Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

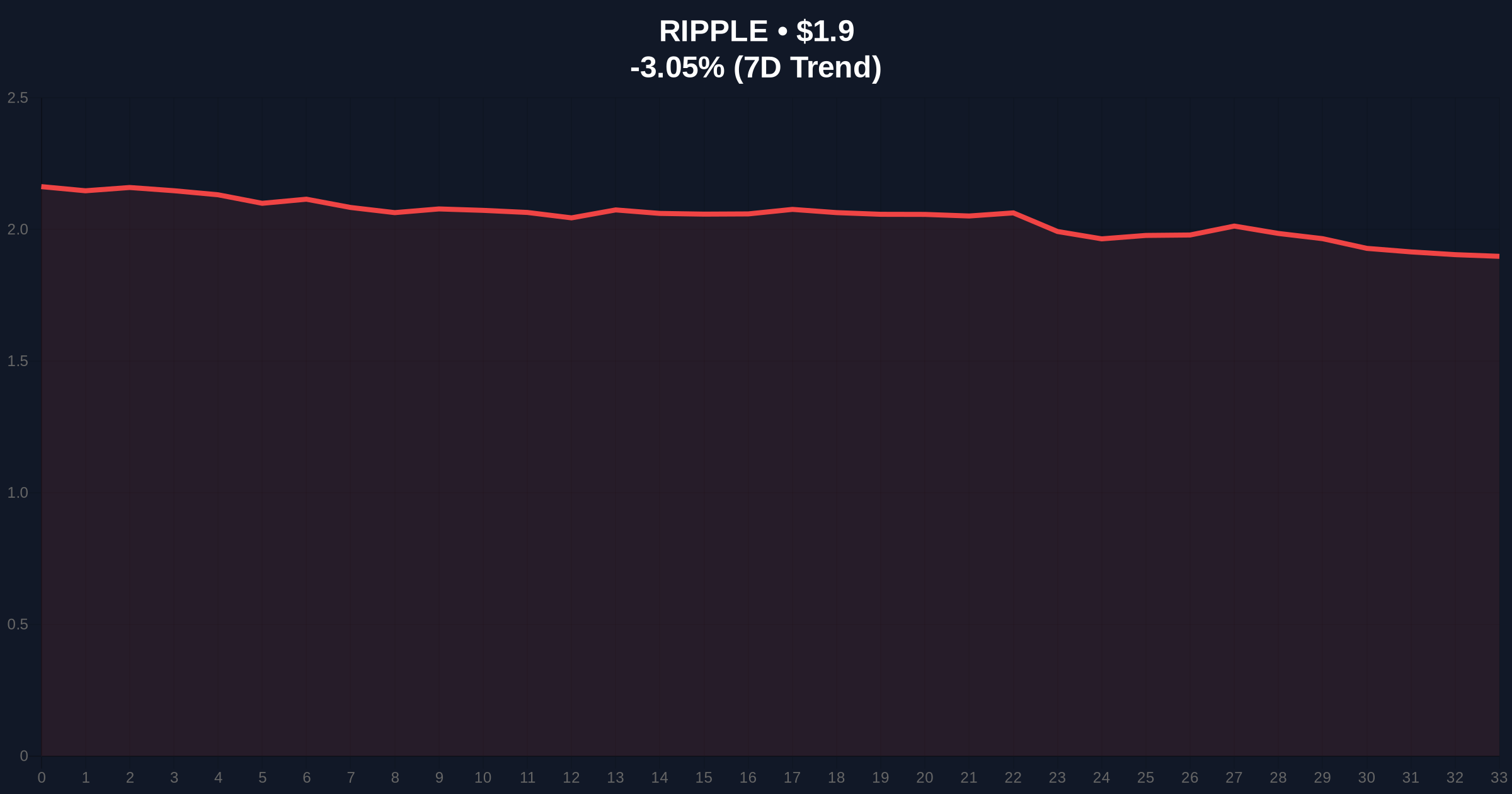

VADODARA, January 21, 2026 — XRP's on-chain metrics are flashing warning signals that mirror the 2022 bear market pattern, according to Glassnode data cited by CoinDesk. This daily crypto analysis reveals a dangerous profit asymmetry where recent buyers are in profit while long-term holders face losses, creating structural selling pressure at the critical $2 psychological level. Market structure suggests this setup could trigger a 60%+ decline if the current support fails.

Historical cycles suggest asymmetric profit distribution precedes major corrections. The February 2022 pattern saw XRP decline from $0.78 to $0.30—a 61.5% drawdown. Current on-chain forensic data confirms similar UTXO age distribution patterns. This occurs amid broader market stress: the Crypto Fear & Greed Index sits at Extreme Fear (24/100), mirroring conditions during previous capitulation events. Related developments include Spot Ethereum ETFs recording $238.6M net outflows and U.S. Spot Bitcoin ETFs seeing $479.6M net outflows, indicating institutional liquidity withdrawal.

According to Glassnode, investors active within the last month accumulated XRP at lower average prices than those who invested 6-12 months ago. This creates a situation where recent buyers are in profit while long-term holders are at loss. Glassnode explained that slow rebound amid this structure could trigger selling from existing holders. Since mid-2025, each retest of the $2 level has led to weekly losses between $500 million and $1.2 billion. On-chain data indicates investors are selling rather than increasing positions at this resistance.

XRP is currently stagnating around $1.9, down 3.08% in 24 hours. The $2 level represents a major Order Block where liquidity has been consistently grabbed. Volume Profile shows significant distribution above this level. RSI sits at 42, indicating neutral momentum with bearish divergence on higher timeframes. The 50-day moving average at $2.05 acts as dynamic resistance. Bullish Invalidation: $1.85 (Fibonacci 0.618 retracement from 2025 low). Bearish Invalidation: $2.15 (previous swing high). A break below $1.85 would confirm the bearish pattern and target the $1.20 Fair Value Gap.

| Metric | Value |

|---|---|

| Current XRP Price | $1.9 |

| 24h Change | -3.08% |

| Crypto Fear & Greed Index | Extreme Fear (24/100) |

| Weekly Losses at $2 Level | $500M-$1.2B |

| 2022 Decline Pattern | 61.5% ($0.78 to $0.30) |

This matters because profit asymmetry creates structural selling pressure. Institutional impact: Large holders (whales) facing losses may trigger cascading liquidations. Retail impact: Recent buyers may panic-sell if long-term holders exit. The widening disparity between holders' average costs increases Gamma Squeeze risk. According to Ethereum.org's research on network effects, similar on-chain patterns in other assets have preceded multi-month corrections. Market structure suggests the $2 level acts as a liquidity magnet for both buyers and sellers.

Market analysts on X/Twitter note the similarity to 2022 patterns. One quantitative trader stated: "XRP's MVRV ratio shows short-term holders in profit while long-term holders are underwater—classic distribution phase." Another analyst highlighted: "The $2 level has rejected price five times since July 2025. Each rejection saw increased on-chain selling volume." Bulls point to Ripple's ongoing SEC case resolution as potential catalyst, but bears emphasize the technical breakdown risk.

Bullish Case: If XRP holds above $1.85 and breaks $2.15, it could target $2.50 (previous resistance). This requires rapid reduction in profit asymmetry and increased network activity. Positive regulatory developments from the SEC case could provide catalyst.

Bearish Case: If XRP breaks below $1.85, the 2022 pattern suggests target of $0.76 (60% decline). This would confirm the bear market continuation pattern. Selling pressure from long-term holders would accelerate, potentially triggering a liquidity cascade. The Extreme Fear sentiment would likely deepen.

Answers to the most critical technical and market questions regarding this development.