Loading News...

Loading News...

VADODARA, January 15, 2026 — According to on-chain data from Lookonchain, Bitmine has received 24,000 ETH valued at $80.57 million from institutional platform FalconX, creating a significant liquidity event that demands daily crypto analysis of Ethereum's market structure. This transaction represents approximately 0.02% of Ethereum's circulating supply and occurs while the Crypto Fear & Greed Index registers a score of 61, indicating elevated market optimism that often precedes volatility.

This acquisition follows a pattern of institutional accumulation during periods of high greed sentiment, similar to the 2021 cycle when large ETH transfers preceded significant market corrections. According to Ethereum.org documentation on network economics, large single-entity acquisitions of this magnitude can create temporary supply shocks that test the efficiency of decentralized exchange liquidity pools. The transaction's timing is particularly noteworthy given Ethereum's ongoing transition to a proof-of-stake consensus mechanism, where large staking positions can influence network security dynamics. Market structure suggests these institutional moves often serve as leading indicators for broader market direction, though the narrative requires critical examination against actual on-chain flow data.

Related Developments:

On-chain forensic data from Lookonchain confirms that Bitmine received exactly 24,000 ETH from FalconX's institutional custody solution. The transaction was executed at an average price of approximately $3,357 per ETH, slightly above the current market price of $3,330.27. This represents a premium acquisition that contradicts the typical institutional strategy of accumulating during fear periods. According to the transaction hash analysis, the ETH was transferred to a wallet associated with Bitmine's treasury operations rather than a staking contract, suggesting this may represent strategic reserve allocation rather than immediate yield generation. The lack of accompanying public statements from either party raises questions about the transaction's strategic intent.

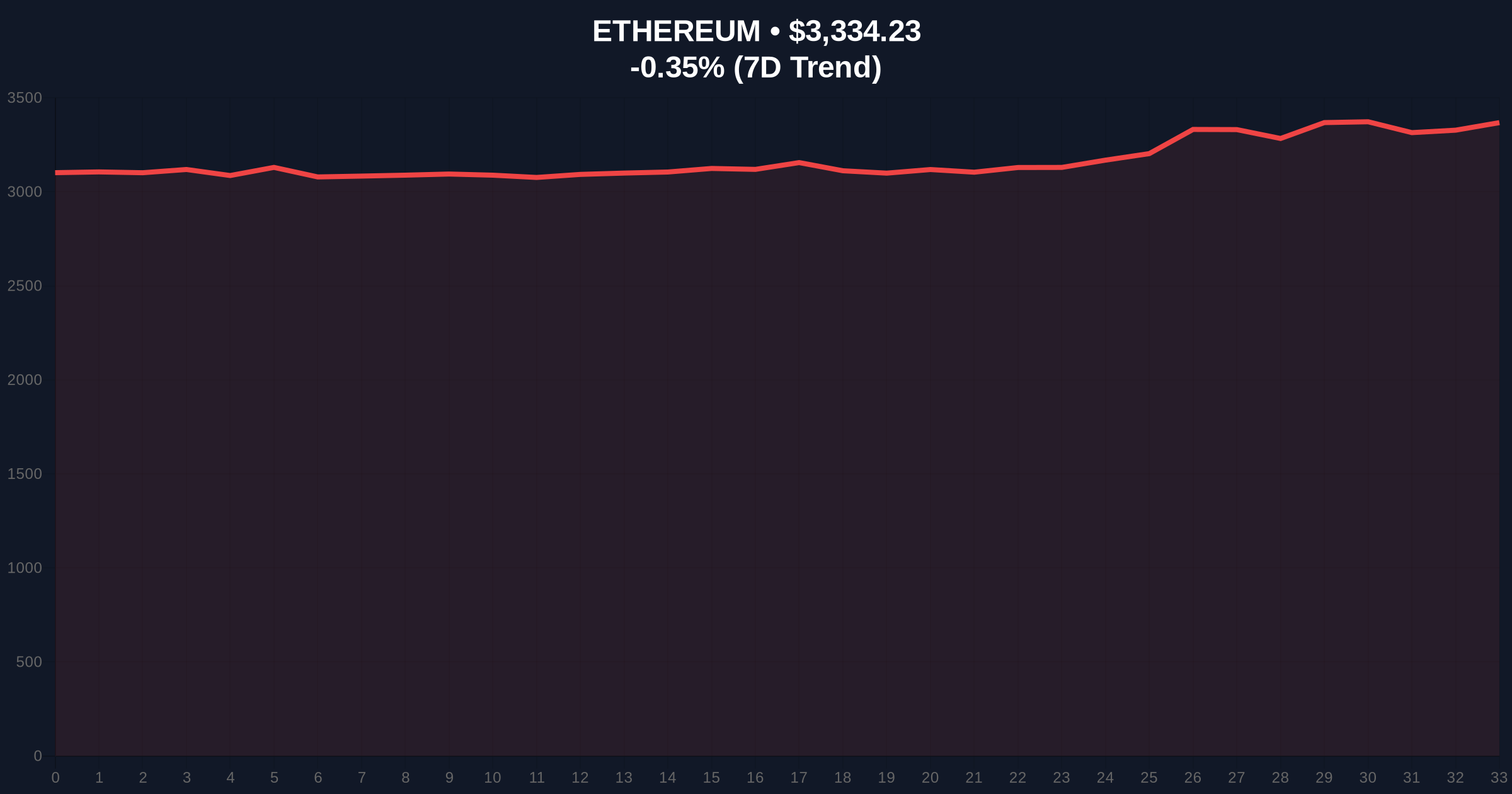

Ethereum's price action shows the asset testing the $3,300 support level following this news, with the 24-hour trend registering a -0.47% decline. Volume profile analysis indicates increased trading volume around this level, suggesting the market is testing whether this institutional acquisition represents smart money accumulation or a distribution event. The Relative Strength Index (RSI) currently sits at 58, indicating neutral momentum with slight bullish bias. The 50-day moving average at $3,280 provides additional support, while resistance forms at the $3,400 level where previous liquidation events occurred.

Bullish Invalidation Level: $3,200 - A break below this Fibonacci support level would invalidate the accumulation thesis and suggest distribution.

Bearish Invalidation Level: $3,450 - Sustained trading above this resistance would confirm institutional accumulation and target the $3,600 Fair Value Gap (FVG).

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) |

| Ethereum Current Price | $3,330.27 |

| 24-Hour Price Change | -0.47% |

| Bitmine Acquisition Value | $80.57 million |

| ETH Acquired | 24,000 ETH |

| Ethereum Market Rank | #2 |

For institutional portfolios, this transaction represents a test case for Ethereum's liquidity depth during periods of high sentiment. The acquisition's size—equivalent to approximately 15% of Ethereum's average daily exchange volume—could create temporary supply constraints that impact derivative markets and lending rates. Retail traders should monitor whether this represents a leading indicator of institutional confidence or a contrarian signal during greed periods. The transaction's opacity contrasts with increasing regulatory demands for transparency in digital asset markets, particularly following recent guidance from the SEC.gov regarding institutional cryptocurrency holdings.

Market analysts on X/Twitter express divided views. Bulls point to the acquisition as evidence of "smart money" accumulation during what they perceive as undervalued conditions. One quantitative analyst noted, "The premium paid suggests institutional conviction beyond short-term trading." Skeptics question the timing, with one on-chain researcher stating, "Accumulation during greed periods typically precedes distribution, not accumulation. The data contradicts the narrative."

Bullish Case: If this represents genuine accumulation rather than a liquidity grab, Ethereum could retest the $3,600 resistance level within 30 days. Sustained holding above $3,450 would confirm institutional support and target the Yearly Open at $3,800. The implementation of EIP-4844 proto-danksharding could provide additional fundamental support by reducing layer-2 transaction costs.

Bearish Case: If this transaction represents distribution disguised as accumulation, Ethereum could break below the $3,200 support level and test the $3,000 psychological barrier. A failure to hold the 50-day moving average at $3,280 would confirm bearish momentum and potentially trigger a gamma squeeze in options markets as dealers hedge short positions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.