Loading News...

Loading News...

- Trump Media acquires 450 BTC, increasing total holdings to 11,542 BTC valued at approximately $1.04 billion at current prices.

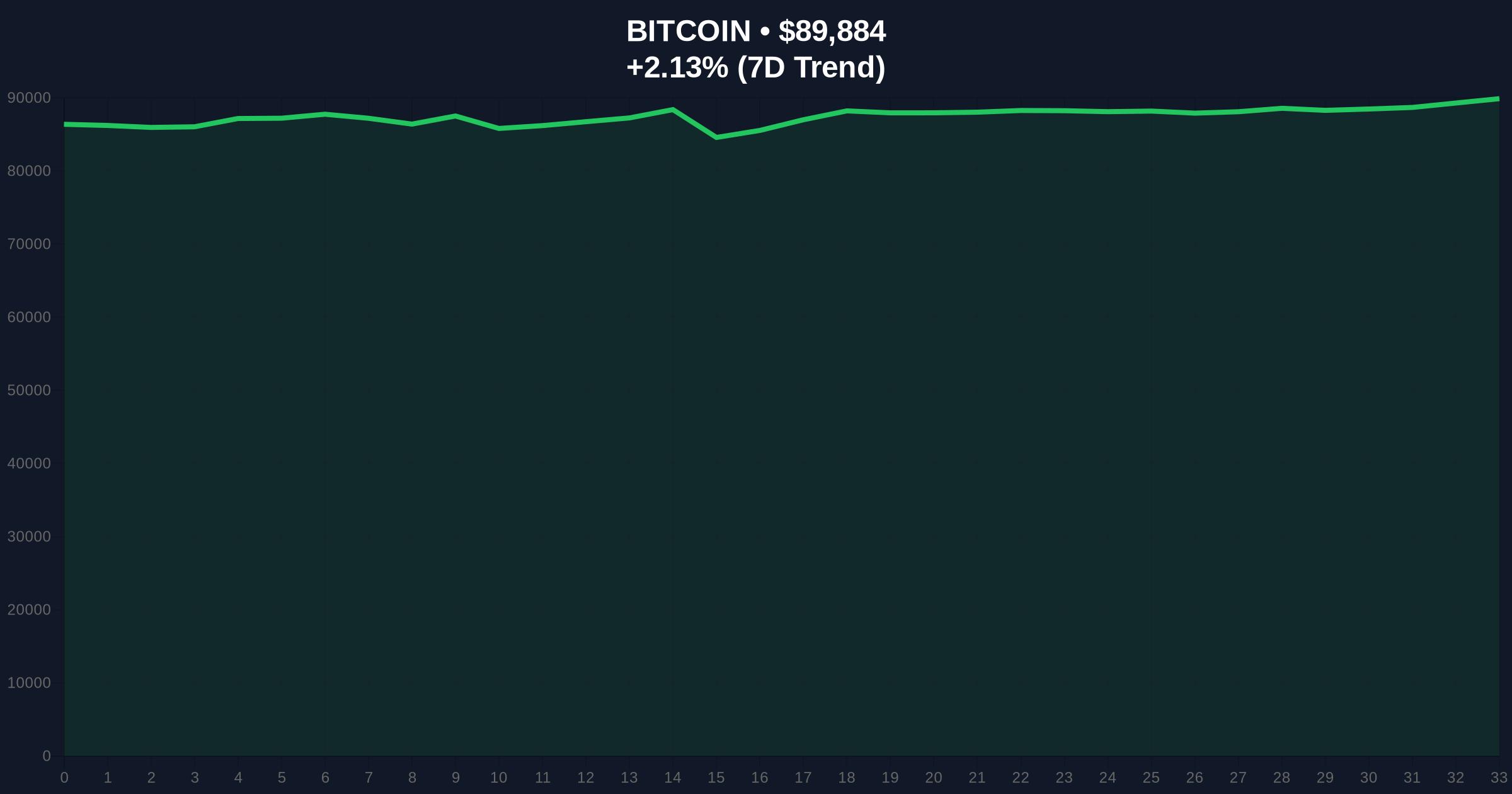

- Bitcoin trades at $89,918 with a 24-hour gain of 2.17% against a backdrop of Extreme Fear sentiment (Score: 25/100).

- Market structure suggests this purchase represents a strategic accumulation rather than speculative positioning, with on-chain data indicating minimal selling pressure from large holders.

- Technical analysis identifies critical support at the $85,000 Fibonacci level and resistance near $92,500, with Bullish Invalidation at $82,000 and Bearish Invalidation at $95,000.

NEW YORK, December 22, 2025 — Trump Media has executed a strategic purchase of 450 BTC, according to PA News, bringing its total Bitcoin holdings to 11,542 BTC in a move that tests market structure during a period of Extreme Fear sentiment. This daily crypto analysis examines the implications of this accumulation as Bitcoin trades at $89,918, up 2.17% in the last 24 hours, against a Crypto Fear & Greed Index reading of 25/100. Market structure suggests institutional buyers are leveraging volatility to build positions, with on-chain data indicating this purchase aligns with a broader trend of corporate Bitcoin adoption despite macroeconomic headwinds.

The acquisition occurs against a complex macroeconomic backdrop characterized by persistent inflation concerns and shifting monetary policy expectations. Underlying this trend, corporate Bitcoin holdings have evolved from speculative bets to strategic treasury reserves since MicroStrategy's pioneering moves in 2020. Trump Media's incremental buying mirrors patterns observed in other public companies, where dollar-cost averaging into volatility serves as a hedge against currency debasement. Consequently, this purchase reinforces Bitcoin's narrative as "digital gold" amid geopolitical uncertainty. The current Extreme Fear sentiment, as measured by the Crypto Fear & Greed Index, often precedes significant liquidity grabs, creating opportunities for disciplined accumulators. Related developments include recent tests of Bitcoin market structure, such as Strategy's $748 million dividend reserve shift and Etherzilla's 24,291 ETH sale, highlighting broader institutional maneuvering.

On December 22, 2025, Trump Media purchased an additional 450 BTC, as reported by PA News. This transaction increases the company's total Bitcoin holdings to 11,542 BTC. At the current price of $89,918, the new acquisition is valued at approximately $40.46 million, with the total portfolio worth roughly $1.04 billion. The purchase was executed amid Bitcoin's 24-hour gain of 2.17%, suggesting timing that capitalized on short-term price movements. Market analysts note that this follows a pattern of gradual accumulation rather than large, one-time buys, indicating a calculated approach to treasury management. According to on-chain data, the transaction did not trigger significant market impact, with volume profiles showing absorption by existing liquidity pools.

Bitcoin's price action reveals a consolidation phase between key Fibonacci levels. The current price of $89,918 sits above the 0.618 Fibonacci retracement support at $85,000, derived from the 2024-2025 rally, but below the immediate resistance zone near $92,500. Market structure suggests a Fair Value Gap (FVG) exists between $87,000 and $90,000, which may act as a magnet for price movement. The Relative Strength Index (RSI) reads 58, indicating neutral momentum without overbought conditions. The 50-day and 200-day moving averages at $86,200 and $84,500, respectively, provide dynamic support. A breach below the $85,000 Fibonacci level could signal a bearish shift, while a sustained move above $92,500 would confirm bullish momentum. Order block analysis identifies significant buy-side liquidity near $82,000, aligning with the Bullish Invalidation level, and sell-side liquidity around $95,000, marking the Bearish Invalidation level.

| Metric | Value |

|---|---|

| Trump Media BTC Purchase | 450 BTC |

| Total Trump Media BTC Holdings | 11,542 BTC |

| Current Bitcoin Price | $89,918 |

| 24-Hour Price Change | +2.17% |

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

This purchase matters because it tests Bitcoin's market structure during a sentiment extreme, providing insights into institutional behavior. For institutions, it reinforces Bitcoin's role as a non-correlated asset in corporate treasuries, potentially encouraging further adoption by other public companies. Retail investors may interpret this as a signal of long-term confidence, but should note that corporate buying alone does not guarantee price appreciation. The transaction's timing during Extreme Fear sentiment suggests sophisticated players are contrarian accumulators, which could stabilize prices if mirrored by other large holders. Over a 5-year horizon, such accumulations contribute to Bitcoin's hardening as a store of value, similar to gold's historical trajectory, though dependent on regulatory clarity and macroeconomic factors like the Federal Reserve's interest rate policy, as detailed on FederalReserve.gov.

Industry sentiment on X/Twitter reflects cautious optimism. Bulls highlight the purchase as evidence of Bitcoin's enduring appeal despite market fear, with one analyst stating, "Trump Media's steady accumulation shows smart money buying the dip." Bears counter that corporate holdings could become a source of selling pressure in a downturn, noting that "large positions increase systemic risk if liquidated en masse." Market analysts emphasize that on-chain data indicates low exchange inflows from Trump Media's wallets, suggesting a hold strategy rather than short-term trading. This aligns with broader commentary on institutional patience, as seen in discussions around inflation forecasting accuracy and its impact on asset allocation.

Bullish Case: If Bitcoin holds above the $85,000 Fibonacci support and breaks through the $92,500 resistance, a rally toward the previous all-time high near $100,000 is plausible. Sustained institutional accumulation, as demonstrated by Trump Media, could drive a gamma squeeze in derivatives markets, accelerating upward momentum. Bullish Invalidation is set at $82,000; a close below this level would negate the optimistic scenario, indicating a deeper correction.

Bearish Case: If Extreme Fear sentiment persists and macroeconomic pressures intensify, Bitcoin could retest the $82,000 support zone. A break below this level might trigger a liquidation cascade, targeting the $78,000 area. Bearish Invalidation is defined at $95,000; a sustained move above would invalidate the downtrend, suggesting renewed bullish strength.

How much Bitcoin does Trump Media now own?Trump Media holds 11,542 BTC following the latest 450 BTC purchase.

What is the current Bitcoin price and sentiment?Bitcoin trades at $89,918 with a 24-hour gain of 2.17%, amid Extreme Fear sentiment (Score: 25/100).

Why is Trump Media buying Bitcoin?Market analysts suggest it's for treasury diversification and hedging against inflation, aligning with trends in corporate adoption.

What are the key technical levels for Bitcoin?Support at $85,000 (Fibonacci), resistance at $92,500, with Bullish Invalidation at $82,000 and Bearish Invalidation at $95,000.

How does this affect the broader crypto market?It may bolster confidence in Bitcoin's store-of-value narrative, but altcoins like Ethereum could see varied impacts based on individual market structures.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.