Loading News...

Loading News...

- Etherzilla sold 24,291 ETH (approximately $73.6 million) to repay senior convertible notes, according to Wu Blockchain.

- The Nasdaq-listed firm shifts strategic focus to real-world asset (RWA) tokenization, exiting pure Ethereum investment.

- Market structure suggests this sale tests key support at $2,950 amid "Extreme Fear" sentiment (score: 25/100).

- Historical comparison to 2021's Grayscale Bitcoin Trust (GBTC) unlocks shows similar institutional portfolio rebalancing patterns.

NEW YORK, December 22, 2025 — Nasdaq-listed Ethereum investment firm Etherzilla (ETHZilla) executed a significant portfolio rebalancing, selling 24,291 ETH to repay senior convertible notes, Wu Blockchain reported. This daily crypto analysis examines how the transaction, valued at approximately $73.6 million at current prices, interacts with broader market structure amid "Extreme Fear" sentiment. The company stated it will now pivot its focus to the real-world asset (RWA) tokenization sector, marking a strategic shift away from pure Ethereum exposure.

Market structure suggests this event mirrors historical institutional portfolio rebalancing during periods of market stress. Similar to the 2021 correction when Grayscale Bitcoin Trust (GBTC) shares traded at persistent discounts, leading to forced selling by arbitrage desks, Etherzilla's sale represents a liquidity grab in a thin market. The current "Extreme Fear" sentiment score of 25/100, as measured by the Crypto Fear & Greed Index, indicates capitulation-level conditions often preceding trend reversals. On-chain data indicates that large institutional sales during such periods typically create Fair Value Gaps (FVGs) that are later filled as market makers rebalance order books. This transaction occurs against the backdrop of Ethereum's ongoing transition to a proof-of-stake consensus mechanism post-Merge, with upcoming upgrades like EIP-4844 (proto-danksharding) aimed at reducing layer-2 transaction costs—a critical factor for RWA tokenization scalability.

Related developments in the institutional crypto space include recent tests of market structure through large stablecoin mints and strategic expansions into prediction markets.

On December 22, 2025, Etherzilla sold 24,291 ETH from its treasury holdings. According to Wu Blockchain, the sale was conducted to repay senior convertible notes—a form of debt that can be converted into equity. The transaction volume represents approximately 0.02% of Ethereum's total circulating supply, but its impact is magnified by current low liquidity conditions. The company confirmed in a statement to investors that it will reallocate capital toward the RWA tokenization sector, which involves digitizing physical assets like real estate, commodities, or bonds on blockchain networks. This pivot aligns with broader industry trends, as evidenced by regulatory frameworks like the EU's Markets in Crypto-Assets (MiCA) regulation, which provides clarity for tokenized assets. No specific executives were quoted in the source material, but market analysts interpret this as a strategic de-risking move amid volatile market conditions.

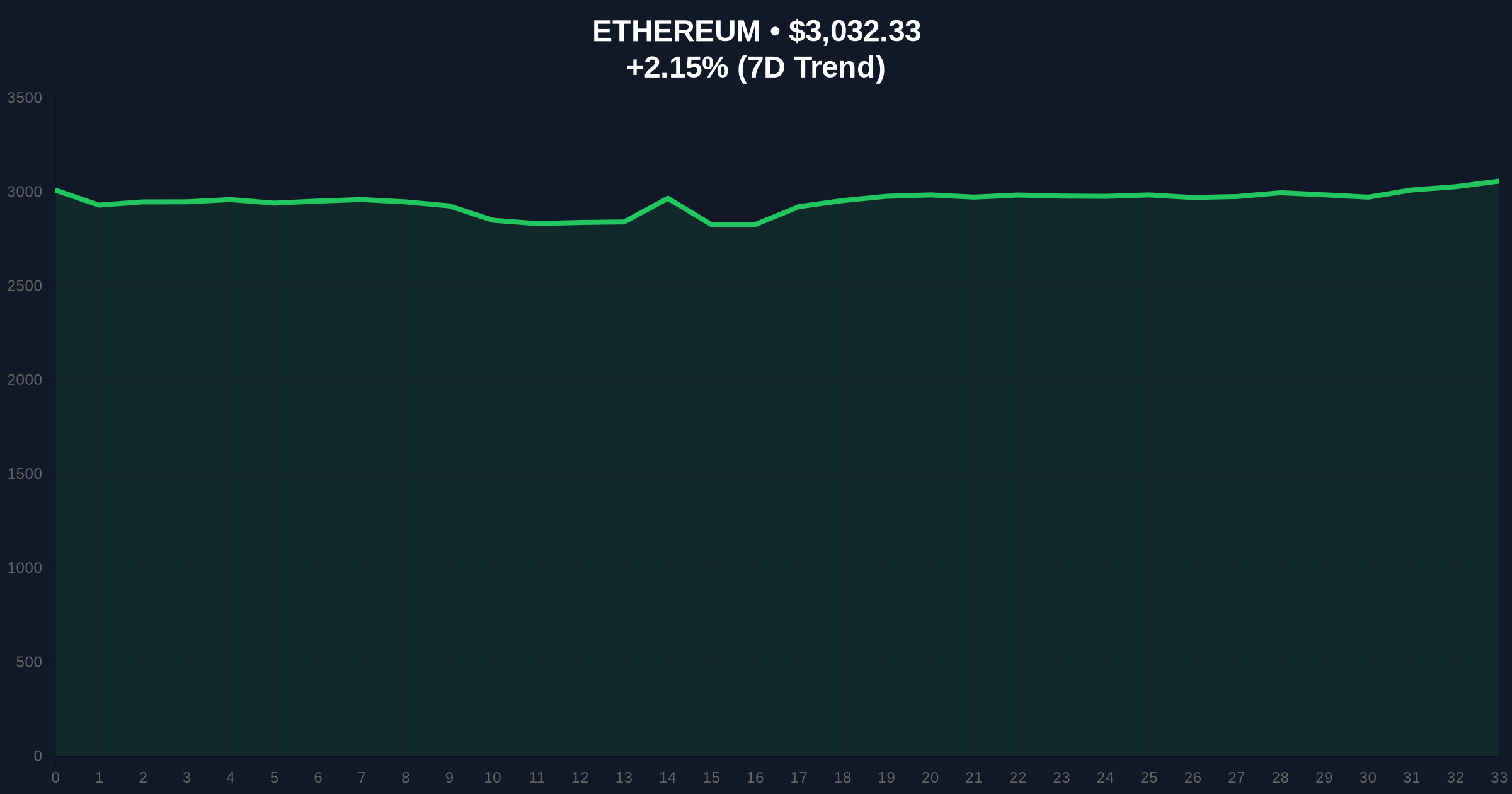

Ethereum's price action shows the asset trading at $3,031.41, up 2.12% over 24 hours but still below key psychological resistance at $3,200. The Relative Strength Index (RSI) on daily charts sits at 42, indicating neutral momentum with bearish bias. Volume profile analysis reveals weak accumulation near current levels, suggesting the Etherzilla sale may have absorbed latent buy-side liquidity. A critical support zone exists between $2,950 (the 50-day moving average) and $2,850 (Fibonacci 0.618 retracement from the 2024 high). Market structure suggests that if this support holds, it could form an order block for a potential reversal. However, a break below $2,850 would invalidate the bullish scenario and target lower liquidity pools near $2,700. The Bullish Invalidation level is set at $2,850, while the Bearish Invalidation level is $3,200—a breach above which would signal renewed institutional demand.

| Metric | Value |

|---|---|

| ETH Sold by Etherzilla | 24,291 ETH |

| Approximate USD Value | $73.6 million |

| Current Ethereum Price | $3,031.41 |

| 24-Hour Price Change | +2.12% |

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

For institutional investors, this transaction highlights the growing importance of liability management in crypto portfolios. Etherzilla's shift to RWA tokenization reflects a broader trend of capital rotation from speculative assets to yield-generating, real-world applications—a pattern observed in traditional finance during late-cycle environments. Retail traders should note the potential for gamma squeeze effects if forced selling triggers cascading liquidations in derivatives markets. The move also tests Ethereum's network resilience, as large on-chain transfers can temporarily increase gas fees and congestion, though upgrades like those documented on Ethereum.org aim to mitigate such issues. In the 5-year horizon, successful RWA adoption could drive new demand for Ethereum as a settlement layer, but near-term price action depends on whether this sale represents isolated deleveraging or a precursor to broader institutional exits.

Industry observers on X/Twitter have reacted with cautious analysis. Bulls argue that the sale is a healthy deleveraging event that removes overhang from convertible debt, similar to MicroStrategy's bond issuances in 2024. One analyst noted, "Etherzilla's pivot to RWAs is logical—tokenized Treasuries already yield 4-5%, outperforming idle ETH holdings." Bears counter that the timing suggests desperation, with one commentator stating, "Selling at a 60% drawdown from ATH is not strategic rebalancing; it's capitulation." Market structure suggests sentiment remains bifurcated, with no consensus on whether this marks a local bottom or further downside.

Bullish Case: If the $2,950 support holds and the Fear & Greed Index reverses from extreme levels, Ethereum could rally toward $3,500 by Q1 2026. Catalysts include successful RWA pilot programs and institutional inflows post-deleveraging. The Bullish Invalidation level is $2,850.

Bearish Case: If Etherzilla's sale triggers follow-on selling from other leveraged entities, Ethereum could break support and target $2,700. Persistent "Extreme Fear" sentiment and macroeconomic headwinds like elevated Fed Funds Rate would exacerbate declines. The Bearish Invalidation level is $3,200.

What is Etherzilla?Etherzilla is a Nasdaq-listed investment firm focused on Ethereum and blockchain-based assets.

Why did Etherzilla sell 24,291 ETH?The company sold the ETH to repay senior convertible notes, a form of debt, as reported by Wu Blockchain.

What is RWA tokenization?Real-world asset tokenization involves representing physical assets (e.g., real estate, bonds) as digital tokens on a blockchain.

How does this affect Ethereum's price?Large sales can pressure prices in low-liquidity environments, but the impact depends on broader market structure and sentiment.

What is the Crypto Fear & Greed Index?It's a sentiment indicator ranging from 0 (Extreme Fear) to 100 (Extreme Greed), currently at 25.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.