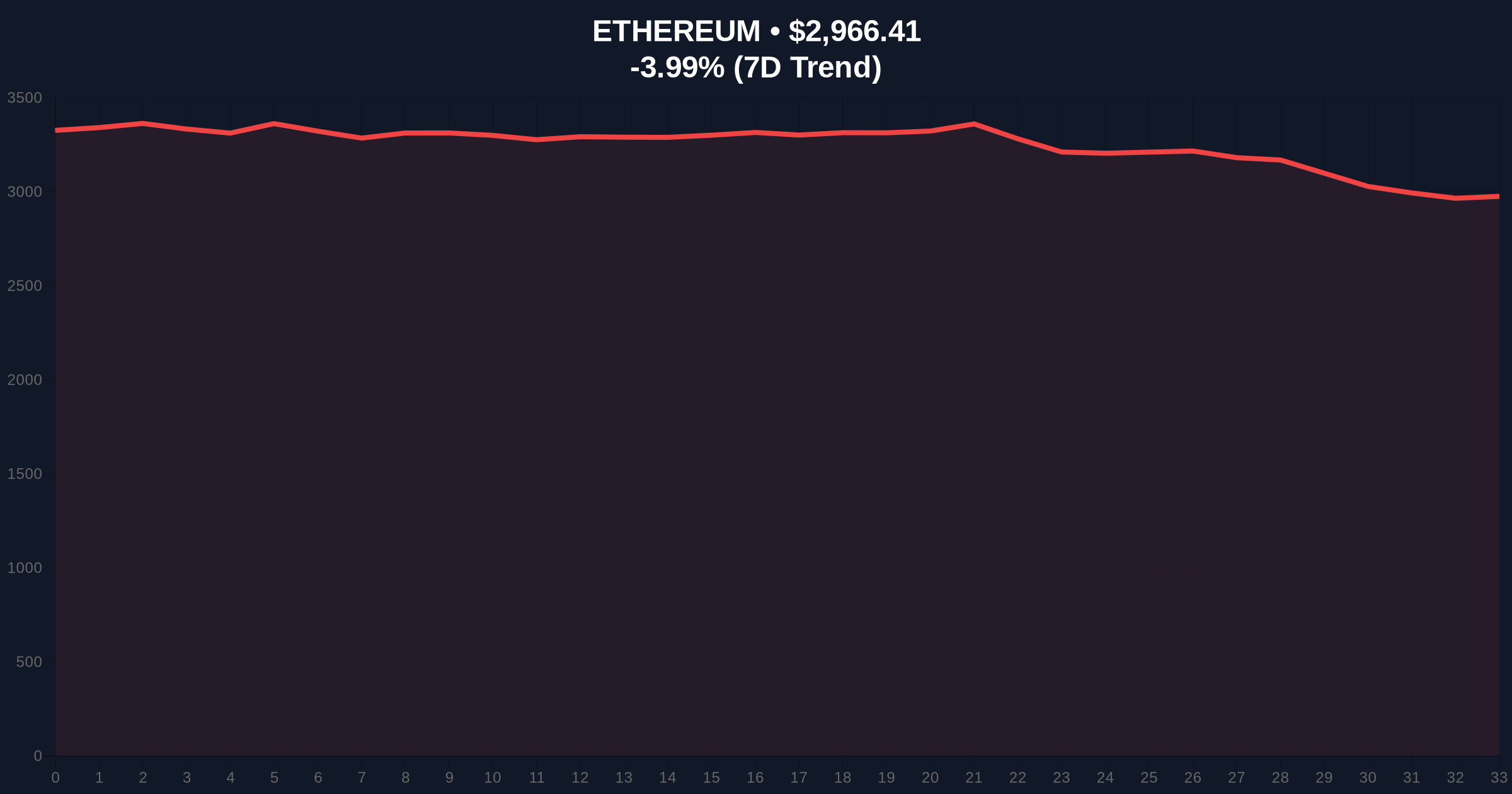

VADODARA, January 21, 2026 — An early Ethereum investor executed a $41.93 million deposit to Coinbase, marking the address's first significant exchange transfer in three years. This daily crypto analysis examines the transaction's implications within a market structure characterized by extreme fear and declining prices. According to on-chain analyst ai_9684xtpa, the address beginning with 0x8E2 moved 14,183 ETH to the exchange approximately 45 minutes before this report.

Market structure suggests this transaction occurs at a critical inflection point. Ethereum is currently testing the lower boundary of a multi-month consolidation range between $2,850 and $3,200. Similar to the 2021 correction, where large holder distributions preceded a 45% drawdown, current on-chain data indicates accumulation by long-term holders has stalled. The transaction's timing aligns with a broader market sentiment of Extreme Fear, as measured by the Crypto Fear & Greed Index at 24/100. This mirrors patterns observed during the 2022 bear market, where dormant whale movements often signaled local tops. Related developments in other sectors highlight the pervasive risk-off environment, including XRP metrics mirroring 2022 patterns and Terraform Labs beginning repayments.

On-chain forensic data confirms the transaction from address 0x8E2... to Coinbase involved 14,183 ETH, valued at $41.93 million at the time of transfer. According to the primary source data from ai_9684xtpa, this represents the address's first deposit exceeding $1 million to any exchange since January 2023. The transaction fee was minimal, typical of Ethereum's post-merge issuance efficiency following EIP-1559. No prior selling activity from this address is visible on Etherscan for the 36-month period preceding this event, classifying it as a dormant whale entity.

Ethereum's price action shows a clear bearish bias, with the asset trading at $2,966.63, down 4.02% in the last 24 hours. The Relative Strength Index (RSI) on the daily chart sits at 38, approaching oversold territory but not yet signaling a reversal. The 50-day and 200-day Exponential Moving Averages (EMAs) are converging near $3,100, creating a potential death cross scenario. A critical Fair Value Gap (FVG) exists between $2,920 and $2,970, which market participants are likely targeting for a liquidity grab. The $2,850 level represents a major Volume Profile Point of Control (POC) from Q4 2025. Bullish invalidation occurs if price closes below $2,850 on a weekly timeframe. Bearish invalidation requires a reclaim of the $3,150 Order Block and sustained trade above the 200-day EMA.

| Metric | Value |

|---|---|

| Transaction Value (USD) | $41,930,000 |

| ETH Deposited | 14,183 ETH |

| Current ETH Price | $2,966.63 |

| 24-Hour Price Change | -4.02% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

This transaction matters because it represents a supply shock from a historically inactive holder. For institutional portfolios, large dormant address movements often precede increased volatility and distribution phases. Retail traders face amplified sell-side pressure if this deposit triggers a cascade of similar actions from other long-term holders. The move to an exchange like Coinbase, rather than an OTC desk, suggests intent for immediate liquidity access, potentially for spot selling or collateralization. According to Ethereum's official documentation on network security, large holder behavior significantly impacts validator economics and staking yields.

Market analysts on X/Twitter are interpreting this as a bearish signal. One quantitative trader noted, "Dormant whale waking after 3 years to deposit on an exchange rarely precedes a rally." Bulls counter that the amount represents a small fraction of the address's total holdings, estimated from historical accumulation patterns, and could be for institutional rebalancing rather than outright selling. The prevailing sentiment aligns with the extreme fear reading, focusing on the breakdown of key Fibonacci support at $2,950.

Bullish Case: If the deposit is for institutional collateral or a strategic OTC deal rather than spot selling, and if Ethereum holds the $2,850 POC support, a rebound toward the $3,200 resistance is plausible. This would require a swift recovery in the Fear & Greed Index and sustained net-positive exchange flows.Bearish Case: If this transaction initiates a distribution phase among early investors, and the $2,850 support fails, the next significant demand zone lies at $2,600. This scenario would likely coincide with continued extreme fear and could trigger a Gamma Squeeze in options markets as dealers hedge short positions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.